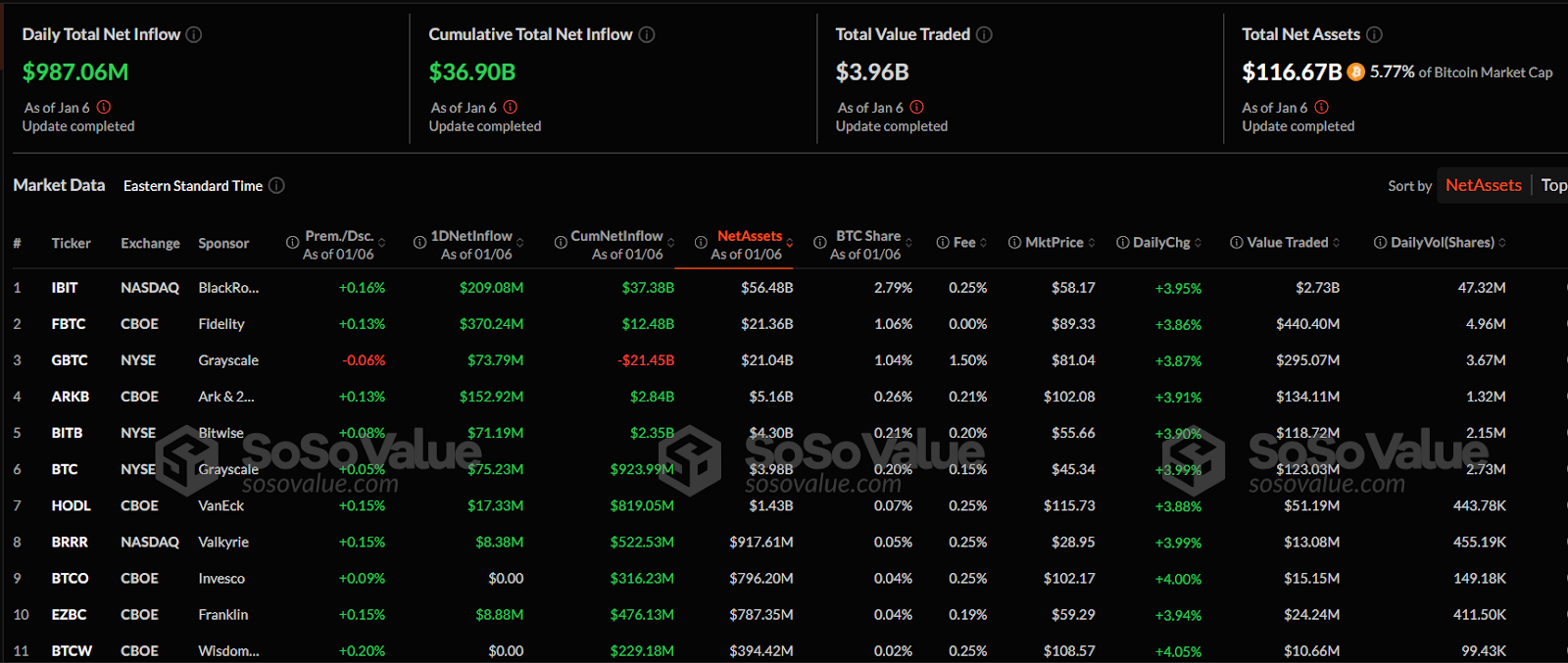

As of January 6, SoSoValue’s recent data update indicates that the daily net inflow for Bitcoin ETFs reached $987.06 million, while the cumulative total net inflow was $36.90 billion. The total value traded stood at $3.96 billion, as the total net assets for ETFs amounted to $116.67 billion, representing 5.77% of BTC’s market cap.

