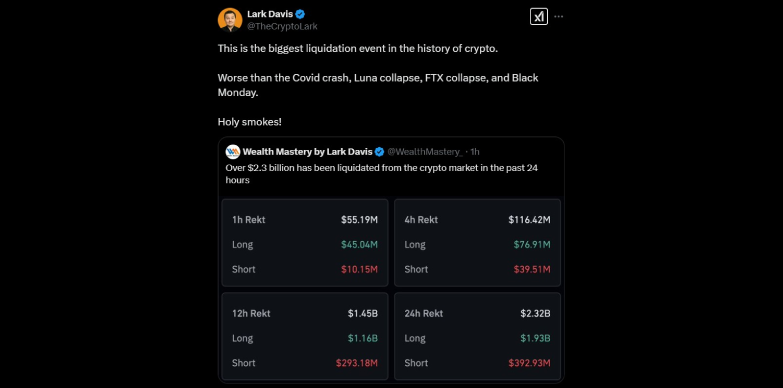

The cryptocurrency market has witnessed the largest liquidation event in history, surpassing previous crashes such as the COVID-9 market crash, the Luna debacle, the FTX collapse and even the infamous Black Monday. In the past 24 hours, over $2.32 billion in leveraged positions were liquidated. The long positions out of the total liquidation contributed about $1.93 billion and the short positions contributed about $392.93 million.

Intense and Aggressive Tariffs Announced

This situation has left the entire market stunned as the market is currently struggling to recover from the crash. The main reasons for this large liquidation event has been because of the trade tension that has been fueled by U.S. President Donald Trump. Intense and aggressive tariff have been announced for Mexico, China and Canada.

For Mexico and Canada, 25% additional tariff on imports have been imposed, excluding energy resources from Canada which have a lower 10% tariff. For China, 10% additional tariff on imports will be imposed.

To this arrangement, Canada retaliated with 25% tariff on U.S. exports and China has also announced that they will also come up with a retaliation. To further add fuel to this fire, Trump also announced that he could impose additional tariffs on the EU and BRICS nations if they launch a new currency that is aimed at challenging the dominance of the U.S. dollar.

Traditional Financial Market Also Affected

These developments were felt not only by the crypto market but the traditional financial market also took a hit as the S&P 500 futures dropped by 1.6% and the Nasdaq futures dropped down by 2.4%. These low numbers indicate widespread investor panic across the board. The rapid decline led to massive liquidations within hours, $116.42 million over 4 hours, and a staggering $1.45 billion in 12 hours before reaching the 24 hour total of $2.32 billion.

The combination of strict trade policies, countries retaliating with their own tariffs, and fear of a global economic slowdown has created a perfect storm. This has left the cryptocurrency market reeling from one of its worst crashes ever, and investors are preparing for more volatility.

Also Read:India Imposes 70% Tax Penalty on Unreported Crypto Gains

cryptonewsz.com

cryptonewsz.com