While there were sharp declines in Bitcoin and altcoins last week due to the tension between Iran and Israel, recoveries started this week.

As BTC surpasses $66,000, CoinShares releases its weekly cryptocurrency report.

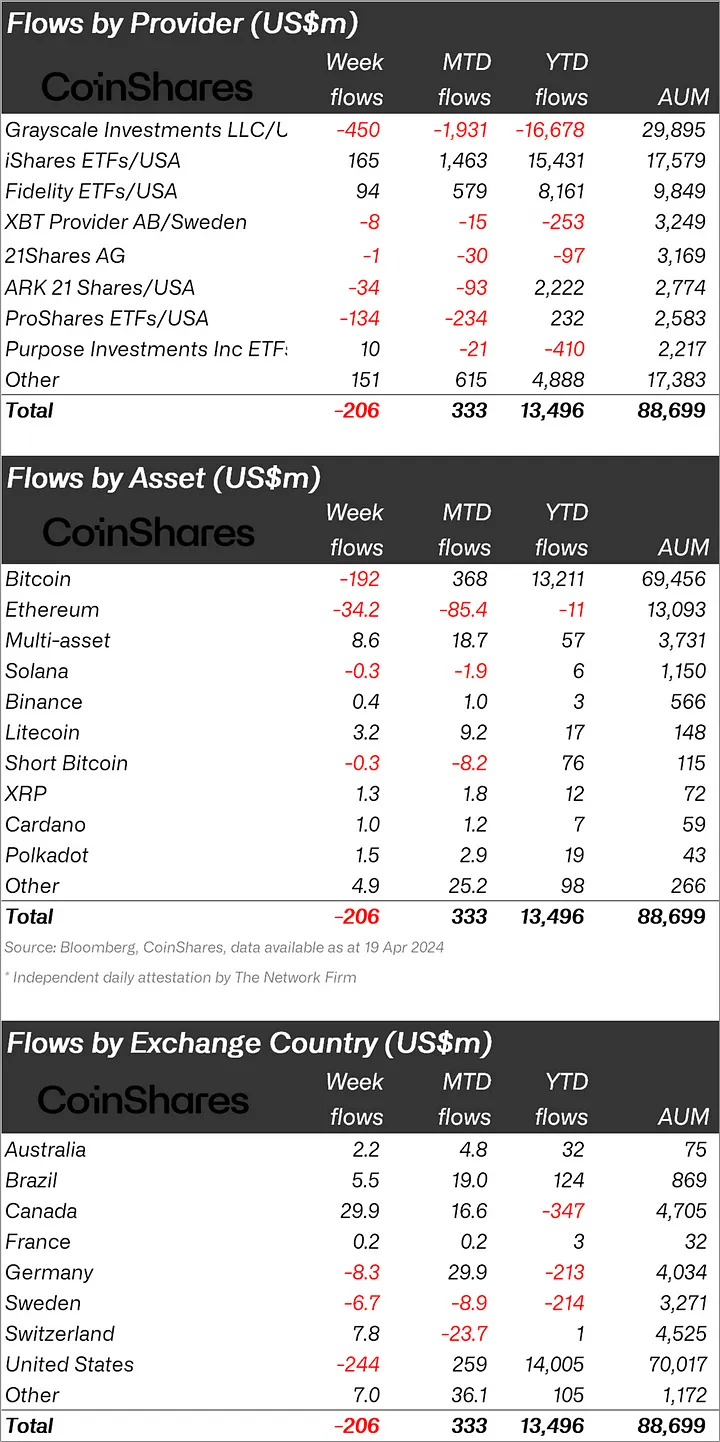

Stating that cryptocurrency investment products experienced outflows totaling $206 million for the second week in a row, Coinshares said that these outflows were due to investors' concerns about interest rate expectations.

“Cryptocurrency investment products saw outflows totaling $206 million for the second week in a row as investors worried about interest rate expectations.”

Ethereum (ETH) Sales Continue for the 6th Consecutive Week!

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $192 million, the largest altcoin Ethereum (ETH) also saw an outflow of $34.2 million.

There was a small outflow of $0.3 million in the Bitcoin Short fund, which was indexed to the decline of BTC.

When we look at other altcoins, Litecoin (LTC) experienced an inflow of 3.2 million dollars, Polkadot (DOT) 1.5 million dollars, and XRP 1.3 million dollars; Solana (SOL) experienced an outflow of $0.3 million.

“Bitcoin saw outflows of $192 million, but few investors saw this as a short selling opportunity. The BTC short fund saw outflows of $0.3 million.

Ethereum saw $34 million in outflows, marking its 6th consecutive week in outflows. Sentiment increased in altcoins last week with $9 million inflows. Litecoin and Chainlink saw inflows of $3.2 million and $1.7 million respectively.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an outflow of 244 million dollars.

After the USA, Germany ranked second with 8.3 million dollars.

Against these outflows, Canada lost 29.9 million dollars; Brazil experienced an inflow of 5.5 million dollars.

*This is not investment advice.