Main Takeaways

-

BFUSD offers a high APY (recently in the 30%-47% range) through returns from funding fees and staking, but such returns are dynamic and depend on market conditions.

-

A robust Reserve Fund shields users from negative funding rates, ensuring stability even during bearish market conditions.

-

Backtesting shows that BFUSD’s Reserve Fund can withstand extreme market scenarios, providing a reliable buffer that will likely grow over time.

This is a general announcement. Products and services referred to here may not be available in your region.

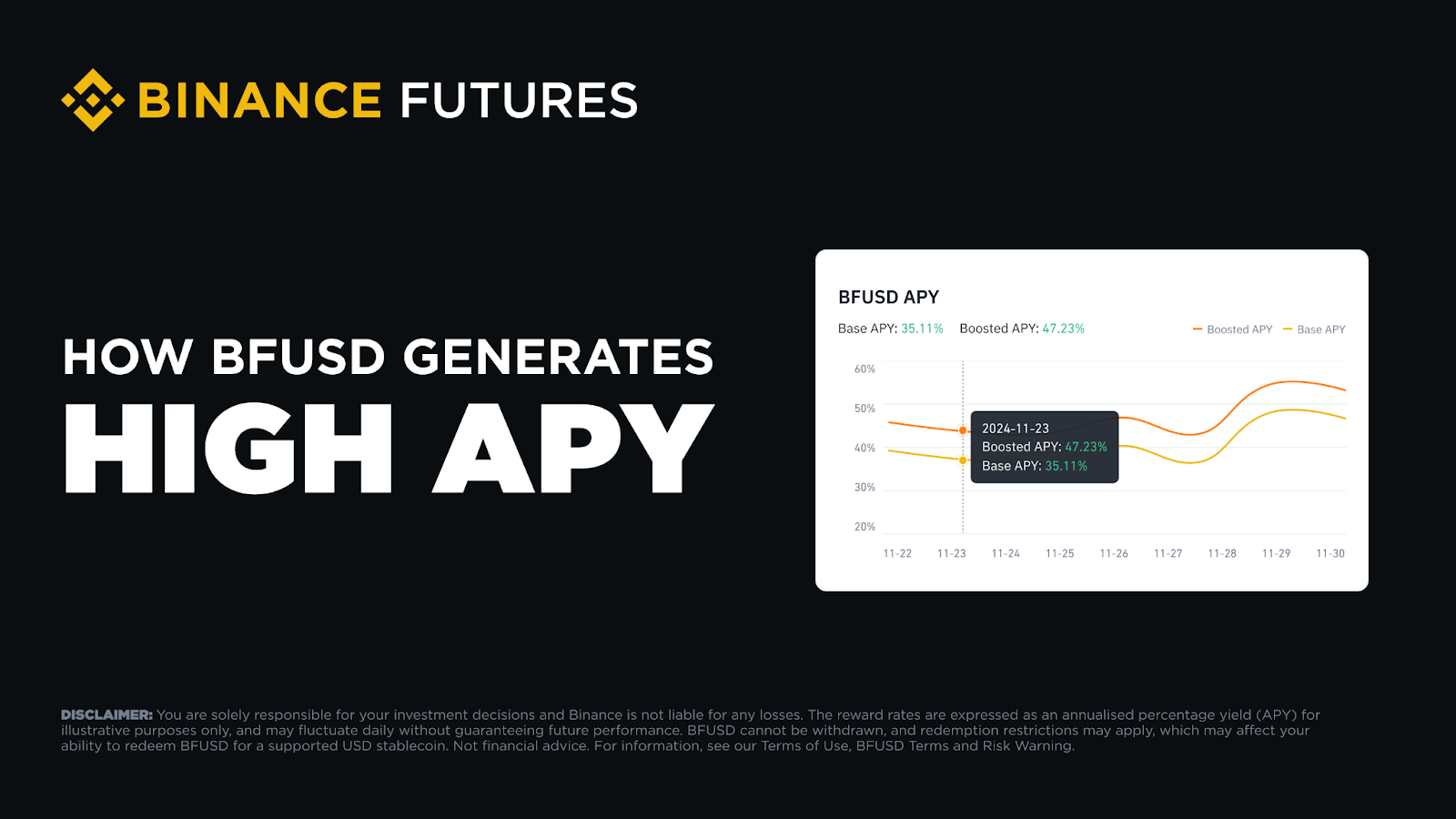

The introduction of BFUSD, our exclusive reward-bearing margin asset launched in November 2024, has sparked enthusiasm and curiosity, particularly regarding its Annual Percentage Yield (APY), which has recently ranged from 30% to 47%. Many users wonder: How is this high APY possible? Is it sustainable? What are the risks?

