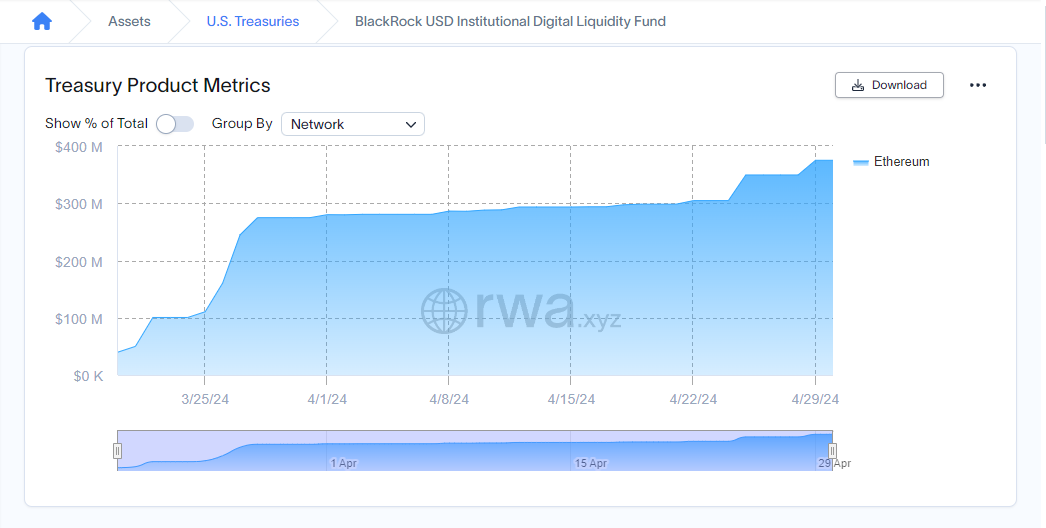

BlackRock’s BUIDL tokenized asset fund has quickly become the largest of its kind, surpassing Franklin Templeton’s similar fund just six weeks after its launch. The BlackRock USD Institutional Digital Liquidity Fund, represented by the BUIDL token on the Ethereum network, now holds $375 million in assets, with $70 million added in the past week.

You might also like

Animoca Brands Plans to Develop the Largest Web3 Ecosystem on Bitcoin

Stripe Enables Direct AVAX Purchases with Avalanche C-Chain Integration

This growth has given it almost 30% market share since its debut on March 21. In contrast, Franklin Templeton’s OnChain U.S. Government Money Fund, represented by the BENJI token, has seen its assets decline to $368 million due to minor outflows during the same period.

The surge in BlackRock’s tokenized offering is partly attributed to the success of Ondo Finance’s tokenized Treasury offering (OUSG), which uses BlackRock’s token as a reserve asset and attracted $50 million in inflows in a week.

.@BlackRock‘s first natively onchain fund, BUIDL, has crossed the $350M AUM mark!

Last week saw inflows of $50M into the fund, largely driven by Ondo’s $OUSG.

We continue to see strong demand for more capital efficient cash solutions across the board, and we are proud to have…

— Ondo Finance (@OndoFinance) April 29, 2024

The trend of tokenizing traditional assets like bonds and credit into blockchain-based tokens, known as tokenization of real-world assets (RWA), has gained significant interest from digital asset firms and traditional finance giants. Tokenization offers advantages such as faster settlements, increased operational efficiency, and enhanced transparency.

U.S. Treasuries have become a key focus for tokenization efforts, providing a low-risk, familiar investment option for on-chain cash, allowing investors to earn stable yields within the blockchain ecosystem. The tokenized Treasury market has grown substantially, reaching nearly $1.3 billion from around $100 million in early 2023, driven in part by BlackRock’s entry into this space.

coinculture.com

coinculture.com