Leading asset manager Grayscale has filed for a new exchange-traded fund (ETF), this time for its fund containing multi-coins, including XRP.

Crypto investors are bracing for the first multiple-coin fund after Grayscale filed to convert one of its long-standing investment vehicles, containing assets like Bitcoin and XRP, to an ETF. According to a Tuesday filing, Grayscale has filed to convert its Digital Large Cap Fund to an exchange-traded fund.

On October 15, the NYSE submitted the 19b-4 filing to the US Securities and Exchange Commission in Grayscale’s stead. If approved, the exchange will list and trade the ETF, providing investors with exposure to multiple digital assets in one fund.

ETF to Provide Multi-Coin Exposure, Including XRP

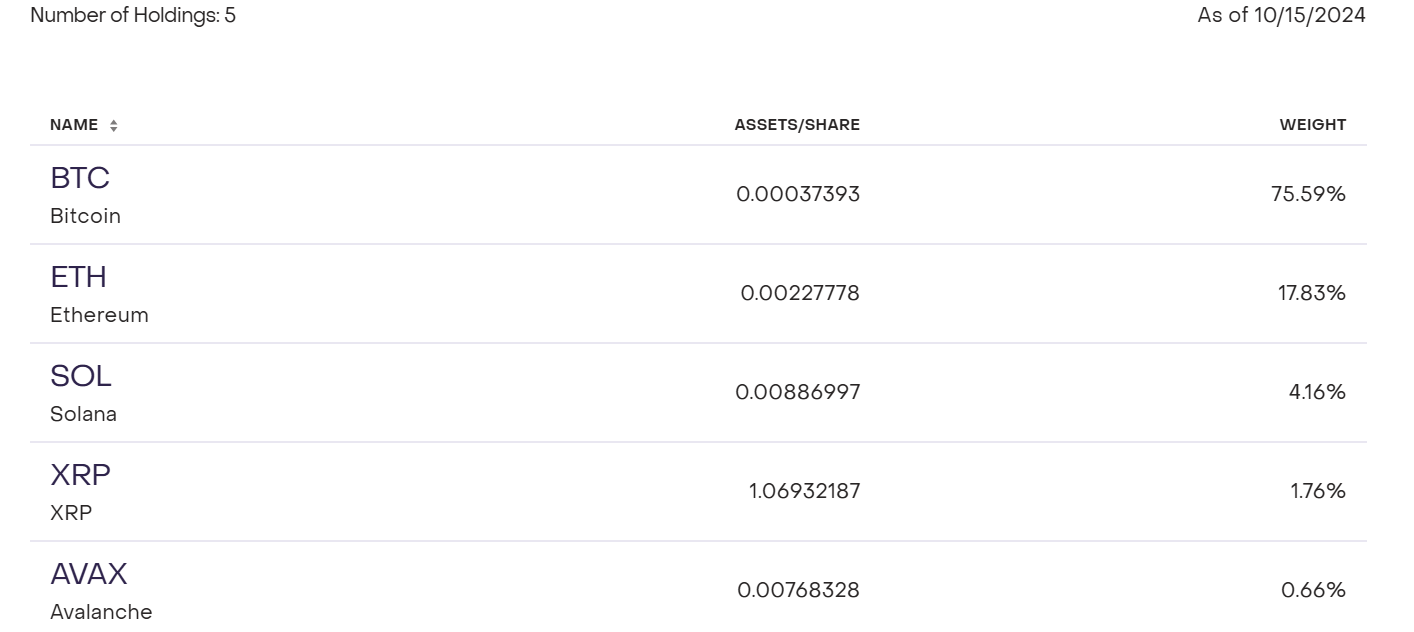

The Digital Large Cap Fund, with ticker GDLC, has existed as a closed-end investment product since July 2022, accruing an asset under management of $524 million. Notably, the fund is weighted with five crypto assets, all in the top 20 cryptocurrency rankings by market cap.

According to Grayscale’s website, the GDLC contains 75% Bitcoin, 18% Ethereum, 4.16% Solana, 1.76% XRP, and 0.66% Avalanche. As of October 15, the fund trades over the counter at $23.15 per share.

If approved, the fund will be the market’s first multi-token digital asset investment vehicle. It would also give US investors their first ETF-related exposure to assets like XRP, Solana, and Avalanche.

Notably, Grayscale is not the first to push an ETF that offers investors alternative exposure to more than one cryptocurrency. Franklin Templeton filed for a Bitcoin and Ethereum Index ETF with the Wall Street regulator earlier this month.

Crypto Gearing up For Regulatory Landscape Shift

It bears mentioning that the number of ETFs filed recently has grown substantially. For instance, Bitwise and Canary have filed for an XRP ETF. Also, Ark Investment and VanEck filed for a Solana ETF earlier in the year.

These ETF filings have increased as the November presidential elections draw nearer. According to ETF Store president Nate Geraci, the applications depict increased confidence among crypto firms in a regulatory shift in the US when a new administration comes into office.

Both Republican and Democratic nominees have embraced the nascent innovation, promising to set clear regulatory reforms that would favor the crypto industry. Meanwhile, key industry players have preferred Donald Trump due to his clear plans for the sector, including firing SEC chair Gary Gensler.

Analysts have argued that the chances of approving both XRP and Solana ETFs are higher if Trump becomes president. Also, an end to the years-long battle between the SEC and Ripple, which would further boost the chances of an XRP ETF approval, could take effect when Gensler is out of office.

thecryptobasic.com

thecryptobasic.com