In this blog, we’ll break down how BFUSD generates its returns, explain the role of funding rates and staking, and provide insights into the mechanisms that ensure its stability, including the Reserve Fund. By the end, you should have a much clearer view of how BFUSD works and why it’s a valuable addition to your trading strategy.

How Does BFUSD Generate High APY?

The answer lies in BFUSD’s structure. Its daily APY is derived from an aggregate return generated from staking fees and funding fees from the previous day. It’s important to note that APY is not fixed, and past results do not guarantee future performance.

For example, on November 23, 2024, BFUSD offered a Boosted APY of 47.23%, while the Base Rate stood at 35.11%. This elevated APY was driven by favorable market conditions, including notably high ETHUSDT funding rates during this period, as reflected in Binance’s publicly available funding fee data.

Funding fees, which are influenced by market demand and volatility, played a key role in achieving this high yield. By design, BFUSD shares the value generated from these mechanisms as rewards with Binance’s community and traders.

Can BFUSD’s Funding Fee Be Negative?

The answer is yes. There will be times when the APY for BFUSD is negative — especially during bearish market conditions when funding fee income turns negative.

To mitigate this, BFUSD is designed with a built-in Reserve Fund. During favorable market conditions, a portion of the total APY generated is allocated to this Fund. This buffer ensures users are shielded from negative funding fees when the market shifts.

For example — as previously mentioned — on November 23, 2024, BFUSD offered a Base Rate of 35.11% and a Boosted Rate of 47.23% for those actively trading. These rates were supported by favorable market conditions, including notably high ETHUSDT funding rates on that day. Alongside distributing competitive APYs to users, BFUSD strategically allocated a portion of the returns during this period to the Reserve Fund.

This allocation reinforces the Reserve Fund’s capacity to provide a safety net during periods of negative funding fees, ensuring long-term stability for BFUSD holders even in less favorable market conditions. However, it’s essential to understand that BFUSD’s APY is not guaranteed, and could even be zero at times. As a dynamic product, its performance depends on market conditions. Past APY results do not guarantee future outcomes.

For more details on risks and conditions, please refer to our FAQ and Terms.

Can BFUSD Consistently Generate a High APY Despite Negative Funding Rates?

