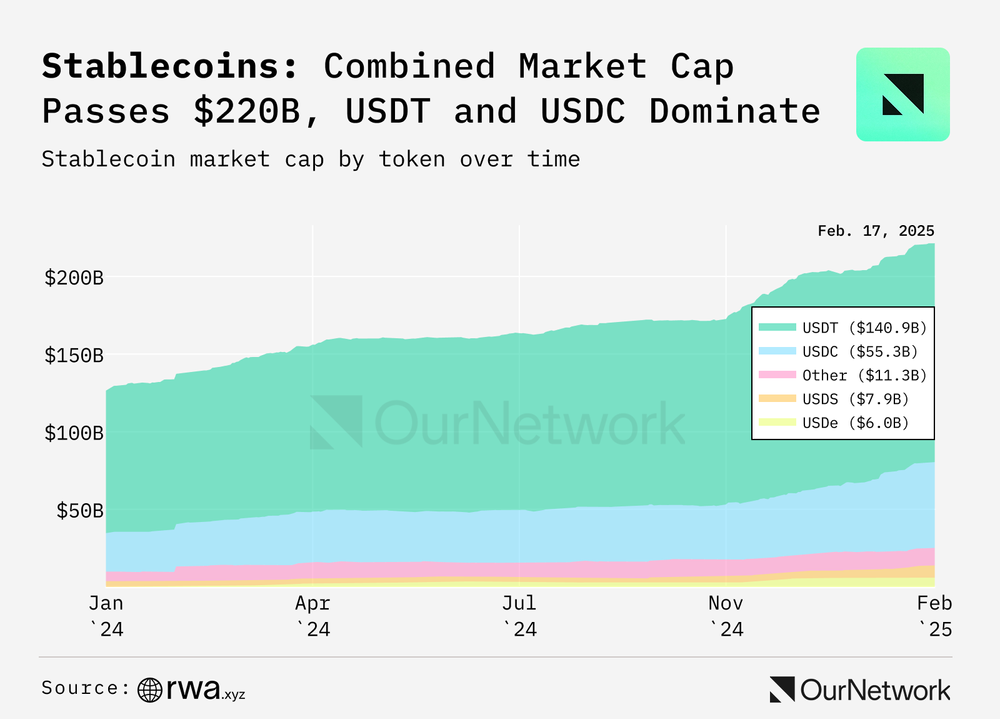

The total stablecoin supply has surpassed $221 billion, making up more than 1% of the U.S. dollar M2 money supply.

Stablecoins, once a niche sector, now account for over 1% of the U.S. dollar M2 — a broad measure of money including cash and deposits — money supply, with the market reaching $221 billion after adding nearly $100 billion since 2024, according to data compiled by analysts at OurNetwork.

Tether’s (USDT) market share dropped from 73% to 64%, while Circle’s ($USDC) gained ground, rising from 20% to 25%. And while both account for 89% of the total stablecoin market share, new players, like Ethena’s $USDe and Usual’s $USD0, are also making an impact.

Synthetic dollar $USDe added $5.9 billion, while $USD0 grew by $1.1 billion. FDUSD, which initially gained traction through promotions, has eventually “lost market share as these incentives ended and competition intensified,” the analysts wrote.

Per OutNetwork, $USDC’s recent growth has been mainly pumped by adoption beyond Ethereum’s mainnet. The analysts note that the stablecoin issuer saw “explosive growth” of more than $7.7 billion worth of $USDC on Solana, “likely fueled by a surge in meme coin trading activity.” On top of that, $USDC also saw gains on Ethereum’s layer-2 solutions like Coinbase’s Base and Arbitrum.

Meanwhile, Circle CEO Jeremy Allaire appears set on strengthening the company’s U.S. presence, arguing that issuers of dollar-pegged tokens should be required to register in the country. He stated there “shouldn’t be a free pass” for stablecoin issuers in the U.S., which could make it more difficult for rival Tether to expand in the country after moving its headquarters to El Salvador.