MicroStrategy shareholders are set to vote on several key proposals during a special meeting scheduled for 10 a.m. New York time on Tuesday, according to a recent report from Bloomberg.

The key focus of the vote will be to approve an increase in authorized Class A common stock from 330 million shares to 10.3 billion shares. Shareholders will also consider raising the number of authorized preferred shares from 5 million to 1 billion.

Bloomberg reported that MicroStrategy’s upcoming shareholder vote is likely to easily approve the proposed measure, given co-founder and chairman Michael Saylor’s substantial voting power—approximately 46% through his Class B shares.

The company also plans to raise up to $2 billion through preferred stock offerings, which would rank senior to Class A shares.

The increase would advance MicroStrategy’s 21/21 plan, which targets raising $42 billion over three years through share issuances and debt sales to support extensive Bitcoin acquisitions.

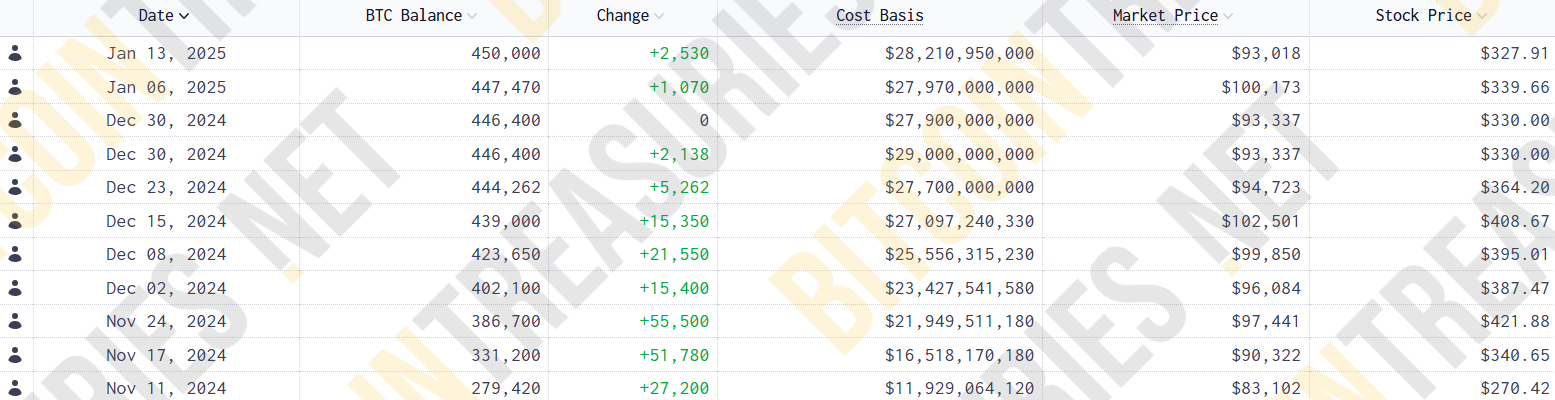

Since revealing the plan, MicroStrategy has accumulated 197,780 $BTC through 10 consecutive weekly purchases, reaching almost half of its goal in over two months. Saylor previously told Bloomberg that the company would re-evaluate its capital allocation strategy after achieving the goal.

$BTC-through-10-consecutive-weekly-purchases.png" data-ll-status="loaded">

$BTC-through-10-consecutive-weekly-purchases.png" data-ll-status="loaded">

The upcoming meeting will also address amendments to the company’s equity incentive plan, including automatic equity grants for newly appointed board members.

Following its latest Bitcoin purchase, MicroStrategy maintains $6.5 billion of equity offerings remaining under its $42 billion plan.

The Tysons, Virginia-based firm currently holds roughly 450,000 $BTC, valued at $48.5 billion at current market prices. It has invested approximately $28 billion in its Bitcoin holdings at an average price of $62,691.

cryptobriefing.com

cryptobriefing.com