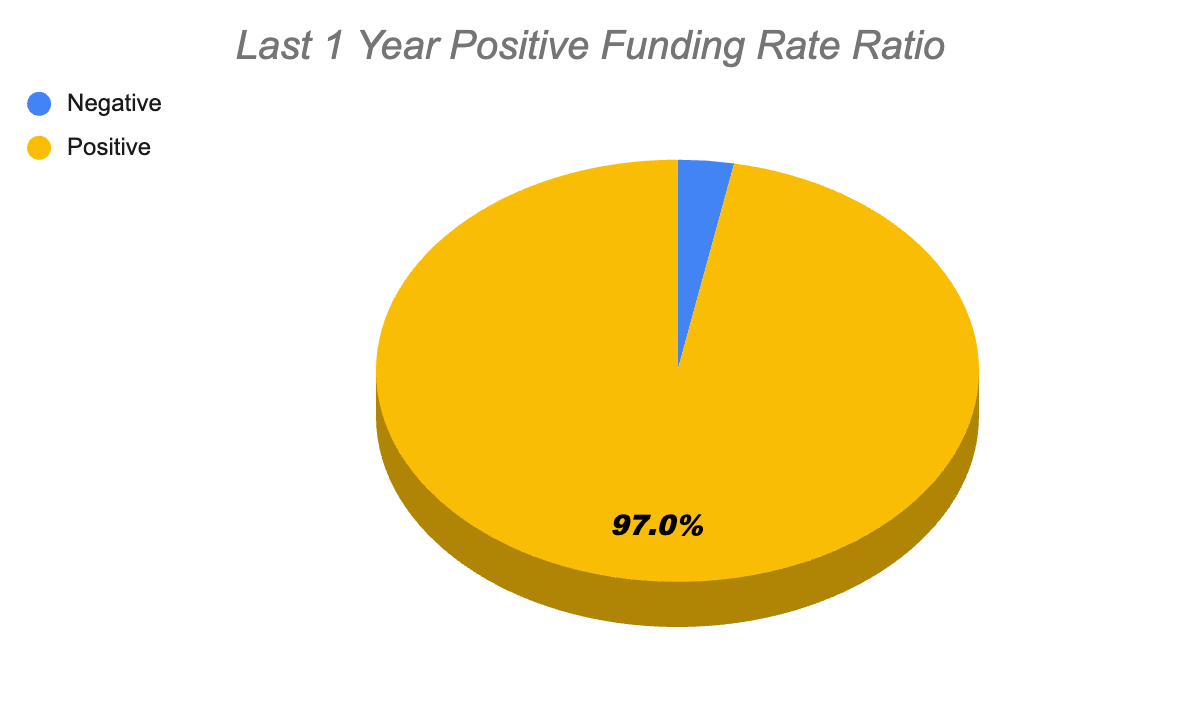

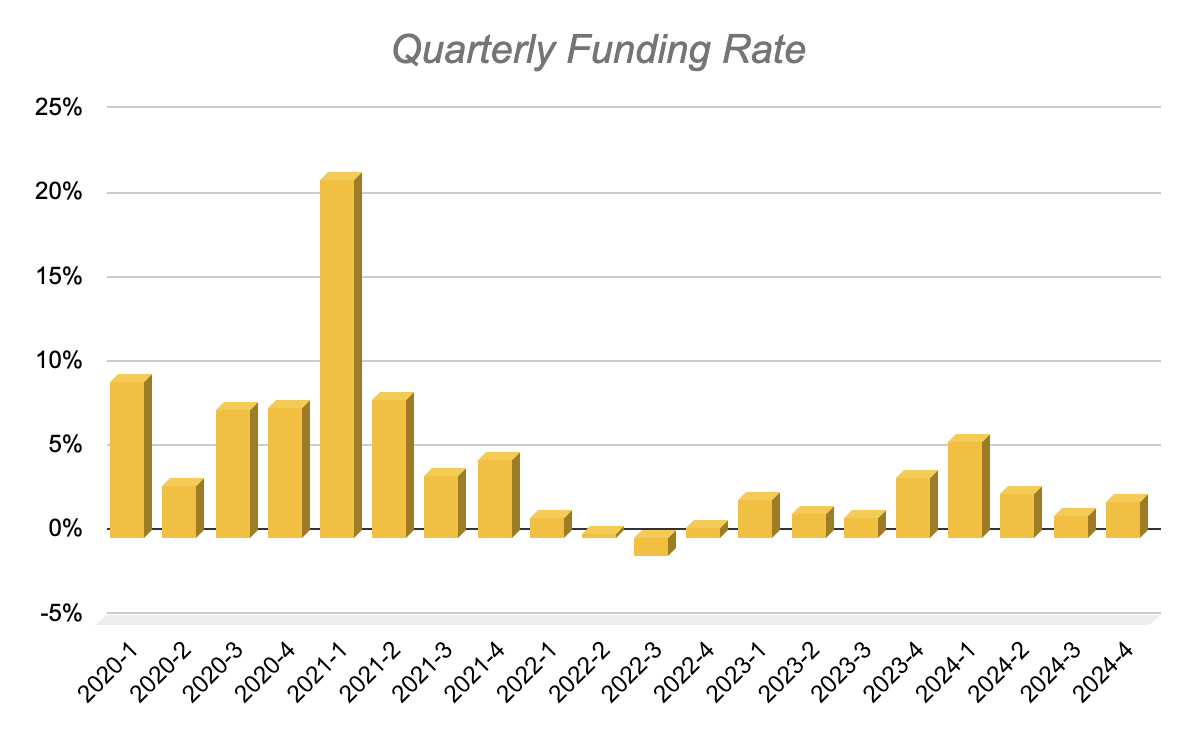

While it’s true that derivatives funding rates can turn negative, they are predominantly positive — a trend supported by the bullish market sentiment and the non-inflationary nature of crypto assets. Take the ETHUSDT trading pair as an example.

