In a decade defined by tech, Cathie Wood has been one of the most forward-thinking investors. The CEO of Ark Investment Management (ARKK) is renowned for her focus on disruptive technologies — but her bets haven’t always paid off.

ARKK was the best-performing actively-managed fund of 2020 — it has fallen from grace significantly since. Down from a February 2021 peak of $156.58, shares of the fund are now trading at just $51.11, although the fund has marked a modest 6.38% year-to-date (YTD) gain.

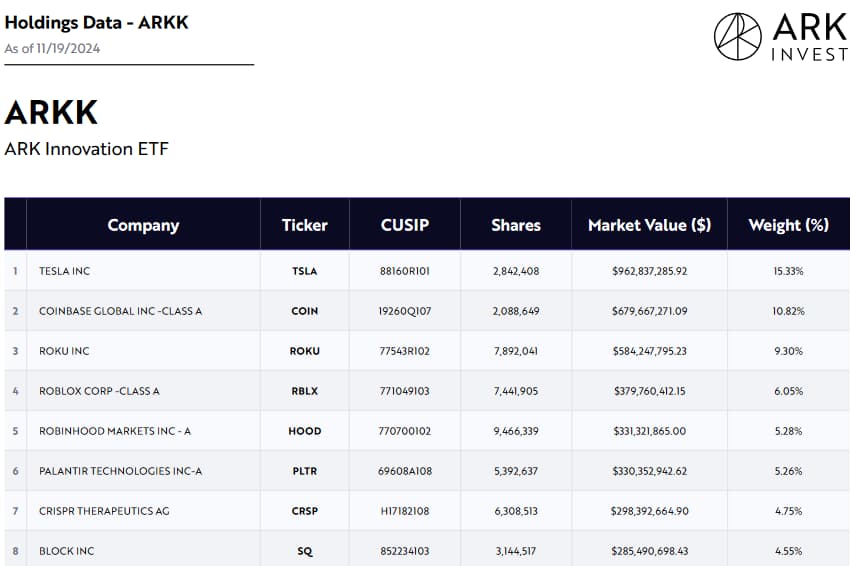

One of Wood’s favorite companies is electric vehicle maker Tesla (NASDAQ: TSLA), which is also ARKK’s largest holding. As of late, the fund has been selling the stock in spite of its impressive performance over the last month — leading to concerns as to whether or not the rise in TSLA share price is sustainable.

Wood trims TSLA stock holdings amidst price upswing

The automaker’s stock has spent most of 2024 in the red — increased competition, production bottlenecks, and concerns regarding valuation drew skepticism from a wide range of investors. The standout Q3 2024 earnings call released on October 23 brought renewed interest in TSLA stock — as did CEO Elon Musk’s support of President-elect Donald Trump.

At press time, Tesla shares were trading at $339.86, having opened at $342.97 on Monday, November 18, for a 7% surge that has brought YTD returns up to 35.25%.

On the very same day, Wood’s fund sold 30,939 TSLA shares, worth roughly $10.5 million. ARKK had previously offloaded 404,400 Tesla stocks in the past few weeks — refocusing the funds toward Amazon (NASDAQ: AMZN).

However, looking at the bigger picture, the trade wasn’t all that significant — as TSLA is still ARKK’s largest holding — at present, the EV trailblazer makes up 15.33% of the fund, with 2,842,408 shares worth approximately $962,837,285.

Is ARKK’s sale of Tesla stock a bearish signal?

While investors tend to take any sale at face value, ultimately, this latest transaction was a minor trimming of ARKK’s stake in Tesla. Wood has previously predicted that TSLA stock would reach prices as high as $2,600 in five years — and she has not walked back her optimistic appraisal of the business since.

It’s also worth remembering that her fund is actively managed — its preferred asset allocation could have drifted, management could have identified other, more appealing opportunities in undervalued companies, or it could simply be locking in gains at an opportune time.

Featured image via Shutterstock

finbold.com

finbold.com