Anthony Scaramucci, founder of SkyBridge Capital and former White House Communications Director, has remained one of Bitcoin’s ($BTC) most vocal advocates, standing firm in his bullish stance on the leading cryptocurrency.

Early last year, he predicted that Bitcoin would surpass $100,000 in 2024, driven by surging demand for Bitcoin exchange-traded funds (ETFs).

Looking ahead, he believes pro-crypto policies under the Trump administration could propel Bitcoin to double its value by 2025, further highlighting his confidence in $BTC’s long-term potential.

While Bitcoin remains Scaramucci’s largest holding, with over 50% of his portfolio allocated to $BTC, he has also invested in Solana (SOL), Avalanche ($AVAX), and Polkadot ($DOT), assets chosen primarily for their utility.

Speaking on the Bankless podcast in early January, he doubled down on Solana as his top choice among layer-one blockchains, citing its speed and low transaction costs.

Anthony Scaramucci’s portfolio — A volatile start to 2025

So far in 2025, Scaramucci’s portfolio has delivered mixed results. Since the beginning of the year, Bitcoin has managed to post a modest gain of 1.48% to trade at $95,000 despite macroeconomic headwinds.

However, Solana, which Scaramucci and SkyBridge Capital have favored over Ethereum (ETH), saw a slight decline of 0.66%, trading at $191 as of press time.

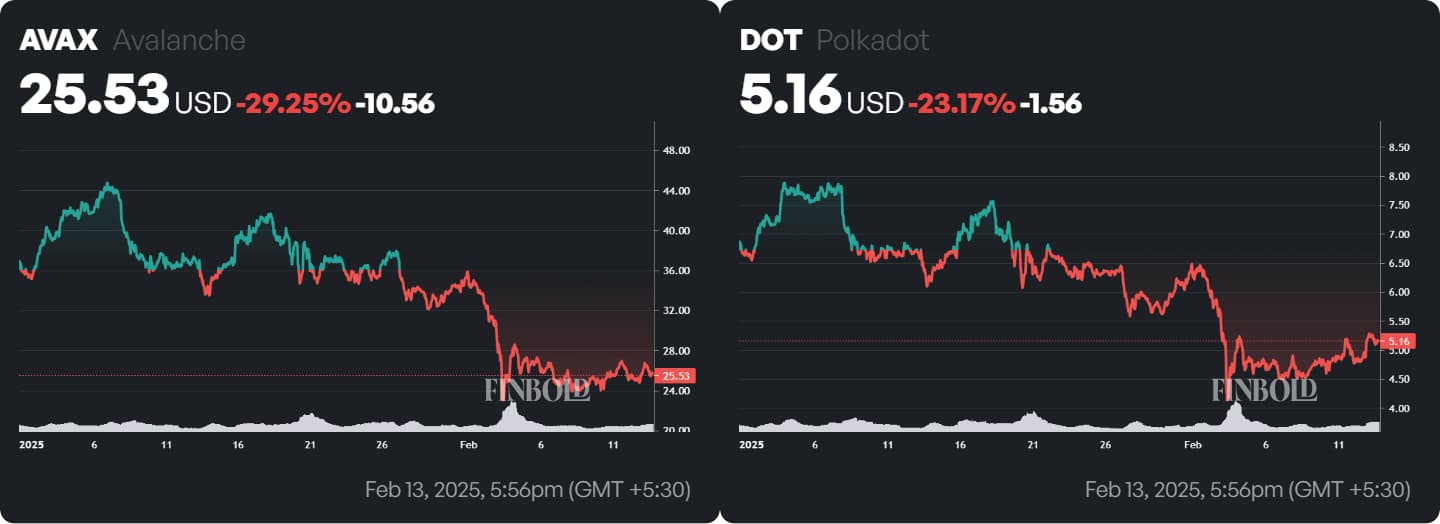

The altcoins in his portfolio, Avalanche and Polkadot, have fared much worse. $AVAX has plunged by 29.28%, trading at $25.53, while $DOT has lost 23.17%, trading at $5.16, primarily due to broader risk-off sentiment in the crypto market.

The downturn in these assets intensified following the announcement of new Trump administration tariffs on February 1, which triggered a broad selloff across risk assets.

The release of hotter-than-expected CPI data also stoked inflation fears, leading to sharp corrections across the crypto market.

A $1,000 investment — Where does it stand now?

To put the portfolio’s performance into perspective, a hypothetical $1,000 investment evenly split across the assets made at the start of 2025 would now be worth $870.93.

While Bitcoin’s gain and Solana’s minor dip offered some stability, the steep losses in $AVAX and $DOT dragged down overall performance, resulting in a 12.91% decline.

The portfolio’s ability to recover will likely hinge on Bitcoin’s trajectory, regulatory clarity on the selected assets, and shifting investor sentiment.

However, its performance so far serves as a stark reminder of the risks associated with concentrated crypto investments.

As for investors, a diversified approach remains the safest bet, balancing potential rewards with the unpredictability of the digital asset space.

Featured image from Shutterstock

finbold.com

finbold.com