Over the past year, its funding rate has been positive for 354 out of 365 days. Looking at historical trends, funding rates have been mostly positive on a quarterly basis since the launch of Binance Futures in late 2019. This strong track record underpins BFUSD’s ability to consistently generate APY from funding fees, even in a volatile market.

Above: Binance’s ETHUSDT Positive Funding Days over the past year

Above: an overview of Binance’s Average Quarterly Perpetual Funding Rates

Can the Reserve Fund Fully Protect Users from Negative Funding Rates?

As explained above, we’ve implemented a robust Reserve Fund to safeguard BFUSD users from the impact of negative funding rates. At launch, the Fund was seeded with 1 million USDT, and its resilience has been rigorously tested against extreme scenarios.

Backtesting the Reserve Fund

We conducted a backtest using the following assumptions (for illustrative purposes only):

-

Subscription Size: $50 million flat initial subscription.

-

Initial Reserve Fund: $1 million.

-

ETH Staking APY: 3%.

-

Reserve Fund Allocation: 30%.

-

No Position Reduction: Positions remain unchanged during negative funding scenarios, with the Reserve Fund covering negative funding fees.

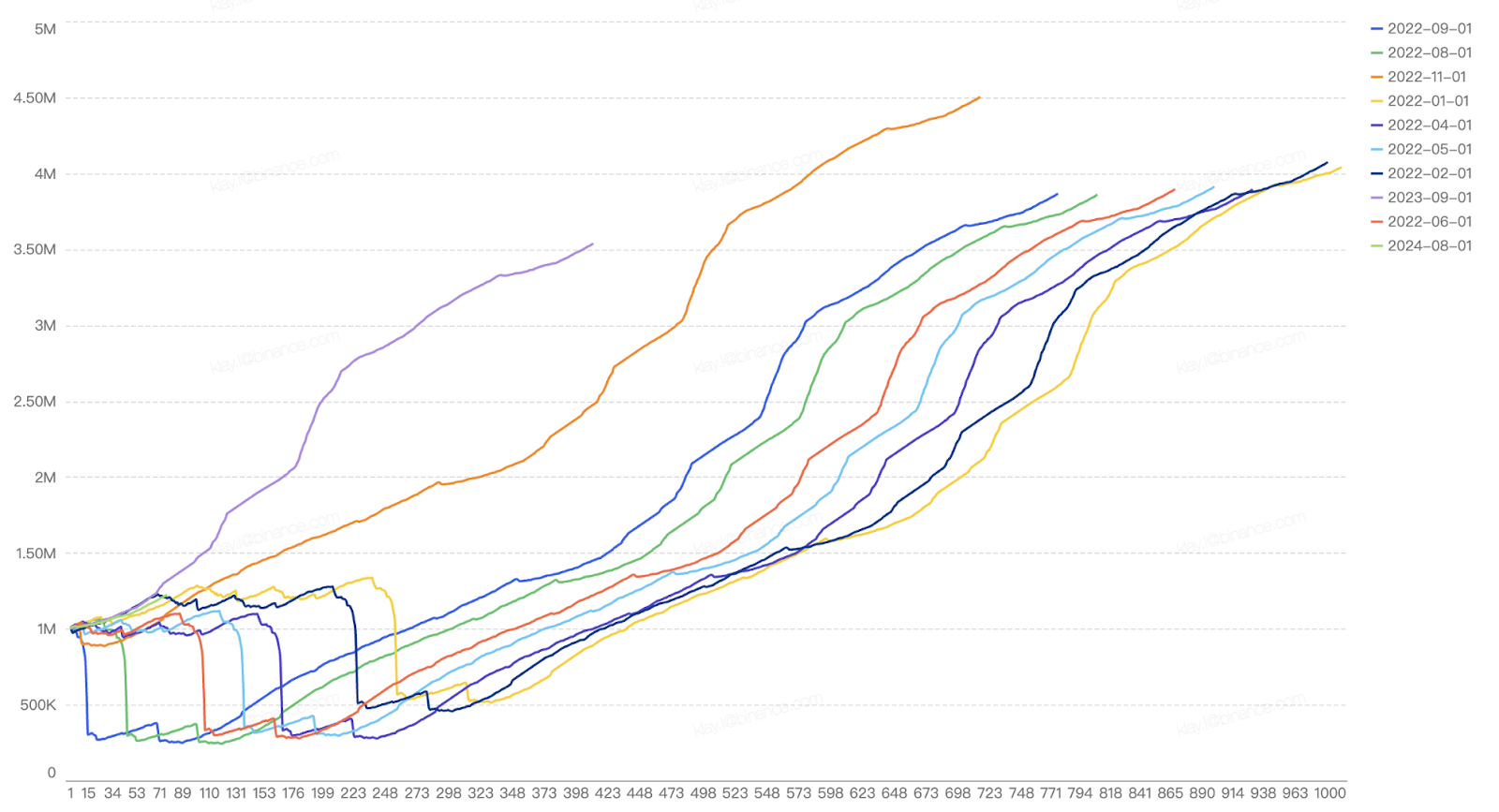

The backtest simulated performance during the 10 worst funding months in Binance Futures history, ranked by the most negative funding rates. The chart below illustrates the Reserve Fund’s size over a 1,000-day period following each backtested launch:

Key Insights

Even under the most challenging backtested conditions, the Reserve Fund demonstrated its ability to protect users. Based on our calculations, the 1M USDT Reserve Fund would not only withstand the stress of the worst historical funding periods, but also likely grow over time.

Ongoing Monitoring

While the backtest confirms the Reserve Fund’s resilience, Binance is committed to consistently monitoring and managing the Fund to ensure its adequacy. Regular adjustments will be made as needed to maintain a reliable buffer.

Final Thoughts

BFUSD was designed with the community in mind, aiming to deliver greater value to Binance users by combining flexible margin with daily rewards.

Throughout this blog, we’ve explored how BFUSD generates its high APY through funding fees and staking income, the mechanisms in place to shield users during challenging market conditions, and the role of the Reserve Fund in ensuring stability.

