MARA Holdings, Inc., a Nasdaq-listed bitcoin mining firm, has announced plans for a $700 million private offering of convertible senior notes due in 2030.

MARA Holdings Proposes $700 Million Convertible Notes Offering

MARA Holdings (Nasdaq: MARA) disclosed on Nov. 18 that the proposed offering is intended for qualified institutional buyers under Rule 144A of the Securities Act. MARA also plans to grant initial purchasers an option to buy an additional $105 million in notes within a 13-day period following issuance. The offering’s terms, including the interest rate and initial conversion price, will be determined upon pricing.

The announcement on Monday states that the proceeds from the offering are earmarked for three primary purposes: repurchasing up to $200 million of MARA’s existing convertible notes due in 2026, acquiring additional bitcoin (BTC), and addressing general corporate needs. These may include strategic acquisitions, asset expansions, and debt repayments.

The notes, which will mature on March 1, 2030, will bear semi-annual interest and may be redeemed or converted under specific conditions. MARA detailed on Monday that holders will have an option for MARA to repurchase their notes on Dec. 1, 2027. Conversion will be possible for cash, stock, or a mix of both, subject to MARA’s election.

The proposed issuance could affect MARA’s stock market performance. The company expects some existing noteholders, who have hedged their equity positions, to unwind these positions, potentially impacting the trading volume and price of its common stock. However, MARA has not quantified the extent of this potential market activity.

As of the announcement, the offering remains subject to market conditions and other variables. At press time, MARA shares are up 1.35% today and 9.45% over the last five days. MARA has lost 10.3% year-to-date, however. MARA emphasized that no assurances could be made about the completion or timing of the transaction.

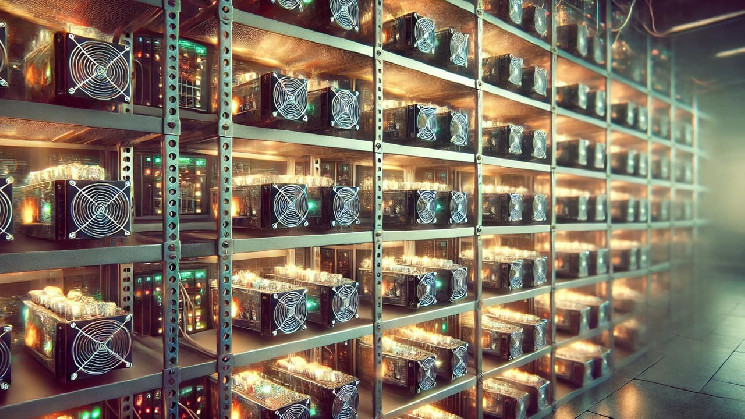

This development highlights MARA’s dual strategy of reducing short-term liabilities while leveraging its position in the bitcoin mining sector. The firm continues to prioritize investments in digital assets, aligning with its broader vision of leveraging stranded energy for economic value.

news.bitcoin.com

news.bitcoin.com