The tokenization of real-world assets is growing at a rapid pace with assets exceeding a combined value of $13 billion.

Interest in Tokenized U.S. Treasury Market Heating Up

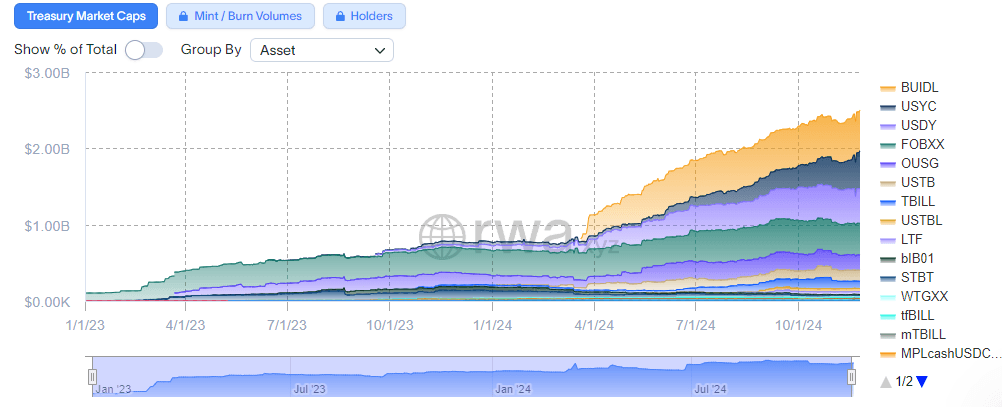

The tokenized U.S. Treasury market has reached $2.5 billion in value, reflecting a rapid embrace of blockchain technologies for digitizing traditionally illiquid real-world assets (RWAs). This is according to data from rwa.xyz, a central repository for tracking every tokenized real-world asset.

Concurrently, the broader RWA sector has seen tokenized assets exceed $13 billion in value across various categories, including private credit, stocks, global bonds, and stablecoins, highlighting a broader trend of financial innovation.

Tokenized treasuries represent a significant portion of the RWA market, appealing to both institutional and retail investors seeking liquidity and enhanced access to high-yield, secure assets. These digital assets are issued on public blockchains such as Ethereum, facilitating transparent and efficient ownership tracking while reducing transaction costs.

The high-yield and secure nature of tokenized treasuries was demonstrated recently when Tether announced its Q3 net profit of $2.5 billion, largely driven by gains realized on its holdings of U.S. Treasuries. The largest Treasury bond onchain fund in the mix is the Blackrock USD Institutional Digital Liquidity Fund (BUIDL), issued by Securitize, boasting an impressive $530 million in total value locked (TVL).

Key players in this space include platforms like Matrixdock and Backed Finance, which tokenize short-term Treasury bills and bonds. For instance, Matrixdock’s Treasury Bill Token (STBT) has accumulated over $17 million in value, while Backed Finance offers bonds with varying maturities.

The tokenized asset market is projected to experience exponential growth with estimates of tokenized assets accounting for up to 10% of global GDP by 2030 with the tokenization of traditionally static asset classes such as U.S. Treasuries offering new liquidity pathways and investment accessibility.

news.bitcoin.com

news.bitcoin.com