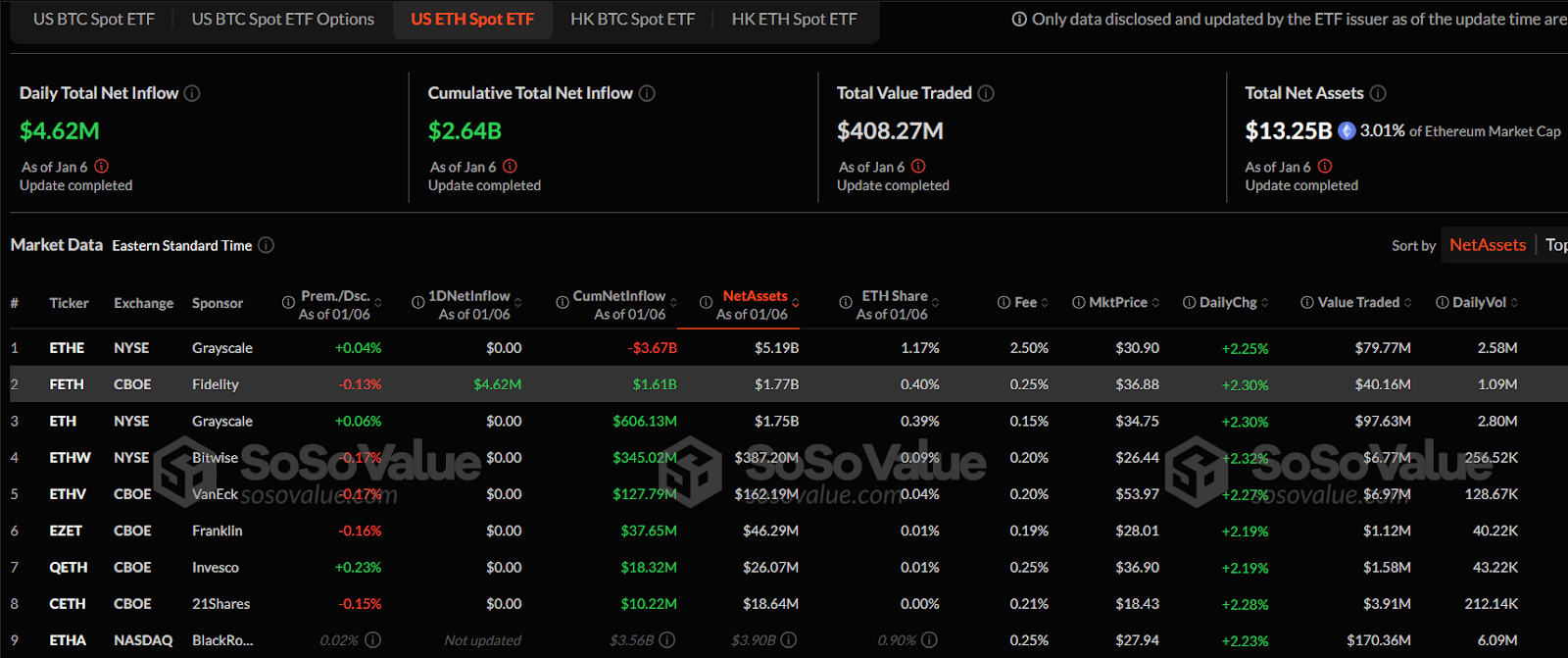

On the other hand, US Ethereum Spot ETF’s total daily net inflow was recorded at $4.62 million. The cumulative total net inflow amounted to $2.64 billion, while the total net assets reached $13.25 billion. This accounts for 3.01% of Ethereum’s market capitalization, while the total value traded was $408.27 million.

FBTC ETF Hits $21.36B, Leading with $370M Daily Inflow

In a detailed view, the IBIT ETF listed on NASDAQ, sponsored by BlackRock, gained $56.48 billion in net assets. The fund recorded a daily net inflow of $209.08 million and a cumulative net inflow of $37.38 billion. Its market price registered a daily increase of +3.95%, trading at $58.17 with discount rate of +0.16%.

Source: SoSoValue

FBTC ETF, sponsored by Fidelity and listed on the CBOE exchange, recorded net assets of $21.36 billion. It experienced a daily net inflow of $370.24 million, contributing to a cumulative net inflow of $12.48 billion. The fund’s market price rose by +3.86% to $89.33, with a discount rate of +0.13%. Its daily trading volume was 4.96 million shares, translating to a traded value of $440.40 million.

