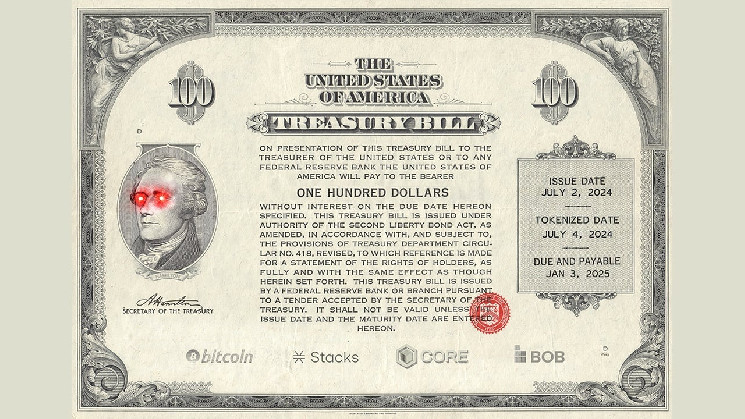

Hamilton has announced the tokenization of U.S. Treasury bills on Bitcoin’s layer two (L2) platforms, stating that it marks a significant advancement in bridging traditional finance with Bitcoin’s decentralized finance (defi) sector. The move aims to enhance financial accessibility and liquidity within the Bitcoin ecosystem.

U.S. Treasury Bills Tokenized on Bitcoin’s L2s

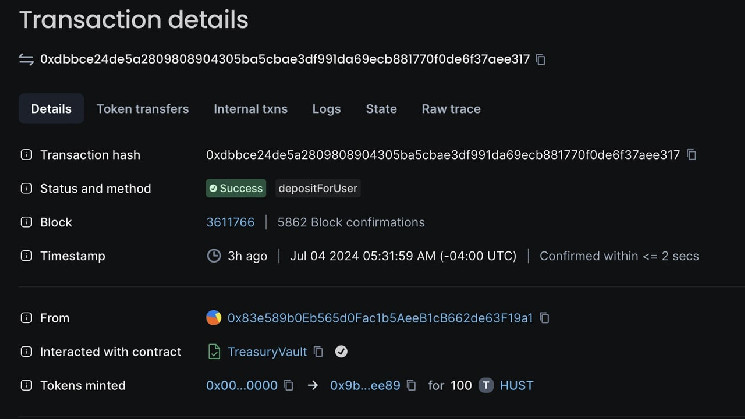

Hamilton, a startup specializing in real-world asset (RWA) tokenization, initiated the tokenization of U.S. Treasury bills on Bitcoin Layer 2 solutions—Stacks, Core, and BoB—on July 4, 2024. This effort highlights a pivotal step in integrating traditional financial instruments with the security and transparency of Bitcoin.

The tokenization project seeks to make government-backed assets more accessible and tradable within Bitcoin’s defi ecosystem. By utilizing Bitcoin’s L2 solutions, Hamilton told Bitcoin.com News that it aims to improve scalability, reduce costs, and enhance the liquidity of these assets. Hamilton further highlighted a Boston Consulting Group report, showing the RWA market is projected to reach $16 trillion by 2030, underlining the potential impact of this initiative.

Brendon Sedo, an initial contributor to Core DAO, stated that tokenizing U.S. Treasury bills on the Core chain is a significant milestone, leveraging Bitcoin’s security and Core’s scalability to bridge the gap between traditional finance and Web3. Alexei Zamyatin, co-founder of BoB, emphasized that this tokenization leverages both Bitcoin and Ethereum’s strengths to drive financial innovation.

“Tokenizing U.S. Treasury bills on BoB leverages the combined power of Bitcoin and Ethereum to drive financial innovation and liquidity,” the CEO and co-founder of Hamilton, Kasstawi said.

The tokenized Treasury bills will soon be available on Hamilton’s platform, the announcement on Thursday detailed. Kasstawi told Bitcoin.com News that the combination of Bitcoin’s security with tokenized T-notes is a “historic step towards financial independence.”

What do you think about minting U.S. Treasury notes on Bitcoin? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com