Anthony Scaramucci’s career in finance started off with a seven-year stint at Goldman Sachs (NYSE: GS) as an investment banker. In 2017, during Donald Trump’s first term in office, he was appointed White House Communications Director.

However, Scaramucci’s role in the public sector was not to last — just ten days after he was appointed, he was dismissed, after a well-publicized spat with Reince Priebus. Following this, he went on to found SkyBridge Capital.

The former Communications Director is an outspoken cryptocurrency bull — having allocated over 50% of his net worth to Bitcoin ($BTC) alone, per statements made in late December on the Bankless podcast.

On top of $BTC, Scaramucci’s crypto portfolio also includes Solana ($SOL), Avalanche ($AVAX), and Polkadot ($DOT) — assets selected primarily on account of their utility.

Let’s take a closer look at how mirroring Anthony Scaramucci’s crypto portfolio with a $1,000 investment made on January 1, 2025, would have turned out — using two illustrative examples.

Scaramucci’s crypto portfolio has suffered losses since the start of the year

For the purpose of simplicity, we are going to look at two scenarios — one in which the $1,000 investment is allocated evenly between the 4 crypto assets we’ve mentioned, and another, in which Bitcoin will account for 50%, with the remaining 50% split between $SOL, $AVAX, and $DOT.

From January 1 to press time on February 3, the price of Solana decreased by 0.34%. Bitcoin saw a loss of 0.78% in the same timeframe.

Since the beginning of the year, all of the aforementioned assets are in the red — although readers should note that the losses only began mounting after the market-wide selloff caused by Trump’s tariffs announced on February 1.

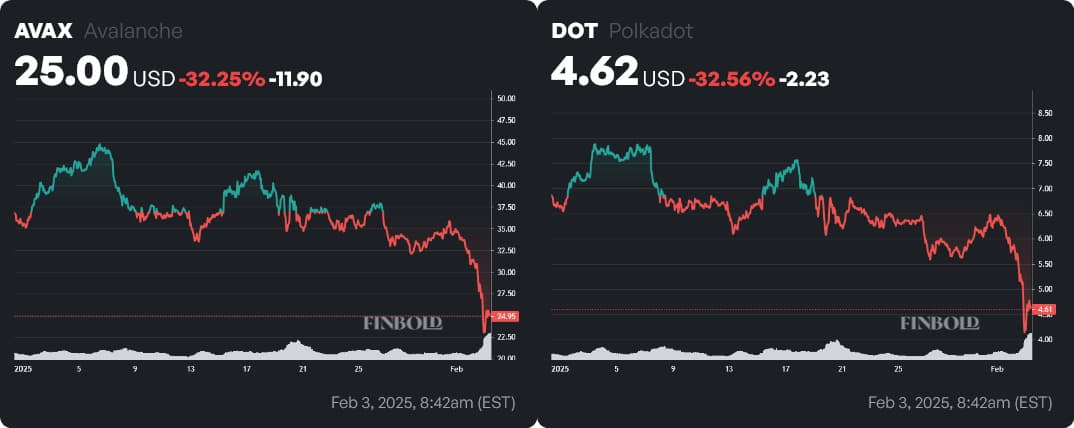

In contrast with Bitcoin and Solana, $AVAX and $DOT were hit much harder — having recorded a 32.25% and 32.56% loss, respectively.

A $1,000 investment split evenly between these 4 assets would have suffered a 16.48% loss — and it would be worth $835.20 at press time. In this instance, in absolute dollar amounts, the loss is $164.8.

In the second scenario, where Bitcoin accounts for 50% of the portfolio, the results are significantly better, yet still negative — with an overall loss of 11.25%, which would have made a $1,000 investment depreciate to $887.50.

Featured image via Shutterstock

finbold.com

finbold.com