Crypto asset manager Grayscale has filed with the U.S. Securities and Exchange Commission (SEC) to convert its $520 million Digital Large Cap Fund, which tracks multiple cryptocurrencies, into an exchange-traded fund (ETF).

You might also like

Crypto market grew by 8% in Sep, surpassing other major sectors

Aussie Towns Embrace Crypto: Surge in ATM Installations and Rising Interest

The New York Stock Exchange (NYSE) made the formal request for conversion on Grayscale’s behalf through a 19b-4 filing on October 14, asking the SEC to modify rules to enable the listing of this new ETF.

The fund manages over $524 million in assets, with a majority allocation of 76% in Bitcoin, 18% in Ether, and the remaining split among Solana, XRP, and Avalanche.

In an 8-K form sent to investors, Grayscale outlined the proposed rule and listing changes by the NYSE. Converting to a spot ETF would make it easier for investors to buy and sell shares in the fund.

This filing follows two major conversions earlier this year, where the SEC approved Grayscale’s Bitcoin Trust (GBTC) and Ethereum Trust (ETHE) to be converted into ETFs. Initially, the SEC had rejected all applications for spot crypto ETFs, but a court ruling in favour of Grayscale in August led to a shift in the regulator’s stance.

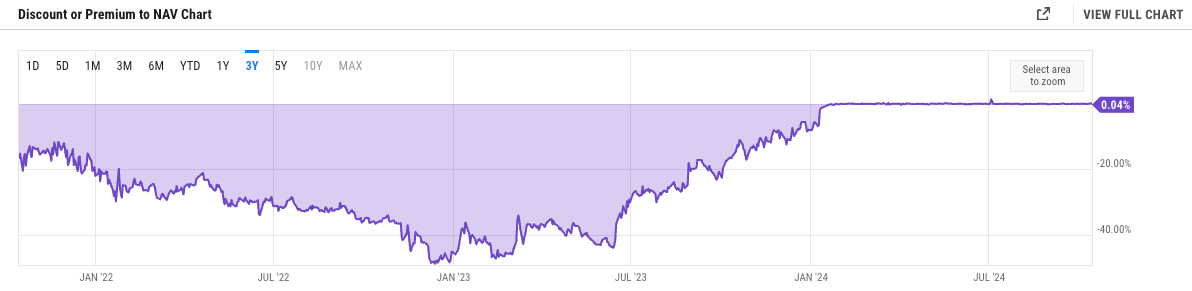

Unlike trusts or futures-based funds, spot ETFs hold the actual underlying assets, simplifying the buying and selling process for investors. However, after converting its funds to ETFs, Grayscale saw significant investor sell-offs due to changes in the discount to net asset value (NAV).

For example, six months before GBTC’s conversion, shares were trading at a 44% discount compared to buying Bitcoin directly. After conversion, these pricing discrepancies disappeared, prompting investors to cash out.

Since converting its Bitcoin ETF in January, Grayscale has experienced $21 billion in outflows, with an additional $3 billion in outflows from its Ethereum ETF since July. On October 10, Grayscale added 35 altcoins, including Dogecoin, Worldcoin, and Jupiter, to its list of potential future investment assets. Additionally, the firm has been launching new crypto funds almost monthly, with recent offerings including an Aave fund in October, an XRP Trust in September, and an Avalanche fund in August.

coinculture.com

coinculture.com