- Stablecoins are increasing demand for U.S. Treasuries, with $120 billion in collateral invested.

- Blockchain initiatives, like JPMorgan’s Onyx Platform, are revolutionizing Treasury operations and post-trade processes.

- Most central banks are exploring CBDCs to address emerging challenges in the digital asset landscape.

Digital assets, particularly stablecoins and blockchain projects, are reshaping the financial landscape. A report from the U.S. Department of Treasury shows that digital currencies are driving demand for U.S. Treasuries as investors and institutions explore blockchain’s potential to enhance the efficiency of financial transactions.

Stablecoins Increase Treasury Demand

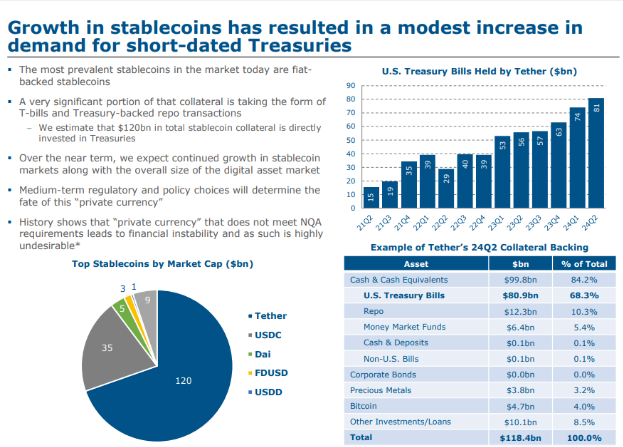

Stablecoins, digital currencies pegged to fiat assets, play a crucial role in boosting Treasury demand. An estimated $120 billion in stablecoin collateral is invested in Treasuries. Tether, the largest stablecoin by market capitalization, allocates 68.3% of its $118.4 billion reserves to Treasury bills.

Other major stablecoins, such as USDC, also boost this demand. Stablecoins act as collateral in decentralized finance (DeFi) markets and provide liquidity in digital transactions. Over 80% of crypto transactions use stablecoins as one leg of the transaction.

Fiat-backed stablecoins have been popular because of their ability to maintain a stable value, making them suitable collateral in financial markets. This integration of stablecoins into the Treasury market highlights their essential role in the digital asset ecosystem. Moreover, stablecoins are attractive in DeFi markets because of their cash-like characteristics, which makes them appealing for lending and borrowing.

Blockchain Projects Modernize Treasury Operations

In addition, both private and public projects are promoting the integration of blockchain into Treasury operations. The SIFMA Multi-Asset Ledger Settlement Pilot and the DTCC’s Digital Asset Treasury Tokenization Project aim to improve post-trade processes using shared, immutable ledgers.

For instance, JPMorgan’s Onyx Platform, which launched in 2020, now allows real-time repo transactions through tokenized Treasuries, helping institutions to manage collateral more efficiently.

In the public sector, initiatives like Project Cedar—a collaboration between the New York Federal Reserve and the Monetary Authority of Singapore—are using distributed ledger technology (DLT) to improve cross-border payments.

The European Investment Bank also made news last year by issuing £50 billion in digital bonds on a private blockchain. These projects highlight the growing interest in blockchain’s potential to modernize financial infrastructure.

Moving forward, regulatory decisions will be key in shaping the role and oversight of digital assets. A 2021 BIS survey showed that 86% of central banks are actively researching the creation and implementation of Central Bank Digital Currencies (CBDCs) to address these emerging challenges.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com