Quick Take

MicroStrategy, the business intelligence firm, has further solidified its position as a Bitcoin corporate treasury, holding approximately 1% of the total Bitcoin supply. During the first quarter of 2024, MicroStrategy acquired an additional $1.65 billion worth of Bitcoin, bringing its total holdings to a staggering 214,400 $BTC.

While there was speculation that MicroStrategy would adopt the updated FASB (Financial Accounting Standards Board) rules, which streamline Bitcoin accounting, the company ultimately decided against it.

According to PunterJeff, a risk and capital advisor and long-standing MicroStrategy bull, due to the absence of FASB adjustments, MSTR incurred a $191 million asset impairment charge in accordance with GAAP accounting principles. This resulted in a bottom-line impact of approximately—$11 per share. Isolating this charge from the P&L statement transforms the EPS from (-$3) to +$8.

One standout highlight from the Q1 earnings presentation was the bullish trajectory of MSTR’s Bitcoin net asset value (Bitcoin NAV = Bitcoin Holdings Market Value minus Total Outstanding Debt).

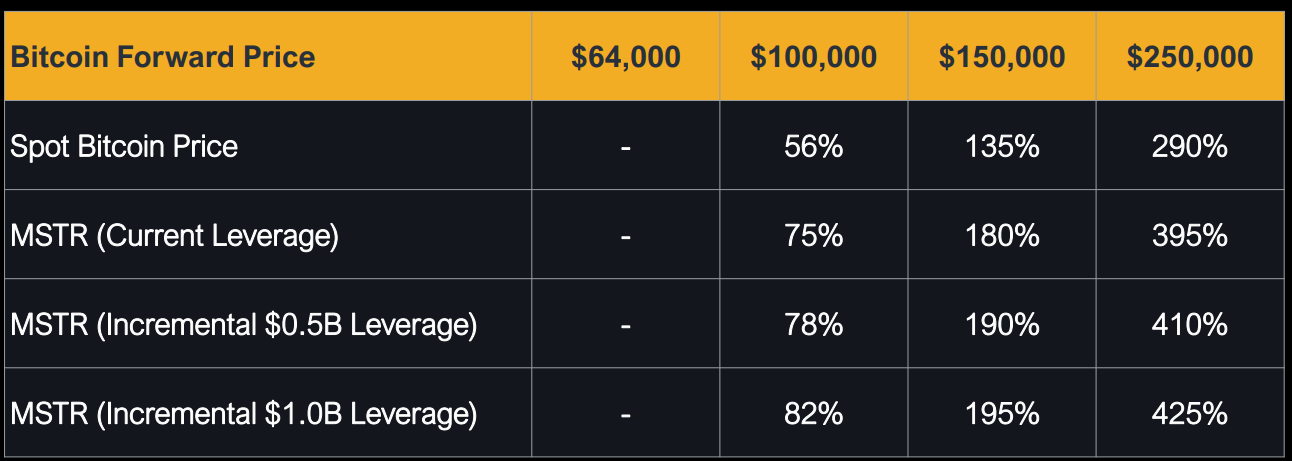

Exploring hypothetical scenarios with potential $BTC price increases:

If $BTC reached $100,000, this would signify a 56% increase. At $250,000 per coin, the appreciation would skyrocket to 290%. Considering MSTR’s current leverage, a $100,000 $BTC price would lead to a 75% appreciation. This appreciation trajectory continues to grow incrementally with higher leverage.

As of April 30, the share price has declined by 15%, currently trading around $1,100.

cryptoslate.com

cryptoslate.com