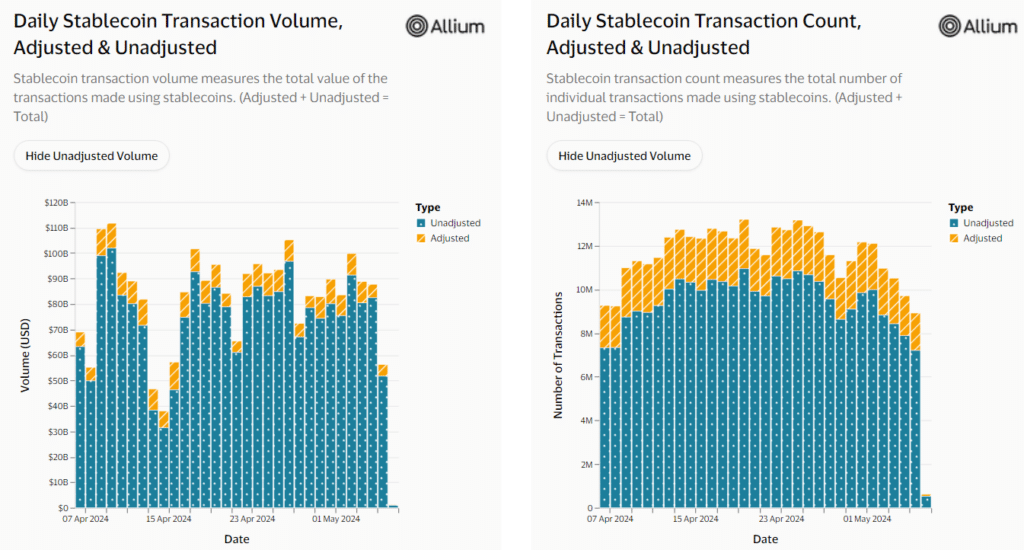

International payment giant Visa has unveiled a new study challenging the assumption that stablecoin turnover is approaching levels seen in traditional payment networks.

Visa, a global payment network, has raised concerns about the reliability of stablecoin transactions, opposing the common belief that they are becoming as popular as traditional money networks.

Cuy Sheffield, Visa’s head of crypto, suggested in a recent X thread that a significant portion of stablecoin transactions across many blockchain networks are influenced by “a lot of noise,” mainly due to automated bot activities.

3/ We found there can be a lot of noise in stablecoin data given that they can be used across a range of use cases with transactions that can be initiated manually by an end user or programmatically through bots.

— Cuy Sheffield (@cuysheffield) April 25, 2024

Visa’s methodology of differentiating between stablecoin transactions relies on two metrics. Firstly, it focuses only on the largest stablecoin amount transferred within a single transaction, excluding smaller transactions resulting from complex smart contract interactions.

Secondly, it employs an “inorganic user filter,” targeting transactions initiated by accounts engaging in fewer than 1,000 stablecoin transactions and $10 million in transfer volume.

“This removes various bot activity as well as automatic transactions from large entities like centralized exchanges.”

Visa

In a commentary to Bloomberg, Pranav Sood, executive general manager for EMEA at payments platform Airwallex, noted that data says that stablecoins “are still in a very nascent moment in their evolution as a payment instrument,” adding that in the short-term and the mid-term, the market should focus on “making sure that existing rails work much better.”

However, not everyone in the cryptocurrency market agrees with Visa’s findings, questioning their methodology. Nick van Eck, co-founder of Agora, a startup specializing in stablecoins, said in a statement to DL News that the data “makes no sense because then it would factor in trading firms, which are entirely legitimate businesses using these products.”