While GBTC ETF reported $21.04B in assets, a +3.87% price rise, and a $73.79M daily inflow despite -$21.45B cumulative inflows, ARKB ETF achieved $5.16B in assets with a $152.92M daily inflow. BITB ETF recorded $4.30B in assets, a $71.19M daily inflow, and a $2.35B cumulative inflow.

BTC ETF, also sponsored by Grayscale, showed net assets totaling $3.98 billion with a cumulative inflow of $223.99 million. It recorded a daily inflow of $75.23 million and a price change of +3.99%. Its market price was $45.34, with a premium/discount rate of +0.05%. The daily volume for BTC ETF was 2.73 million shares, and its traded value stood at $123.03 million.

BRRR, BTCO, EZBC, and BTCW ETFs Report Strong Price Gains Up to 4.05%

The BRRR ETF, listed on NASDAQ and sponsored by Valkyrie, achieved net assets of $917.61 million. It recorded a daily inflow of $8.38 million, with a cumulative inflow of $522.53 million. BRRR’s market price increased by +3.99%. On the other hand, the BTCO ETF, listed on CBOE and sponsored by Invesco, reported net assets of $796.20 million, achieving a daily inflow of $316.23 million, with a cumulative inflow of $796.20 million.

EZBC ETF, sponsored by Franklin, registered $787.35 million in net assets and a cumulative inflow of $476.13 million. It recorded zero daily inflows but displayed a price change of +3.94%, trading at $59.29. BTCW ETF, funded by WisdomTree and listed on CBOE, recorded $394.42 million in net assets. It earned a cumulative inflow of $229.18 million with no daily inflows. BTCW’s market price increased by +4.05% to $108.57, with a premium rate of 0.00%.

Ethereum ETFs Shine Bright: Can They Outpace BTC Growth?

Ethereum-sponsored ETFs were not left behind, as SoSoValue notes that ETHE ETF, listed on NYSE and sponsored by Grayscale, reported $5.19 billion in net assets. The fund registered no daily inflows, with a cumulative net inflow of -$3.67 billion. Its market price rose by +2.25%, trading at $30.90 with a discount rate of +0.04%. The daily trading volume reached 2.58 million shares, with a value traded of $79.77 million.

Source: SoSoValue

A deeper analysis indicates that FETH ETF, listed on CBOE and sponsored by Fidelity, recorded net assets of $1.77 billion. It reported a daily net inflow of $4.62 million, contributing to a cumulative net inflow of $1.61 billion. Its market price increased by +2.30%, reaching $36.88, with a premium/discount rate of −0.13%. The daily trading volume was 1.09 million shares, translating to a traded value of $40.16 million.

Ethereum ETFs Mixed Trend: Rising Prices, No Daily Inflows

The ETH ETF, also sponsored by Grayscale and listed on the NYSE, had net assets of $1.75 billion. It recorded no daily inflows, with a cumulative net inflow of $606.13 million. Its market price increased by +2.30%, trading at $34.75 with a premium/discount rate of +0.06%. The daily trading volume was 2.80 million shares, with a value traded of $97.63 million.

The ETHW ETF, sponsored by Bitwise, reported $387.20M in assets and a +2.32% price rise, trading at $26.44. The ETHV ETF by VanEck recorded $162.19M in assets and a +2.27% price increase to $53.97. Both ETFs had no daily inflows, with trading volumes of 256.52K and 128.67K shares, respectively.

The EZET ETF, sponsored by Franklin and listed on CBOE, had net assets of $46.29 million. It recorded no daily inflows, with a cumulative net inflow of $37.65 million. Its market price increased by +2.19% to $28.01, with a premium rate of −0.16%. The daily trading volume stood at 40.22K shares, valued at $1.12 million.

The QETH ETF, sponsored by Invesco and listed on CBOE, reported $26.07 million in net assets. It recorded no daily inflows, with a cumulative net inflow of $18.32 million. Its market price increased by +2.26% to $28.01, with a premium rate of +0.23%.

ETHA ETF, sponsored by BlackRock, reported $18.64 million in net assets. It recorded no daily inflows, with a cumulative net inflow of $10.22 million. Its market price rose by +2.23%, trading at $27.94 with a premium/discount rate of 0.02%. The daily trading volume reached 212.14K shares, with a value traded of $3.91 million.

cryptonews.net

cryptonews.net