Despite widespread acknowledgment that MicroStrategy has issued a tremendous amount of debt to acquire most of its bitcoin, some star-struck novices believe that billionaire CEO Michael Saylor has no liquidation risk on this debt.

Although the nuances of the term ‘liquidation’ are important, there are people who honestly believe that MicroStrategy cannot default on its debt no matter how low the price of bitcoin goes.

That is not true. There is no free lunch on Wall Street.

Lenders to MicroStrategy do have a risk of default. Specifically, they are loaning USD to MicroStrategy and expect USD or USD-equivalent repayment. Even lenders in recent series who waived all interest payments expect to receive their principal back at maturity.

To be clear, no lenders have agreed to accept repayment in bitcoin, and no lenders have agreed to denominate their principal repayment in bitcoin. They lent USD and expect the USD, or its equivalent or extra amount of MSTR shares, upon loan maturity.

Debt conversion is just a fancy USD repayment

Yes, most of MicroStrategy’s debt is convertible debt. This type of commercial paper allows lenders to accept repayment of their principal and unpaid interest via conversion of their loan into MSTR shares.

In other words, their convertible bond is embedded with a free call option.

Each series of MicroStrategy’s convertible bonds specifies a conversion ratio and timeline, specifying how many shares of stock the bondholder can receive upon conversion within a date and MSTR price range.

This is identical to a call option. Calls, as their name suggests, are securities that permit the owner to call shares from the call seller at a specified price and predetermined date. This is advantageous if the price of the share rises above this strike by the predetermined date.

Just as calls allow the owner to buy shares at a predetermined price during a rally above this strike, so too does MSTR convertible debt allow a bondholder to convert a loan into shares. For this reason, it is common knowledge that convertible debt embeds a de facto call option.

Read more: The math behind MicroStrategy’s bitcoin bet

Lenders pay and MicroStrategy must repay them

To recap, lenders pay MicroStrategy:

- Capital (the loan principal),

- The risk of default (the probability-weighted cost of not getting their money back), and

- The opportunity cost of their capital (say, the average return of the S&P 500).

As compensation for this capital, MicroStrategy promises to repay lenders:

- Quarterly interest (applicable to most but not all of its debt series),

- Principal (at maturity), and

- Optional conversion into stock (embedded call option).

As of press time, MicroStrategy has outstanding commitments to repay lenders tens of billions of dollars at various maturities ranging from next year through 2032.

The firm can either repay the loan and interest in USD, or allow the bondholder to convert its USD value into common shares. The implied conversion price of these loans into MSTR shares — i.e. their call-like strike prices — range from $39.80 to $672.40 per share.

MicroStrategy’s future ability to repay lenders

The vast majority of the company’s outstanding loans are backed by its assets and creditworthiness. Because MicroStrategy has minimal business operations besides holding bitcoin, these loans are mostly backed by the company’s 386,700 bitcoin balance.

To be clear, MicroStrategy’s debts are unsecured. In other words, lenders do not possess bitcoin as collateral. They have simply accepted MicroStrategy’s promise of repayment.

For this reason, MicroStrategy does not have a risk of liquidation in the sense of a lender forcing the company to sell bitcoin if bitcoin were to crash below a certain price. No lender can force MicroStrategy to liquidate bitcoin if it suddenly crashes intraday.

Nevertheless, MicroStrategy does have the risk of bitcoin liquidation — not at a particular price trigger, but as time progresses.

Read more: MicroStrategy bulls think Michael Saylor can pump it to 10X its BTC

The calendar, not the price, could liquidate MicroStrategy’s bitcoin

Specifically, MicroStrategy must earn or sell enough bitcoin to make quarterly interest payments on its debt. Upon annual maturities through 2032, MicroStrategy must possess, raise, or sell enough USD to repay any non-converted loans due.

Again, its loans mature starting next year and nearly every year through 2032. Although most of these lenders are likely to waive USD repayment and convert into MSTR shares, if the price of bitcoin declines and drags MSTR down with it, lenders have the right to demand USD repayment.

If bitcoin is down, MSTR declines, and then lenders demand USD repayment of their principal upon maturity of their loan, MicroStrategy would be in big trouble.

At that point, it will have to seek further financing, possibly diluting shareholders or issuing higher-yield or other types of punitive debt. If bitcoin and MSTR decline too far, the company could go bankrupt in a worst-case scenario.

Creditors are senior to common shareholders. They will be repaid first out of any bankruptcy, before any assets would be distributed to anyone else.

