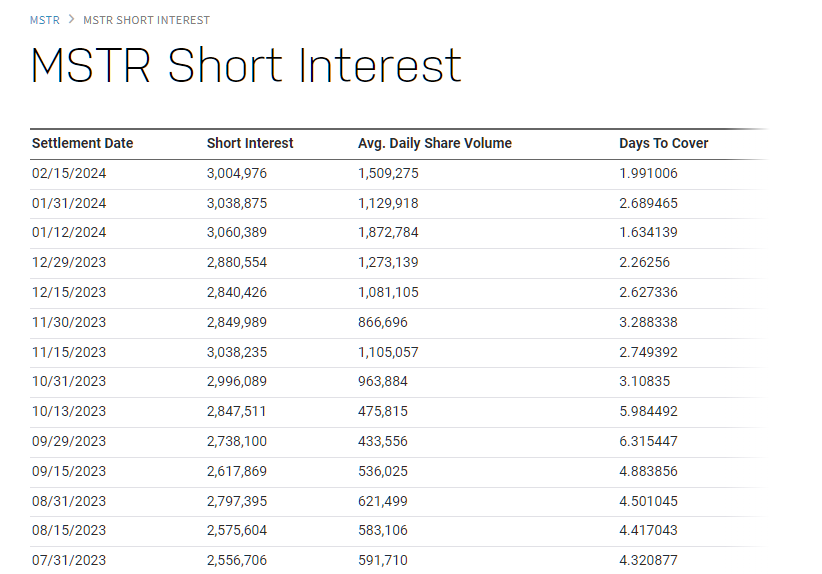

In an interesting turn of events, the short interest in MicroStrategy (NASDAQ: MSTR) has reached a massive figure of $3 billion, or 20% of its float, suggesting that the investors doing the short selling are exceptionally bearish on its future price, but also indicating the possibility of a mega short squeeze.

Indeed, despite a recent rally for Bitcoin (BTC), to which MicroStrategy grants indirect exposure, some investors are betting a lot of money against MSTR, with the short bets accounting for about 20% of the company’s total available shares, as observed by Andrew Kang in an X post on March 4.

According to the cryptocurrency entrepreneur, many of these bettors are “angry TradFi boomers trying to capture the premium to [net asset value (NAV)],” but the premium went from 50% before the spot Bitcoin exchange-traded fund (ETF) approval to 13% after it, only to recover to the highs of the current 70%.

Backfiring price action?

Furthermore, Kang has suggested the possibility of a massive price rally similar to the GameStop (NYSE: GME) situation when hedge funds took major short positions in GME, but retail investors on Reddit’s WallStreetBets bought large quantities of the shares, creating a short squeeze, and causing the price to skyrocket.

Finally, he also highlighted that MSTR has become large enough to become part of the S&P500 index, as well as that “MSTR as levered BTC is back baby,” referring to MicroStrategy’s leveraged position in the flagship decentralized finance (DeFi) asset making a comeback.

In conclusion, the short interest on MSTR stocks is exceptionally high, indicating a dominant bearish sentiment. However, if Kang is correct in his analysis, it could also backfire on the short-bettors, particularly considering that high short capitalizations also create squeeze opportunities for the bulls.

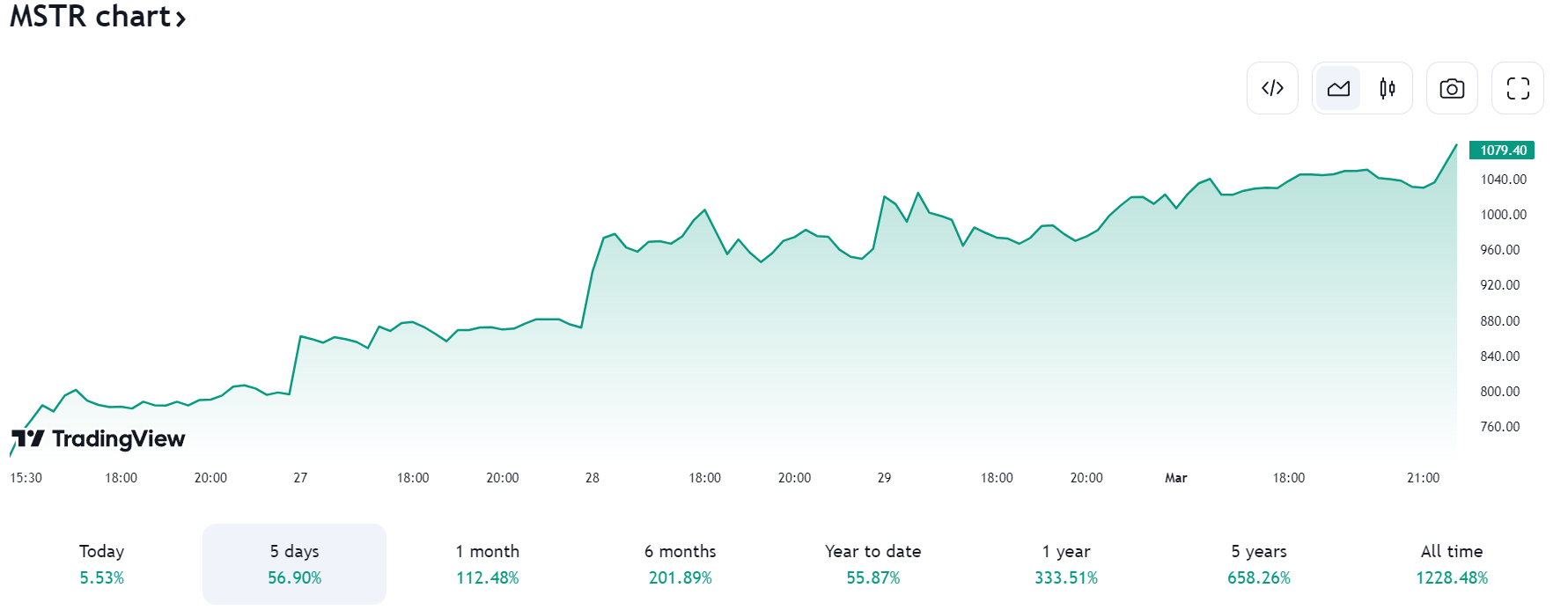

MSTR price analysis

For the moment, the price of MSTR stock amounts to $1,079.40, recording a 5.53% increase on the day, as well as gaining 56.90% across the past week and advancing as much as 112.48% on its monthly chart, performing better than 99% of all other stocks in terms of its yearly performance.

On top of that, it is outperforming 97% of the other 279 stocks in the software industry, as well as making a new 52-week high, which is in line with the performance of the rest of the market, in addition to recording a healthy liquidity of 1.5 million traded shares per day.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com