Michael Saylor-led MicroStrategy (MSTR) stands at the top of organizations that adopted Bitcoin as its primary Treasure reserve asset and is officially joining the Nasdaq 100 index today, December 23, 2024. This is a significant moment for MicroStrategy because the firm started out as a software company and is now a leading player in the financial market.

MSTR Pre-Market Trading Price

Since the announcement, the $MSTR stock price has been fluctuating, and currently, the pre-market price stands at $357.50 as per Trading View.

Analysts predict that there could be a possible rally in the prices of the $MSTR stock due to increased visibility and potential institutional interest as MSTR becomes a part of the Nasdaq 100. Analysts also suggest that once the market opens up, the stock prices may hit the $400 mark.

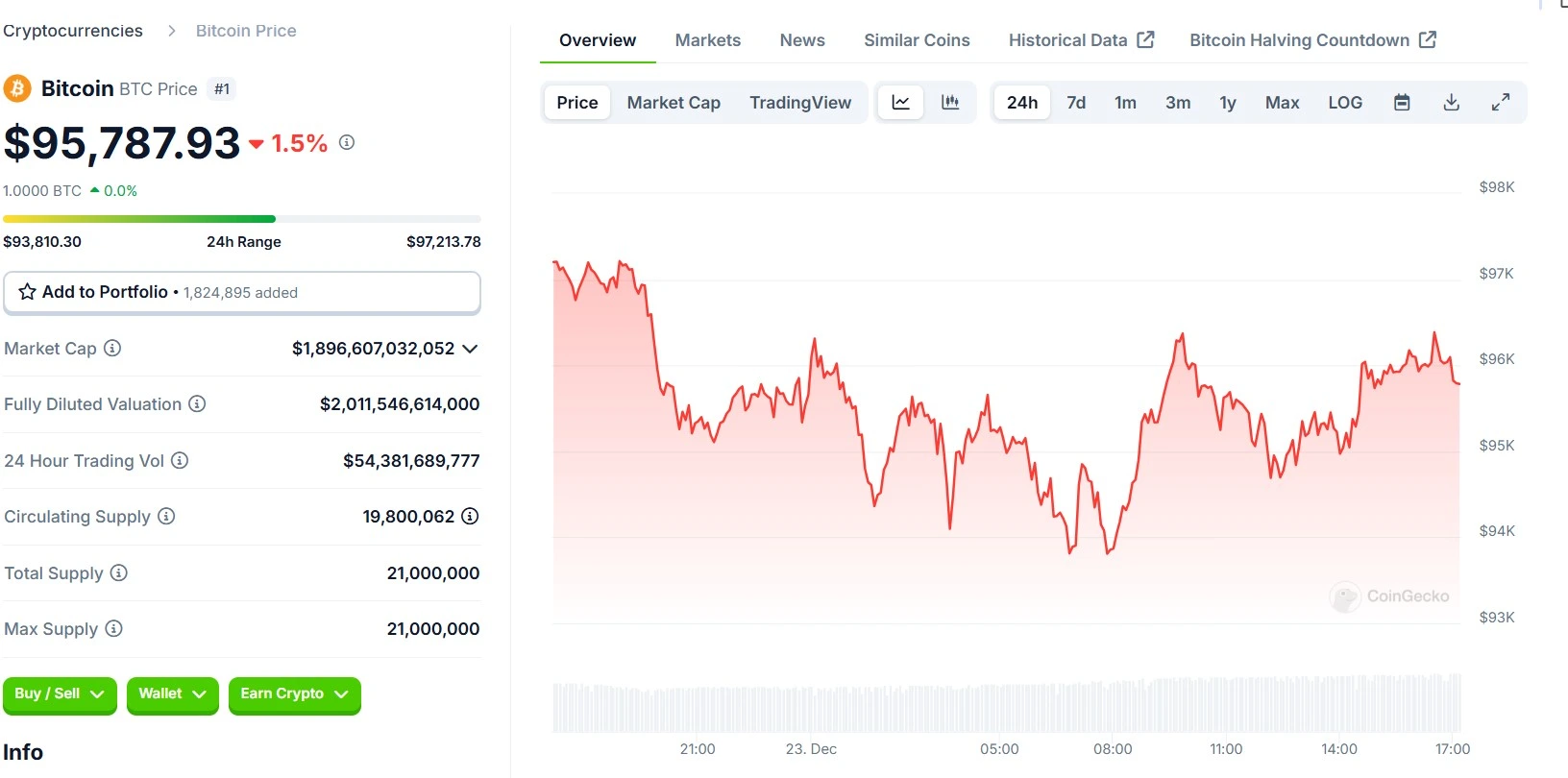

MicroStrategy’s performance revolves around Bitcoin, the company currently holds 79.296K BTC as per Arkham Intelligence. The Saylor-led company acquired BTC at an estimated cost of $7.64 billion. At press time, the price of the Bitcoin token stands at $95,787.93, with a dip of 1.5% in the last 24 hours.

Will MicroStrategy Buy More Bitcoin?

According to a Polymarket bet, 89% of users voted there is an 89% chance that MSTR will buy more Bitcoins before 2024 ends. The price of the token had hit an all-time high of $108,000 but now it is trading at $96,000 which makes a good opportunities for institutions like MicroStrategy to buy more Bitcoins at such low prices.

Polymarket poll betting if MSTR will buy more Bitcoins before 2024 endsAs the company celebrates this milestone, investors will be carefully observing MicroStrategy’s next moves and see if it can hit the $400 mark.

Also Read: Elon Musk Weighs in on Rumors of Biden Pardoning SBF

cryptonewsz.com

cryptonewsz.com