While Bitcoin continues its recovery towards $ 70,000 after Donald Trump's positive statements at the Bitcoin 2024 Conference, Coinshares published its weekly cryptocurrency report.

Stating that it experienced a small inflow of $ 245 million into cryptocurrency investment products last week, Coinshares stated that one of the largest inflows since December 2020 was seen with the launch of spot Ethereum ETFs in the USA.

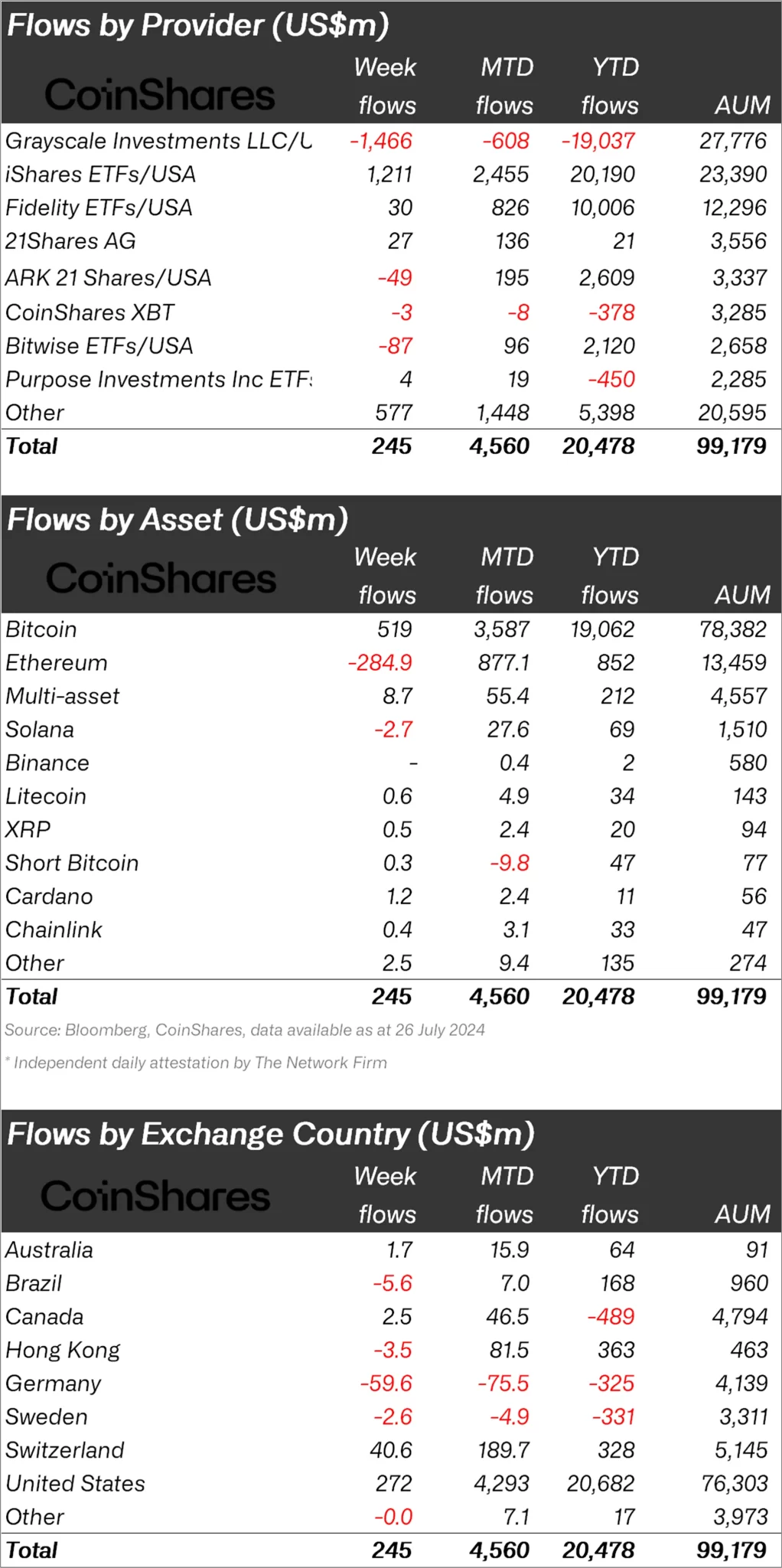

“Cryptocurrency investment products saw a relatively low inflow of $245 million last week.

Bitcoin has seen healthy inflows of $519 million, and inflows since the beginning of the month have reached $3.6 billion.

The launch of spot Ethereum ETFs in the US saw some of the largest inflows since December 2020. “While $2.2 billion inflows came into newly issued ETFs, outflows from existing ETFs resulted in a net outflow of ETH exceeding $285 million in total.”

Bitcoin and Ethereum Paint a Complex Picture!

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of 519 million dollars, the largest altcoin Ethereum (ETH) saw an outflow of 285 million dollars.

When we look at other altcoins, Solana (SOL) experienced an outflow of $2.7 million, Cardano (ADA) experienced an inflow of $1.2 million, Litecoin (LTC) $0.6 million and XRP $0.5 million.

“Bitcoin has seen healthier inflows of $519 million, pushing month-to-date inflows to $3.6 billion and YTD inflows to a record $19 billion.

We believe US election campaign comments about Bitcoin as a potential strategic reserve asset and increasing chances for a Fed rate cut in September 2024 are likely reasons for renewed investor confidence.

Spot Ethereum ETFs also saw some of the largest inflows since December 2020, but this week saw outflows amounting to $1.5 billion from Grayscale's existing trust. This led to a net outflow of $285 million in ETH last week.

“This is similar to the Bitcoin trust exits in the January 2024 ETF launches.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 272 million dollars.

After the USA, Switzerland ranked second with 40.6 million dollars.

Against these inflows, Germany received 59.6 million dollars; Hong Kong experienced an outflow of $3.5 million.

*This is not investment advice.