This week, the value of the fiat-pegged cryptocurrency economy has climbed to $160 billion, a peak last observed in May 2022, shortly before Terra’s UST detached from its intended $1 parity on May 9, 2022. In the past month, various stablecoins have experienced an increase in supply, with Ethena’s USDE at the forefront, registering a supply rise of approximately 86.8%.

Fiat-Pegged Cryptocurrencies Continue to Gain Momentum

This year, the stablecoin economy has seen substantial growth, increasing by $28.63 billion since Dec. 30, 2023. It escalated from the $150 billion milestone to the $160.03 billion range in just over a month, with numerous dollar-pegged coins experiencing increases in supply.

Tether (USDT), the most substantial among them, now holds a market valuation of $109.9 billion, with a circulating supply of 109.84 billion USDT. Over the past month, Tether’s supply has grown by 5.6%.

Circle’s usd coin (USDC), the second-largest fiat-pegged token, experienced a 6.4% increase in supply over the past month. Currently, USDC’s market cap slightly exceeds the $34 billion mark.

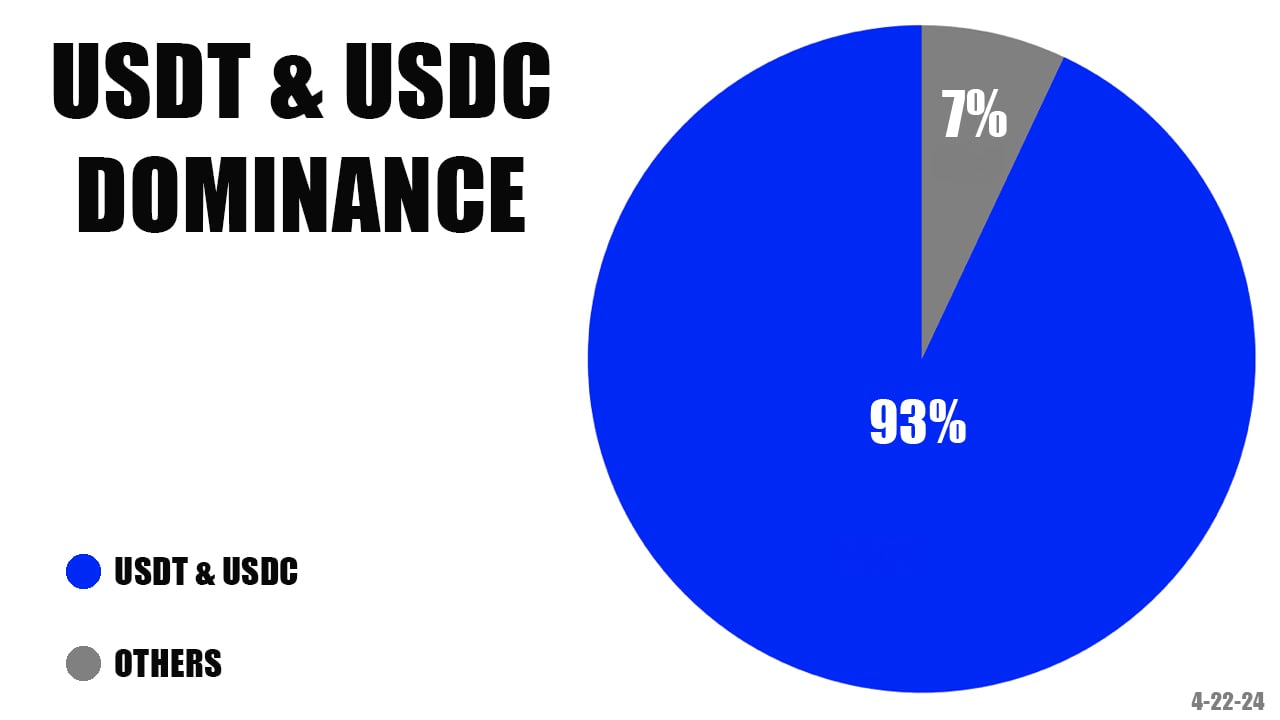

Together, USDT and USDC represent more than 93% of the stablecoin market’s total value. Meanwhile, Makerdao’s DAI has registered a 9.3% increase in supply this last month, bringing its market cap to $5.2 billion.

First Digital’s FDUSD now boasts a market valuation of $3.74 billion, after witnessing a 43% increase over the past 30 days. Ethena’s USDE outpaced other top contenders with an 86.8% increase in supply. As of April 22, 2024, USDE’s market valuation is approximately $2.37 billion.

Together, these five stablecoins account for 96.98% of the total market, holding $155.21 billion of the $160.03 billion stablecoin market value at this time. As the stablecoin market approaches new thresholds, its expansive growth underscores burgeoning confidence in fiat-pegged crypto assets.

What do you think about the stablecoin economy’s steady growth? Let us know what you think about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com