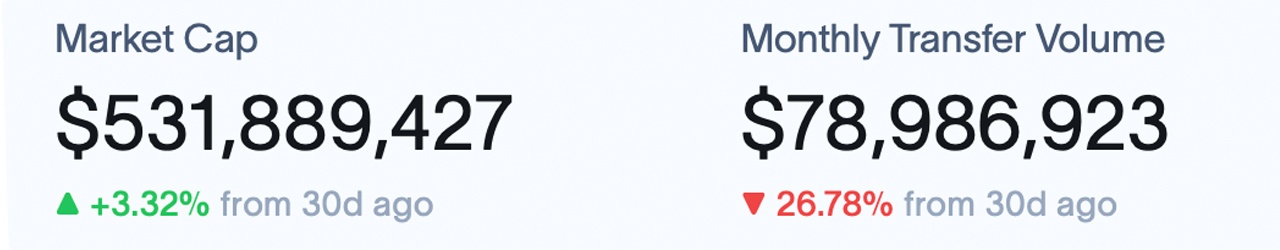

Since surpassing the $2 billion milestone in tokenized U.S. Treasuries at the end of August, the sector has added another $210 million. The Blackrock USD Institutional Digital Liquidity Fund (BUIDL) still holds the top spot with a market cap of $531.88 million, reflecting a 3.32% rise over the last 30 days. Meanwhile, the Hashnote Short Duration Yield Coin (USYC) has seen an impressive 27.38% increase this month.

Behind the Growth of Tokenized Treasuries: What the Numbers Reveal

Since late August, tokenized U.S. Treasuries have continued to expand, with their market value jumping by another $210 million, bringing the total to $2.21 billion. Essentially, these assets are digital versions of U.S. Treasury securities, represented as tradable tokens on a blockchain platform. Much like stablecoins or other real-world-asset (RWA) tokens, each of these is backed by the full faith and credit of a U.S. government bond, offering a secure investment option similar to traditional Treasuries.

Tokenized Treasuries combine the stability of U.S. government bonds with the perks of blockchain technology, including 24/7 accessibility and easier trading of these assets. The largest tokenized U.S. bond fund, managed by financial asset giant Blackrock, holds $531.88 million, marking a 3.32% increase since Sept. 11. Hot on its heels is the Ondo U.S. Dollar Yield (USDY) with a market valuation of $441.14 million, reflecting an 11.3% growth over the past 30 days.

Meanwhile, Franklin Templeton’s Franklin Onchain U.S. Government Money Fund (FOBXX) secures $437.47 million at press time, although its market cap has seen a slight dip of 0.66% since Sept. 11. On a different trajectory, the Hashnote Short Duration Yield Coin (USYC) posted a 27.38% gain, reaching $309.39 million. Completing the top five is the Ondo Short-Term U.S. Government Bond Fund (OUSG), valued at $189.99 million, though it has experienced a 16.23% drop in market cap over the past month.

Interestingly, despite the substantial market values, the total number of holders for all these funds remains quite low, standing at just 6,213. Only 25 investors hold BUIDL, with 12 active addresses last month. Yet, BUIDL still saw $78.99 million in transfer volume over the last 30 days, though it is down 26.78% since Sept. 11. In contrast, OUSG’s transfer volume surged 368.38% from the prior month, with $115.97 million transferred.

The steady growth in tokenized U.S. Treasuries points to an increasing interest in blockchain-based investments that blend the stability of traditional finance (tradfi) with the flexibility of digital innovation. As these assets gain momentum, their potential for scalability and accessibility could open doors for wider adoption by both retail and institutional investors.

Despite the small number of holders, the consistent rise in market caps and transfer volumes shows that tokenized Treasuries are gaining a solid foothold. With blockchain technology and real-world assets (RWA) evolving, many believe these digital investments could revolutionize how investors engage with all forms of tradfi products, offering unique advantages for diverse portfolios.

What do you think about the tokenized Treasuries market swelling by $210 million since crossing the $2 billion mark? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com