According to research firm Sacra, stablecoins are making sense in crypto and are estimated to surpass Visa in Q2 2024.

As the crypto market is continuously evolving, stablecoins are supposed to emerge as a strong competitor to Visa in terms of Total Payment Volume (TPV). Sacra, a research firm, anticipated that Stablecoins could defeat Visa in Q2 due to effective cross-border transactions.

What Scara Says About Stablecoin’s Performance?

A blog post by Scara’s co-founder Jan-Erik Asplund revealed that stablecoins are all prepared to surpass Visa in the current quarter. As per the report, stablecoins could surpass Visa in TPL, reaching over $4 Trillion.

“Most of the banks are shifting to stablecoins to run their payments system,” Asplund added.

Turner Novak, the founder of Banana Capital, took X to communicate the stablecoin’s estimated performance for Q2, 2024.

Here’s how we think about separating signal from noise in stablecoin data at Visa – https://t.co/5k1W5io2Bk

— Cuy Sheffield (@cuysheffield) May 5, 2024

“Stablecoins are estimated to pass Visa in total payments volume in Q2. Anyone know where most of these volumes are coming from? And what they’re being used for?” he wrote.

Stablecoins On The Way To Establish Settlement Network

On April 25, 2024, Visa, the trusted world leader in digital payment technology, posted a blog about Stablecoin’s move to establish a settlement network.

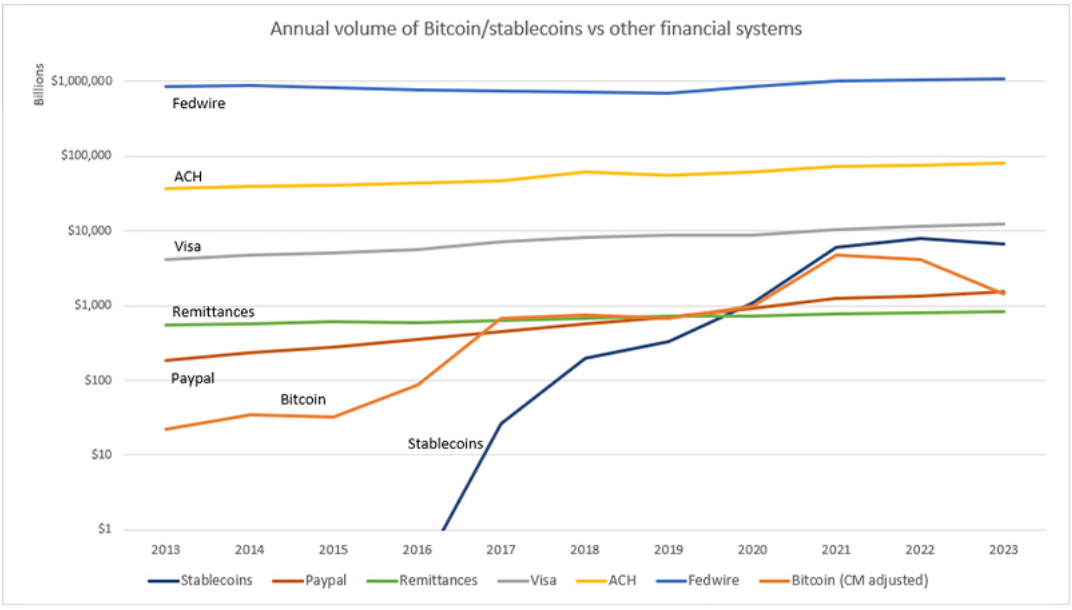

According to the graph, in the space of 6 years, stablecoin reached from $1 to over $9,000 by the end of 2023. Visa, on the other hand, hit around $11,000 by 2023.

Annual volume of BTC/ Stablecoins and other financial systems I Source: Visa

The situation showcases the firm side and outstanding performance of Stablecoins compared to Visa.

As per the Visa Onchain Analytics dashboard, stablecoins recorded $2.4 trillion in total transaction volume (TVL), 337.6 million in transaction count, and 26.4 million in Monthly Active Users (MAY) in the last 30 days.

Visa Head’s Reaction To The Estimations

Cuy Sheffield, Visa’s head of crypto, has voiced doubt regarding the authenticity of stablecoin transaction data. He suggests that the bulk of on-chain movements, often due to bots and automated mechanisms, do not equate to conventional settlement processes.

Visa’s new analytics platform indicates that a major portion, up to 90%, of the stablecoin dealings in the past month did not involve real users.

In April, the aggregate stablecoin transaction volume reached approximately $2.2 trillion. Yet, Visa categorizes a mere fraction, about $149 billion or less than 10%, as legitimate human transactions.

The remainder is attributed to automated operations and bot-driven activities, commonly originating from centralized trading platforms.

Visa is a leader in digital payments, offering transactions between consumers, merchants, financial institutions, and government entities across 200 countries. Visa expanded its stablecoin settlement capabilities to the high-performing Solana blockchain and worked with Worldpay and Nuvei.

thecoinrepublic.com

thecoinrepublic.com