Europe is currently regarded as the global leader in the number of crypto-friendly banks. These banks offer cryptocurrency-related services such as custody, trading, fiat-to-crypto conversions, or support for businesses in this sector.

Developing a regulatory framework for cryptocurrencies is the reason behind this boom in Europe.

The Surge of Crypto-Friendly Banks in Europe

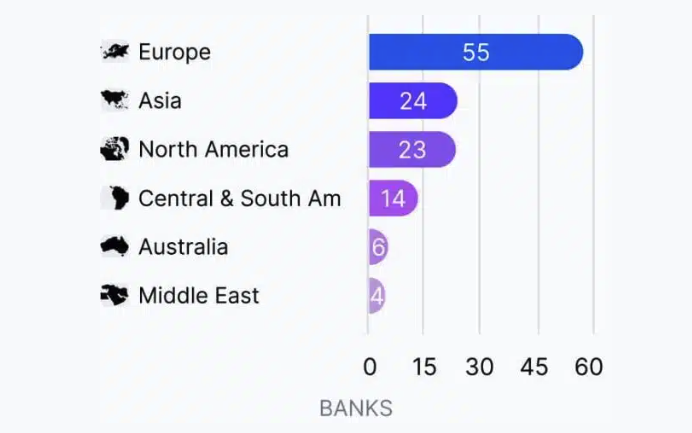

A study by Coincub indicates that up to 55 banks in Europe have integrated cryptocurrency-related services. Germany recorded six banks, while the UK has 5. Countries like Switzerland, Liechtenstein, and Lithuania also boast pioneering banks in this space.

Some typical names include SEBA Bank (Switzerland), Bank Frick (Liechtenstein), Fidor Bank (Germany), SolarisBank (Germany), Revolut (UK), and Bankera (Lithuania). These banks facilitate cryptocurrency transactions and provide services such as secure custody, staking, and asset tokenization.

This figure far surpasses other regions like Asia or North America. Meanwhile, in the US, following the White House Crypto Summit, the Office of the Comptroller of the Currency (OCC) only recently permitted banks to engage in cryptocurrency services.

MiCA Framework Facilitates Bank Participation

The widespread involvement of European banks in the cryptocurrency sector stems from significant steps in establishing a legal framework for cryptocurrencies, particularly with the Markets in Crypto-Assets (MiCA) regulation. MiCA aims to create a transparent and secure environment for crypto service providers while encouraging banks to integrate these services.

“Clear framework should enable crypto-asset service providers to scale up their businesses on a cross-border basis and facilitate their access to banking services to enable them to run their activities smoothly” – stated MiCA recital 6

Capitalizing on this regulatory progress, countries like Germany, Switzerland, and Malta have adopted tax policies and regulations that are friendly to cryptocurrencies. For instance, Germany applies a 0% tax rate on long-term crypto profits.

Digital banks (neobanks) such as N26, Revolut, and Fidor have quickly embraced the crypto trend to attract modern customers. These banks are often more flexible than traditional US banks, which are constrained by strict regulations and a cautious approach.

Although Europe leads in the number of crypto-friendly banks, it has limitations. Issues such as price volatility, fraud, and stringent Anti-Money Laundering (AML) and Know-Your-Customer (KYC) requirements pose significant hurdles for European banks.

With the MiCA framework expected to take full effect soon, Europe is well-positioned to maintain its leading role. However, the emergence of cryptocurrency-related regulations in Asia could threaten Europe’s dominance. To sustain its position, Europe must continue harmonizing regulations and addressing potential risks.

beincrypto.com

beincrypto.com