Crypto.com exchange plans to file for a Cronos ($CRO) spot ETF in late 2025 and launch its own stablecoin by the third quarter.

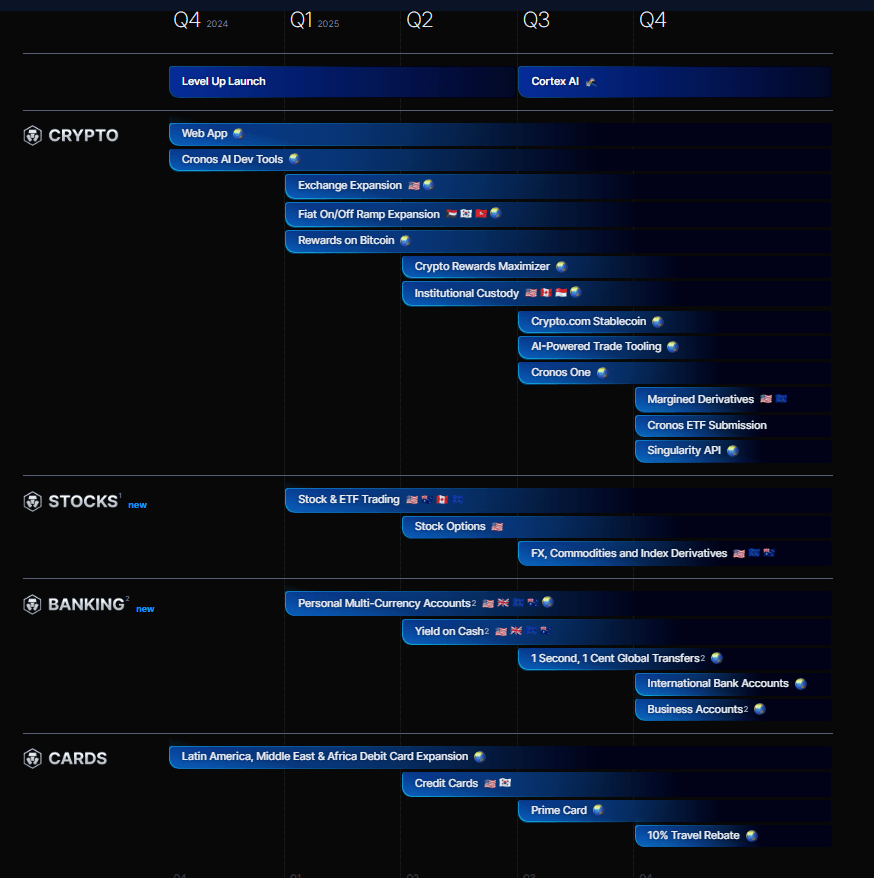

Crypto.com’s Roadmap

Before submitting its ETF application, Crypto.com will introduce new financial products. According to its recently released roadmap:

-

Q1 2025: The platform will begin listing stocks, stock options, and ETFs, allowing users to trade traditional assets alongside cryptocurrencies.

-

Mid-2025: New banking features will launch, including multi-currency personal accounts and cash savings accounts for users.

-

Q3 2025: Crypto.com will issue its own stablecoin, adding another layer of utility to its ecosystem.

-

Q4 2025: The exchange will file for a Cronos ($CRO) spot ETF, aiming to provide investors with a regulated way to gain exposure to its native token.

A Crypto.com spokesperson told Cointelegraph that these products are part of a broader push to enhance user experience by offering a full suite of financial services.

What We Know About the Cronos ($CRO) ETF

Crypto.com has not yet disclosed specific details about its Cronos ETF filing. However, the move follows a rising trend of crypto companies seeking regulated investment products to attract institutional investors.

Spot Bitcoin ETFs have already pulled in over $35 billion in 2024, with expectations that more crypto-based ETFs will follow as US regulations shift in favor of digital assets.

The approval of a Cronos ETF would mark a milestone for Crypto.com, as it would provide mainstream investors with a regulated way to invest in the Cronos ecosystem.

Crypto.com’s Stablecoin: A Game-Changer?

Another major development is Crypto.com’s plan to launch its own stablecoin in Q3 2025. While details remain scarce, stablecoins have become an essential part of the crypto industry, enabling faster transactions, cross-border payments, and DeFi integration.

If successful, Crypto.com’s stablecoin could provide seamless on-platform transactions, offering users an alternative to traditional payment methods.

Regulatory Challenges and Market Positioning

Crypto.com’s expansion comes at a time of increased regulatory scrutiny. The US Commodity Futures Trading Commission (CFTC) is reportedly reviewing the exchange’s futures contracts, particularly those allowing users to bet on sporting events like the Super Bowl.

Despite this, Crypto.com continues to strengthen its global regulatory standing:

-

October 2024: The exchange acquiredWatchdog Capital, a broker-dealer registered with the US SEC.

-

Europe: Crypto.com secured a full MiCA license in the European Union, allowing it to offer regulated crypto services.

-

Global Expansion: The company has established a European headquarters in Dublin and obtained licenses in Italy and Greece for virtual asset services.

With these moves, Crypto.com aims to position itself as a full-fledged financial platform, blending traditional finance with crypto innovations.

bsc.news

bsc.news