The enthusiasm from our community has been inspiring, and we’re committed to refining and improving the product to better serve your needs. As we continue to innovate, your feedback will remain at the heart of BFUSD’s evolution. Thank you for your support — together, we’re shaping a more rewarding futures trading experience.

Further Reading

-

What Is BFUSD and How to Use It as Margin in Futures Trading

-

How to Buy BFUSD and Redeem for USD Stablecoin

-

How are the Reward Rates for BFUSD Holders determined?

-

BFUSD Terms

Disclaimer: You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. The reward rates (including the Base Rate and the Boosted Rate) are calculated daily, and are expressed as an annualised percentage yield (APY) for illustrative purposes only. Each reward rate is not representative of the performance of BFUSD for any period other than the particular date specified and is not indicative of future results. The reward rates are likely to fluctuate day-to-day. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. BFUSD cannot be withdrawn or used for any purpose other than as margin in a Binance Futures Account. Redemption restrictions may apply, which may affect your ability to redeem BFUSD for a supported USD stablecoin.

This content is presented to you on an “as is” basis for general information and educational purposes only, without representation or warranty of any kind. It should not be construed as financial advice, nor is it intended to recommend the purchase of any specific product or service. Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur.

The products and services referred to herein may be restricted in certain jurisdictions or regions or to certain users, in accordance with applicable legal and regulatory requirements. These materials are intended only for those users who are permitted to access and receive the products and services referred to and are not intended for users to whom restrictions apply. You are responsible for informing yourself about and observing any restrictions and/or requirements imposed with respect to the access to and use of any products and services offered by or available through Binance in each country or region from which they are accessed by you or on your behalf. Binance reserves the right to change, modify or impose additional restrictions with respect to the access to and use of any products and/or services offered from time to time in its sole discretion at any time without notification.

This material should not be construed as financial advice. For more information, see our Terms of Use, the BFUSD Terms and our Risk Warning. To learn more about how to protect yourself, visit our Responsible Trading page.

binance.com

binance.com