Coinbase has released its first quarter report for 2024, showcasing a substantial 72% quarter-on-quarter increase in total revenue to $1.6 billion. This surge in revenue was accompanied by a notable net income of $1,176 billion, representing an increase of 1,588% YoY.

Coinbase posted a net income of $1,176 billion in the first quarter, compared to a net loss of 79 million in the same period last year. Compared to last quarter, Coinbase's net income surged 331%.

The cryptocurrency exchange experienced an uptick in its market share across US spot and derivatives trading, along with reaching record highs in Coinbase Prime usage and USDC market capitalization. According to the company, notable international operations significantly contributed to its overall growth.

Impact of Bitcoin ETFs

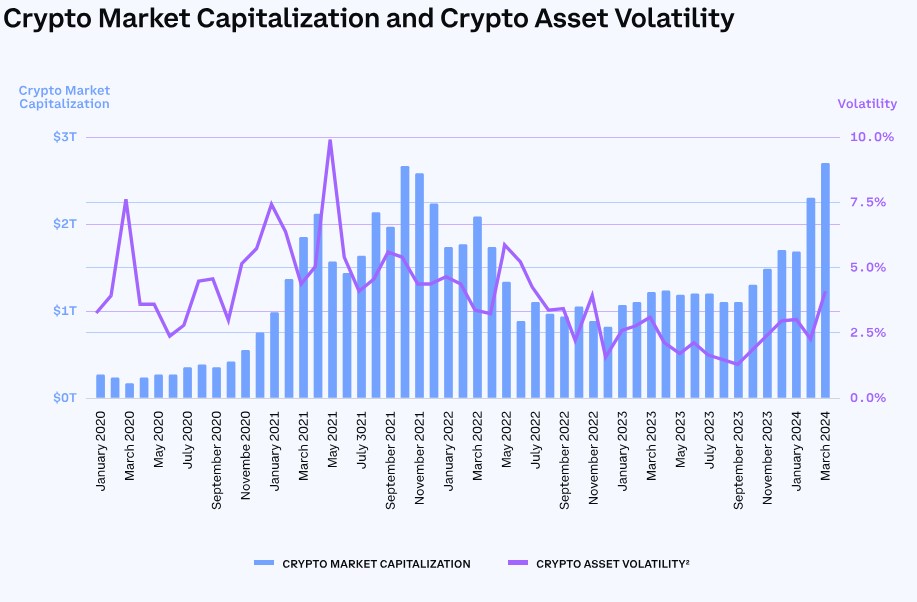

Coinbase mentioned: "While we cannot attribute the increase in market capitalization to a specific driver, we believe this increase was influenced by a variety of factors, such as the launch of the Bitcoin ETFs, which have experienced over $11 billion in net inflows so far in 2024."

Adjusted EBITDA increased from $324 million in the previous quarter to $1.014 billion, compared to $287 million reported in the first quarter of last year. Looking ahead, Coinbase anticipates continued momentum in Q2 2024, with robust projections in transaction, subscription, and service revenue.

Recently, Coinbase secured registration as a restricted dealer by the Canadian Securities Administrators. This achievement marked an important moment in Coinbase's global expansion efforts, positioning it as the first international crypto exchange to attain registration in Canada.

The registration in Canada adds to Coinbase's growing list of registrations in key countries worldwide, including France, Spain, Singapore, Italy, Ireland, and the Netherlands. Meanwhile, in the United States, a federal judge in Manhattan permitted the US Securities and Exchange Commission to proceed with a lawsuit against Coinbase, albeit dismissing one claim.

Navigating Regulatory Hurdles

"On the legislative front, we are seeing a step change among key leaders in Washington DC aligning on the need for stablecoin legislation, which we believe is a hopeful sign that broader crypto legislation will eventually materialize in the US," Coinbase added.

The SEC's lawsuit against Coinbase, initiated in June, alleges violations of securities regulations related to the trading of certain crypto tokens. Central to the legal dispute is the interpretation of crypto assets as securities, with the SEC relying on established legal precedents to support its case.

financemagnates.com

financemagnates.com