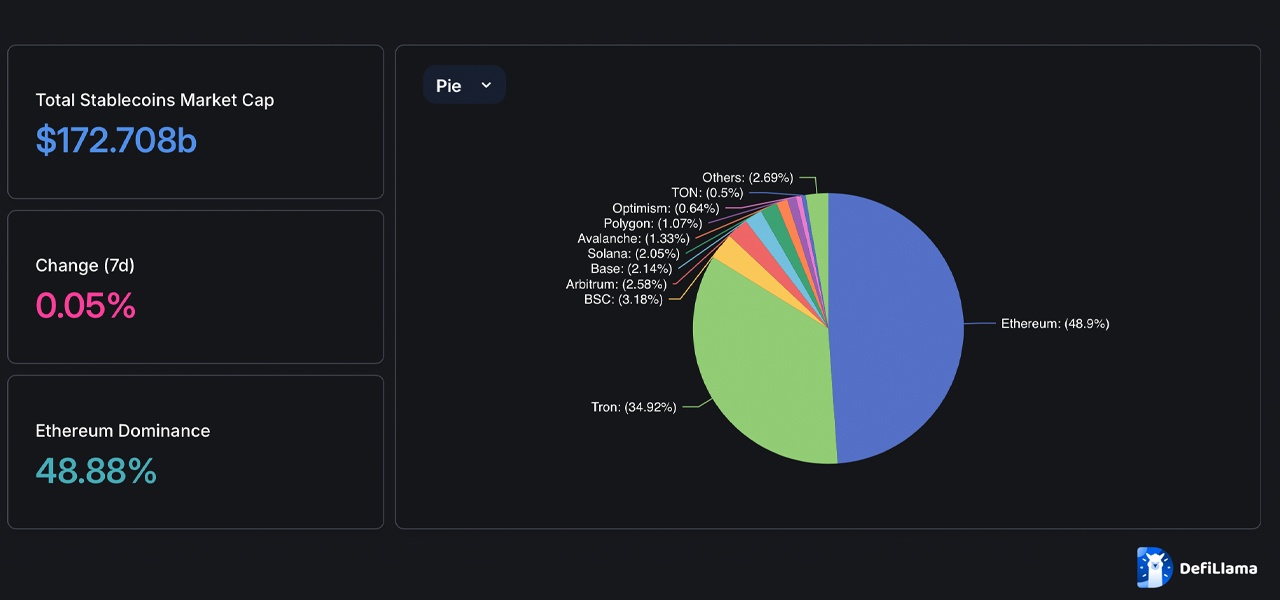

Since October kicked off, the stablecoin market has experienced a modest boost, though overall growth has remained quite slow. Currently, the sector is valued at $172.7 billion, with 48.9% of stablecoins residing on Ethereum and 34.92% circulating on Tron. Although the stablecoin landscape has expanded considerably since the start of the year, transfer volumes have been in a steady decline since May.

Crypto Market Gains, But Stablecoin Transfers Take a Hit—What’s Going On?

This weekend, the fiat-pegged stablecoin market stands at $172.7 billion, according to defillama.com. For comparison, on Jan. 27, 2024, archived data from the same source showed a valuation of $134.99 billion—a rise of 27.93%.

Current metrics reveal that 83.82% of all stablecoins in circulation are issued on Ethereum or Tron. Of this, Ethereum holds 48.9% of the supply, while Tron accounts for a hefty 34.92%.

BNB Chain comes next, hosting 3.18% of the stablecoin pool, followed by Arbitrum with 2.58%. Rounding out the top five is Base, with 2.14%. Back in January, the leading stablecoins were USDT, USDC, DAI, FDUSD, and TUSD.

