-

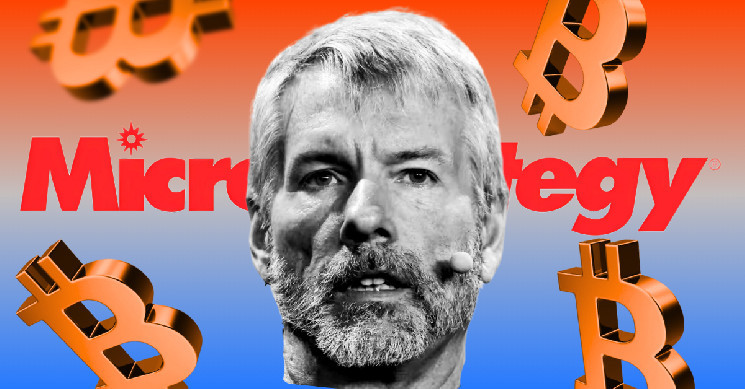

MicroStrategy Eyes 21/21 Plan: Proposal to raise $42B for Bitcoin sparks debate on share dilution, long-term strategy & market impact

-

Saylor's Bold Bitcoin Move: 10.33B share increase plan draws mixed reactions; will it boost MicroStrategy or risk financial stability?

According to recent media news, MicroStrategy’s upcoming special shareholder meeting, where a vote will determine whether to increase outstanding shares from 330 million to 10.33 billion.

MicroStrategy’s Bitcoin accumulation has attracted many new companies to follow the path; however, things at his den are unfavorable. With an argument that such hoarding would disrupt the company’s financial position, many shareholders denied Michael Saylor’s accumulation plans earlier.

Will Saylor’s special proposal change the company’s fate? Well, that will be answered in the future. Until then, let’s sit back and read on to the proposal and community reaction.

What’s in the 21/21 Plan?

The 21/21 plan aims to raise $21 billion through equity financing and another $21 billion through bond issuance over three years. Saylor has already clarified that these funds will be used to buy more Bitcoin to showcase the company’s commitment to Bitcoin. Since mid-2020, MicroStrategy has already acquired 444,262 BTC, now worth around $42 billion, making it the fourth-largest Bitcoin holder globally. As an outcome, the company’s market cap has skyrocketed from $1.1 billion to $82 billion, and its shares have risen 477% this year.

Key Proposals on the Table

MicroStrategy has proposed increasing Class A shares from 330 million to 10.33 billion and raising preferred stock authorization from 5 million to 1.005 billion to support future financing and expand funding options. Plus, the company plans to update its equity incentive plan to grant automatic equity awards to new board members, aligning their compensation with its Bitcoin-focused strategy. This will ensure that the company is not out of funds at any time.

Community Reactions is Mixed

The notice has sparked mixed reactions within the crypto community. A Twitter user Asymmetry clarified such shareholder voting is a long and time-consuming process, hence it allows gradual share issuance that can take over 10-15 years to fund Bitcoin purchases. This shows Saylor’s plan to hoard Bitcoin for a long time.

However, some users, like @ibills, criticized the approach, suggesting shareholders should first see the results of current strategies before agreeing to further dilution. They argued that shareholder benefits, such as stock splits, should take priority before continuing payouts to others. It also means a massive liquidation fear in the future.

Trump is also pushing his Bitcoin Reserve Plan in the US to strategically leverage the new adoptions and give the US economy an instant boost under his leadership. At this time Saylor is also giving companies in the US a hard time by putting his 21/21 Bitcoin plan at the forefront. While the market is down such accumulation plans signal Saylor’s long-term plan of buying the dip.

coinpedia.org

coinpedia.org