- Argentina surpasses Brazil with a staggering $91.1 billion in cryptocurrency transactions between June 2023 and June 2024.

- Amid economic turmoil, 60% of Argentina’s cryptocurrency transactions involve stablecoins, offering a hedge against high inflation.

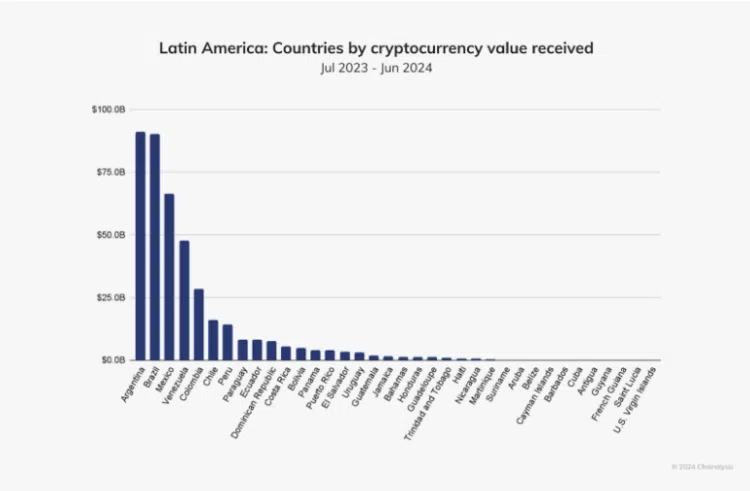

Argentina has surpassed Brazil as the leading user of cryptocurrencies in Latin America, according to data from Chainalysis for the period between June 2023 and June 2024. The report indicates that transactions in Argentina involving cryptocurrencies, particularly stablecoins, amounted to approximately $91.1 billion, compared to Brazil’s $90.3 billion.

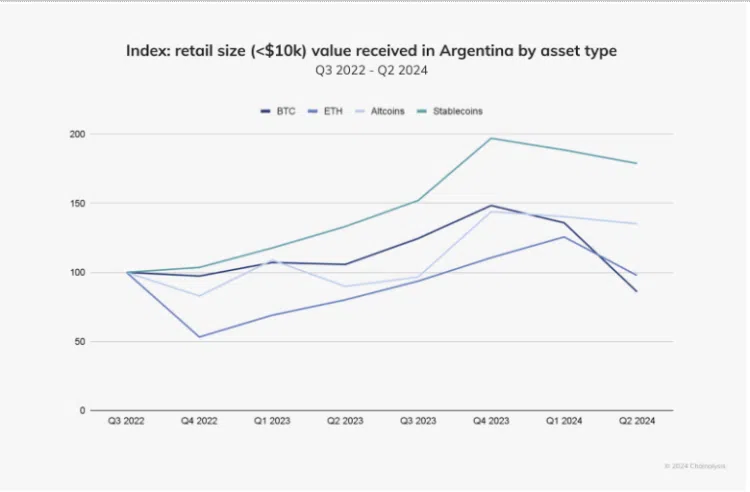

Stablecoins are the most used cryptocurrency in Argentina, comprising 61.8% of all crypto transactions in the country. This preference for stablecoins over other cryptocurrencies like Bitcoin, which accounts for 14.7% of transactions, altcoins at 13.4%, and Ethereum at 10%, is notably higher than global averages.

The increased use of stablecoins in Argentina is largely attributed to the country’s economic instability, characterized by high inflation rates and significant currency devaluation.

This year, unfortunately, Argentina’s economic situation has been particularly volatile. In the second half of 2023, inflation was around 143%, the value of the ARS had plummeted, and four out of ten Argentines lived in poverty. In December 2023, newly elected President Javier Milei announced that the ARS would be devalued by 50%, which he described as “shock therapy,” and that the government would cut energy and transportation subsidies. – Chainalysis.

The economic crisis in Argentina has been severe, with inflation reaching around 143% in the latter half of 2023, and 40% of the population living below the poverty line. In response to these challenges, President Javier Milei implemented a series of economic measures including a 50% devaluation of the Argentine peso and reductions in subsidies for energy and transport.

The integration of stablecoins has become a practical solution for many Argentinians, offering a way to circumvent the volatile local currency.

Data from Chainalysis suggests that the use of stablecoins for smaller, retail-sized transactions is growing faster than any other asset type in Argentina, underscoring their role in providing financial stability.

As we reported on Crypto News Flash, the broader adoption of cryptocurrencies in Argentina reflects a global trend where countries facing economic difficulties increasingly turn to digital assets. This shift is evident in the global cryptocurrency adoption index by Chainalysis, which also highlights the significant role of other Latin American countries such as Mexico and Venezuela in the cryptocurrency market.