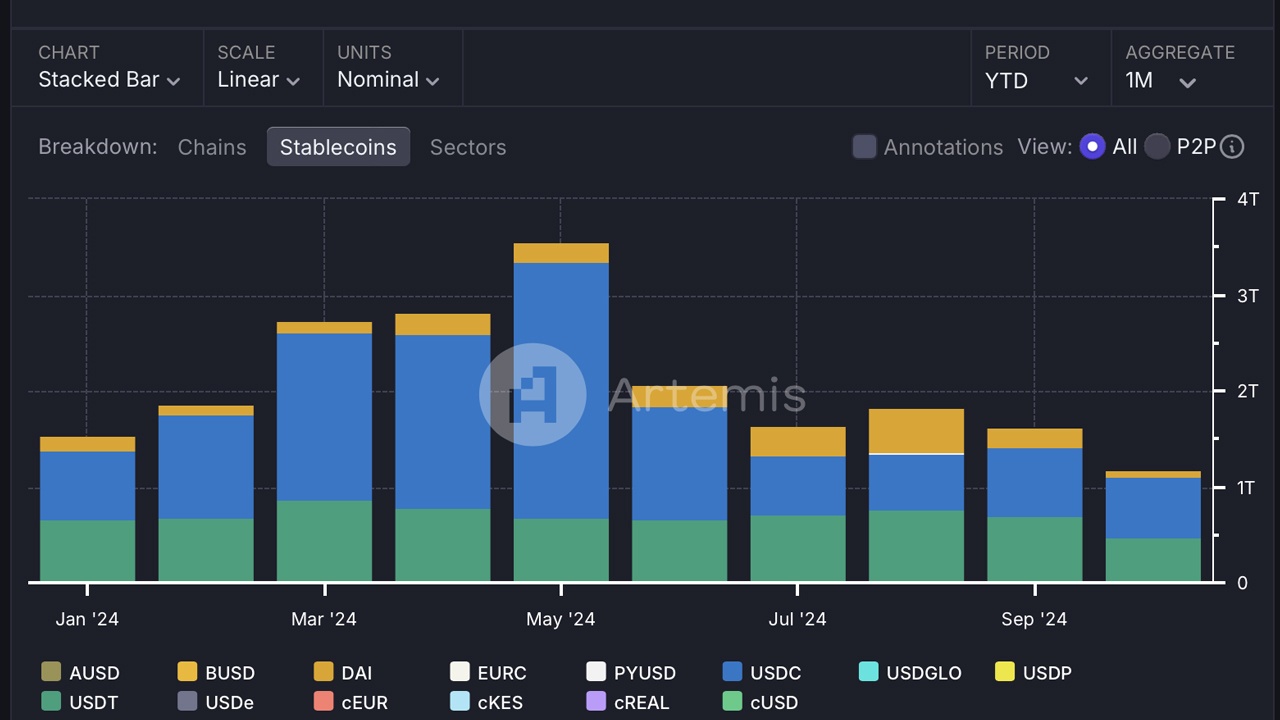

Today, the roster has shifted slightly, with USDT, USDC, DAI, USDE, and FDUSD taking the top five spots respectively. Despite several crypto market aggregation platforms reflecting substantial growth in the stablecoin sector since the start of the year, transfer volumes tell a different story.

Data collected by Artemis Terminal shows that transfer volumes have dwindled significantly since May, when they peaked at $3.6 trillion, down to $1.6 trillion last month. So far in October, about $1.2 trillion in transfer volume has been recorded.

Although active addresses have also declined since March, the drop hasn’t been as drastic as the reduction in transfer volume. Out of the $1.2 trillion transferred this month, $309.2 billion was facilitated on Ethereum, while Tron handled $282.9 billion.

Combined, this means Ethereum and Tron were responsible for 49.34% of October’s transfer volume. The drop in stablecoin transfer volume, despite higher bitcoin and crypto prices earlier this year, particularly in March, April and May, indicates a shift in sentiment.

This noticeable shift, combined with a decline in speculative trading during calmer periods and mounting regulatory pressure this year, likely contributed to the reduced movement of stablecoins. Historically, traders tend to limit fund transfers when markets are steady or uncertain.

Furthermore, the growing stablecoin market is being gradually fueled by yield-bearing fiat-pegged coins such as USDE. These coins are often held for extended periods, unlike their non-yield-bearing counterparts, which are more actively utilized for everyday transactions.

This emerging trend showcases a trend toward holding some stablecoins as investment assets rather than purely as tools for trading or payments. However, if market volatility picks up or investor confidence in crypto assets strengthens, stablecoin transfers could climb again.

During turbulent times, traders often turn to stablecoins to protect value and execute swift trades, making them ideal for rapid, low-risk moves amidst economic fluctuations. Despite the decline, stablecoin transfer volumes continue to outpace a wide range of non-stablecoin crypto transactions.

What do you think about the stablecoin economy’s growth and the dwindling transfer volume over the past few months? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com