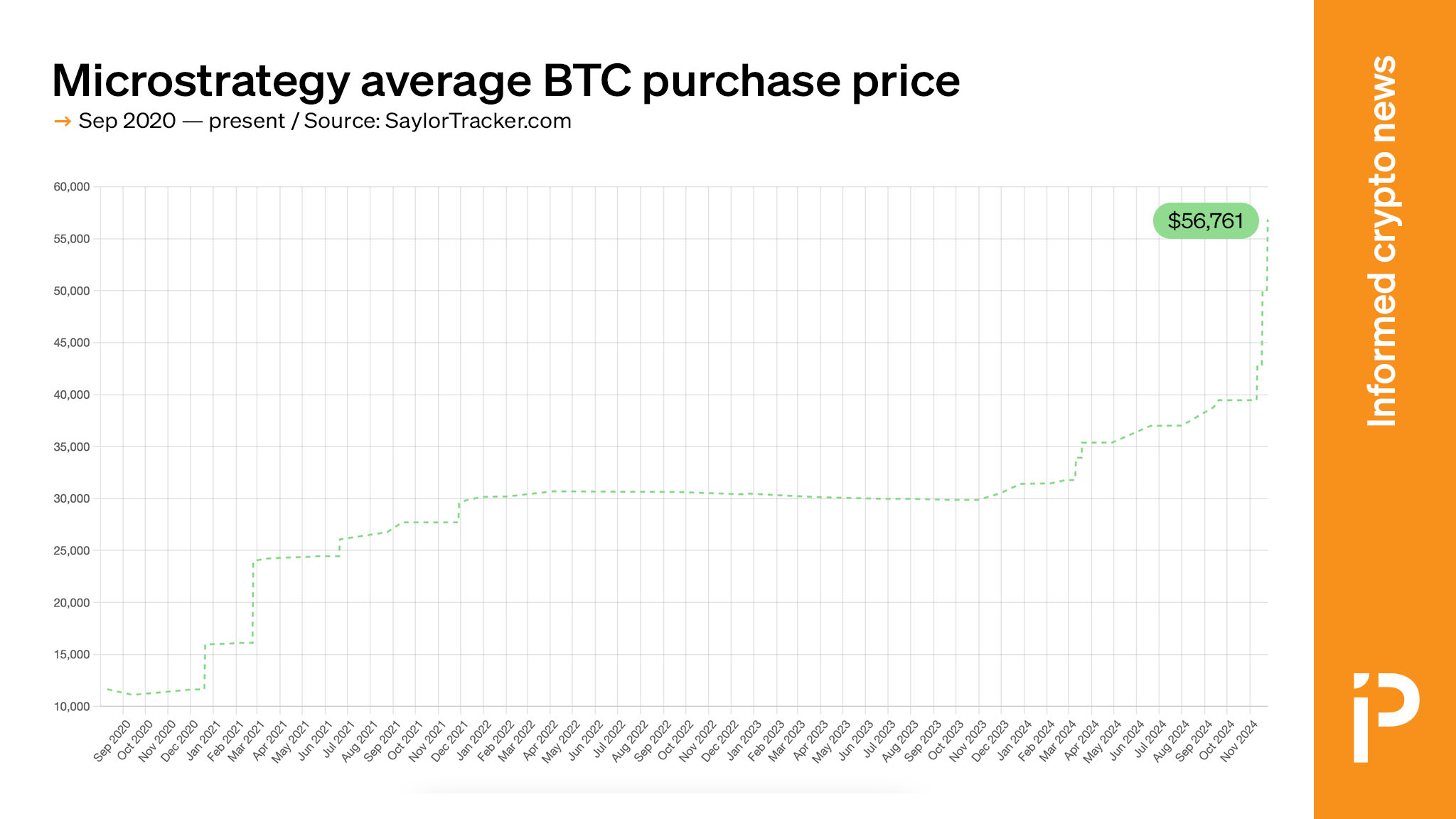

MicroStrategy’s average bitcoin purchase price is currently around $56,761. If bitcoin drops below this price, MSTR will certainly trade lower and bondholders will become worried.

Read more: Michael Saylor has lost voting control of MicroStrategy

A slight dip is manageable. Saylor could sell some shares, issue more debt, or liquidate a few bitcoin to service interest or principal payments of near-term maturities.

The worst case scenario for Saylor, however, is a protracted bear market. If bitcoin stays below MicroStrategy’s cost basis for many years, Saylor will have difficulty servicing his USD obligations to lenders. As years transpire, the calendar will encourage bitcoin liquidations to service his principal repayments.

Obviously, MicroStrategy investors are bullish on bitcoin and downplay the likelihood of this bearish outlook. Betting on higher prices has certainly paid off this year. Whether it’s a strategy that will continue to perform is uncertain.

protos.com

protos.com