We do the research, you get the alpha!

Decrypt’s Art, Fashion, and Entertainment Hub.

Discover SCENE

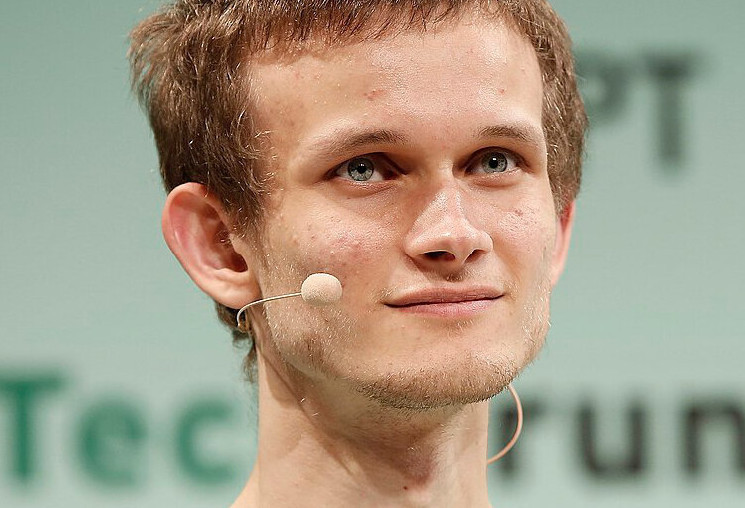

The blockchain-based betting site Polymarket announced Tuesday that it raised $70 million in two fundings rounds, one which saw participation from Ethereum co-founder Vitalik Buterin.

The Series B funding round that Buterin participated in also saw allocations from Eventbrite co-founder Kevin Hartz, the crypto venture fund Dragonfly, and the Founders Fund, a venture capital firm co-founded by Peter Thiel, which led the $45 million funding round.

That was preceded by a $25 million Series A funding round led by the early-stage venture capital firm General Catalyst, which also saw participation from Airbnb co-founder Joe Gebbia, Polymarket said in a press release.

Buterin previously participated in a 2018 seed funding round for StarkWare, creators of the Ethereum scaling solution Starknet. Last year, the Ethereum co-founder also participated in a seed funding round for Nocturne, a protocol enabling private accounts on Ethereum.

“Market-based forecasts will inevitably become an integral part of how we follow news and find truth,” Shayne Coplan, Polymarket’s founder, said in a statement. “It has been humbling to see that vision begin to materialize at scale, with so many people relying on Polymarket when following important current events.”

Polymarket has registered $39.5 million in volume over the past 28 days across 2,600 active wallets, according to a Dune dashboard. As of May 8, the platform had $20.5 million in bets outstanding, a 15% bump over the past month.

On Polymarket, traders can speculate on a myriad of topics, from when the Federal Reserve will cut interest rates to whether Former First Lady Michelle Obama wins this upcoming U.S. presidential election. At times, that range has proved controversial, such as betting last year on whether a submarine lost in the Atlantic Ocean would be found or Snoop Dogg’s smoking habits.

With the new funding, Polymarket said it’s weighing the prospect of a U.S. debut, with help from Richard Jaycobs, the company’s new head of market expansion. Prior to joining Polymarket, Jaycobs served as the CEO of The Clearing Corporation and President of Cantor Exchange.

Polymarket was ordered to pay a $1.4 million penalty by the Commodity Futures Trading Commission in 2022 for offering users “off-exchange event-based binary options contracts” and failure to “obtain designation as a designated contract market (DCM) or registration as a swap execution facility (SEF).”

“I’ve been involved in the registration and operation of over a dozen innovative financial derivatives exchanges and clearinghouses,” he said. “Regulated markets serve an important economic role for commercial interests and offer exceptional transparency.”

Buterin’s comments on Polymarket have been few and far between on social media, but the Ethereum co-founder indicated that he was experimenting with Polymarket years ago.

The magic link service does fancy AWS trusted hardware stuff so that (assuming AWS does not get hacked) the "root of trust" of your account is your email.

And the outreach to non-crypto users is successful; polymarket has a lot of volume!

— vitalik.eth (@VitalikButerin) November 4, 2020

Buterin said on Twitter (aka X) that he was “trying out” Polymarket in 2020, describing its user interface as something optimized for “attracting users outside of crypto.” Additionally, he pointed out the website’s ability to let speculators use a credit card to purchase the stablecoin USDC, the token that Polymarket facilitates users’ trading in.

In March, he referenced Polymarket as a guide to see how far Ethereum transaction costs could fall following Ethereum’s latest upgrade. Noting that some crypto market-participants may be expecting a less pronounced fall, Buterin said, “you can use the market to hedge!”

Edited by Stacy Elliott.

decrypt.co

decrypt.co