Strive Asset Management CEO Matt Cole has urged Gamestop to adopt bitcoin as part of its treasury reserve strategy, a proposal acknowledged by Chairman Ryan Cohen but not yet publicly endorsed by the company.

Strive CEO Proposes Gamestop Allocate Portion of $5B Cash Reserves to Bitcoin

Matt Cole, CEO of Strive Asset Management, recommended in a Feb. 24, 2025 letter that Gamestop (NYSE: GME) allocate a portion of its nearly $5 billion cash reserves to bitcoin, framing it as a strategic hedge against inflation and a potential boost to shareholder value. The proposal, confirmed by Gamestop Chairman Ryan Cohen via social media, aligns with broader corporate trends but stops short of advocating a full conversion of cash holdings.

Cole, a longtime bitcoin advocate and former portfolio manager, leads Strive—a $1.6 billion asset firm co-founded by Vivek Ramaswamy. His letter highlights Gamestop’s strong liquidity position, bolstered by recent financial stabilization efforts, as an opportunity to diversify reserves. Strive holds Gamestop shares through its exchange-traded funds (ETFs), tying its interests to the company’s performance.

The suggestion mirrors moves by firms like Microstrategy, now rebranded as Strategy, which holds over 499,096 bitcoin (BTC) in its treasury. Cole proposed that Gamestop focus exclusively on bitcoin—not other cryptocurrencies—and explore financial tools like convertible debt to fund purchases, rather than depleting cash reserves entirely.

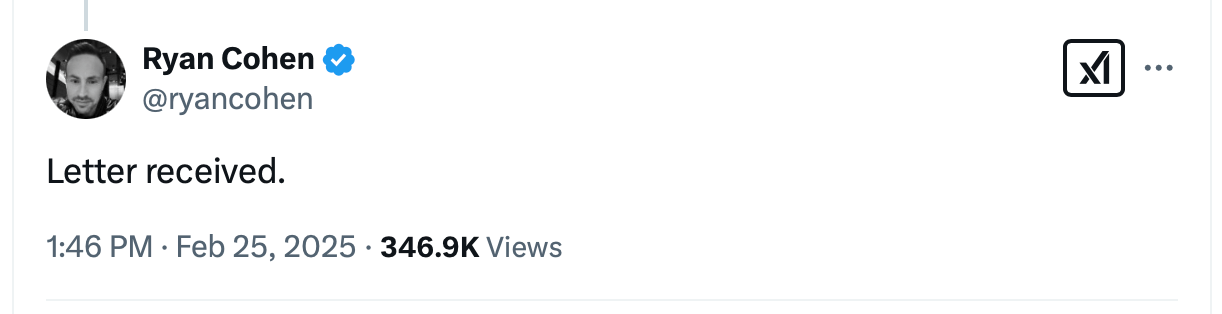

Cohen’s brief acknowledgment of the proposal on X has fueled speculation, with analysts divided on whether adoption would elevate Gamestop beyond its “meme stock” reputation and introduce a new financial paradigm. The company has not disclosed any such timeline for this decision.

news.bitcoin.com

news.bitcoin.com