As expected, the Federal Open Market Committee of the U.S. Federal Reserve on Wednesday left its benchmark fed funds rate range unchanged at 5.25-5.50%.

Also pretty much as expected, the FOMC acknowledged that progress on lower inflation has stalled this year and said it wouldn't be appropriate to trim rates until it has greater confidence inflation is moving "sustainably" towards 2%.

The price of bitcoin (BTC) has bounced modestly in the minutes since the news hit, but remains under pressure, down more than 4% for the session at $58,000.

Markets came into 2024 expecting a long series of rate cuts from the U.S. central bank, but those hopes have been whittled down sharply over the past few weeks as the economy continues to show strength and inflation has actually risen a bit in the year's first four months. According the CME FedWatch tool, markets (prior to today's Fed decision) were pricing in a nearly 25% chance of zero rate cuts this year. One month ago, there was just a 1% chance of no Fed easing in 2024.

That change in expectations has weighed a bit on traditional markets, with the Nasdaq lower by about 5% since hitting its 2024 high about three weeks ago and the S&P 500 off by a similar amount since touching its year-to-date high in late March. It's also likely contributed to the plunging bitcoin price, which is now down more than 20% from its record high from mid-March above $73,000.

A check of traditional markets shortly after the FOMC announcement, finds stocks remaining little-changed and the dollar and bond yields slightly lower. Gold is up 0.5% at $2,316 per ounce but remains about 4% down from its record high above $2,400 hit in mid-April.

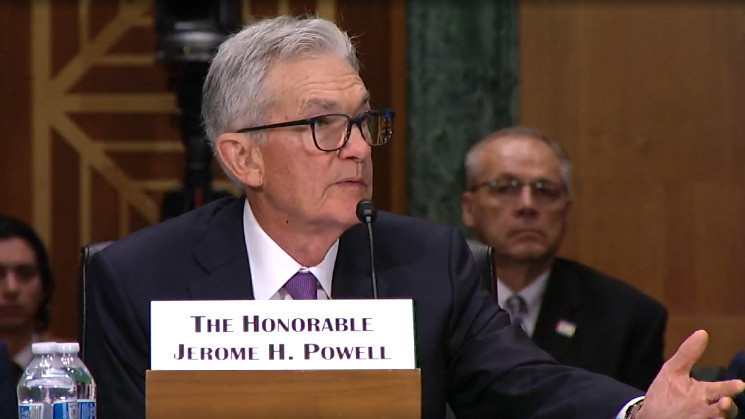

Further clues to the Fed's thinking will come shortly as Chairman Jerome Powell will hold his post-meeting press conference at 2:30 p.m ET.

coindesk.com

coindesk.com