Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR).

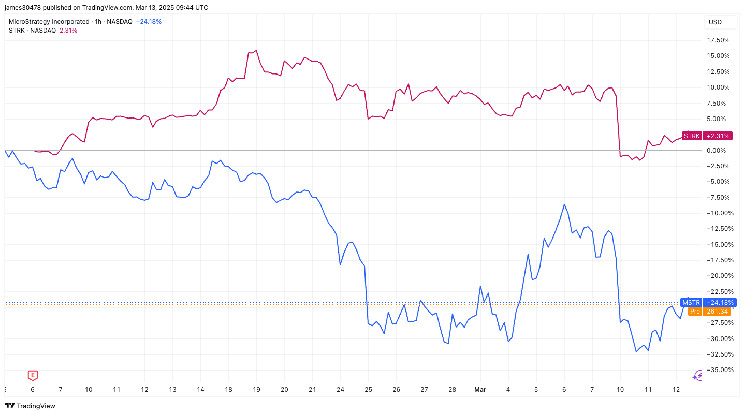

Strike ($STRK), the preferred stock issued by bitcoin buyer Strategy (MSTR) has been listed for just over a month and is currently 3% higher than at its Feb. 5 introduction. Strategy's common stock, on the other hand, is 20% lower over the same period.

Preferred stock like $STRK can be thought of as a hybrid of equity and debt. Holders have a greater right to dividend payments than common stock owners if the company makes them and also to the company's assets in the event of a liquidation. $STRK is a perpetual issue, which lacks a maturity date (like equity) and pays a fixed dividend (like debt).

Those features mean preferred stock tends to be less volatile than the common stock. That certainly seems to be the case for $STRK. According to Strategy's dashboard, $STRK has a 26% correlation with MSTR and a slightly negative -7% correlation with bitcoin (BTC). It's also less volatile, at 49%, compared with bitcoin’s roughly 60% and MSTR’s volatility exceeding 100%.

Last week, Strategy announced a $21 billion at-the-market (ATM) offering for $STRK. That is, it's prepared to sell up to that amount of the stock at the current market price over a period of time. If all the $STRK is sold, the company would face a total annual dividend bill of about $1.68 billion.

Generating that amount of cash means the company would either to sell common stock through an ATM offering — unlikely given the depressed share price as of late —or use cash generated from operations or proceeds from any convertible debt raised.

$STRK offers an 8% annual dividend yield based on its $100 liquidation preference and at the currently price of $87.45, offers an effective yield of around 9%. As with debt, the higher the $STRK price, the lower the yield, and vice versa.

$STRK also includes a feature allowing each share to be converted into 0.1 share of common stock, equivalent to a 10-to-1 ratio, when the MSTR price reaches or exceeds $1,000. Strategy stock closed at $262.55 on Wednesday, for the option to become viable it would have to appreciate significantly, offering potential upside beyond $STRK’s fixed dividend.

As an income-generating product with lower volatility, $STRK presents a more stable option with potential upside. However, the massive ATM offering could impact this potential upside, similar to how ATM share sales have affected the common stock’s performance.

coindesk.com

coindesk.com