While it remains a matter of debate when the FED will start reducing interest rates, there are many different opinions on this issue.

While the FED's statements signaled that March may be improbable for the first interest rate cut and all eyes are on May for the first rate cut, Goldman Sachs thinks differently.

At this point, Goldman Sachs economists said in a recent report that they expect there will be four interest rate cuts in the USA in 2024 and that they estimate that the first will come in June.

Goldman Sachs economists recently updated their forecasts for when the Fed will cut interest rates.

Economists, who expected five interest rate cuts in 2024 in their initial forecasts, stated that they expect the first interest rate cut to be made in June.

Economists think that although the latest inflation data for January is higher than expected, this should not be taken into consideration too much. Economists stated that they predicted that core inflation would fall to 2.5% by the May FOMC meeting and to 2.2% in June.

At this point, Goldman Sachs economists' latest predictions are “We foresee interest rate cuts in June, July, September and December of 2024, and four more interest rate cuts in 2025.” said.

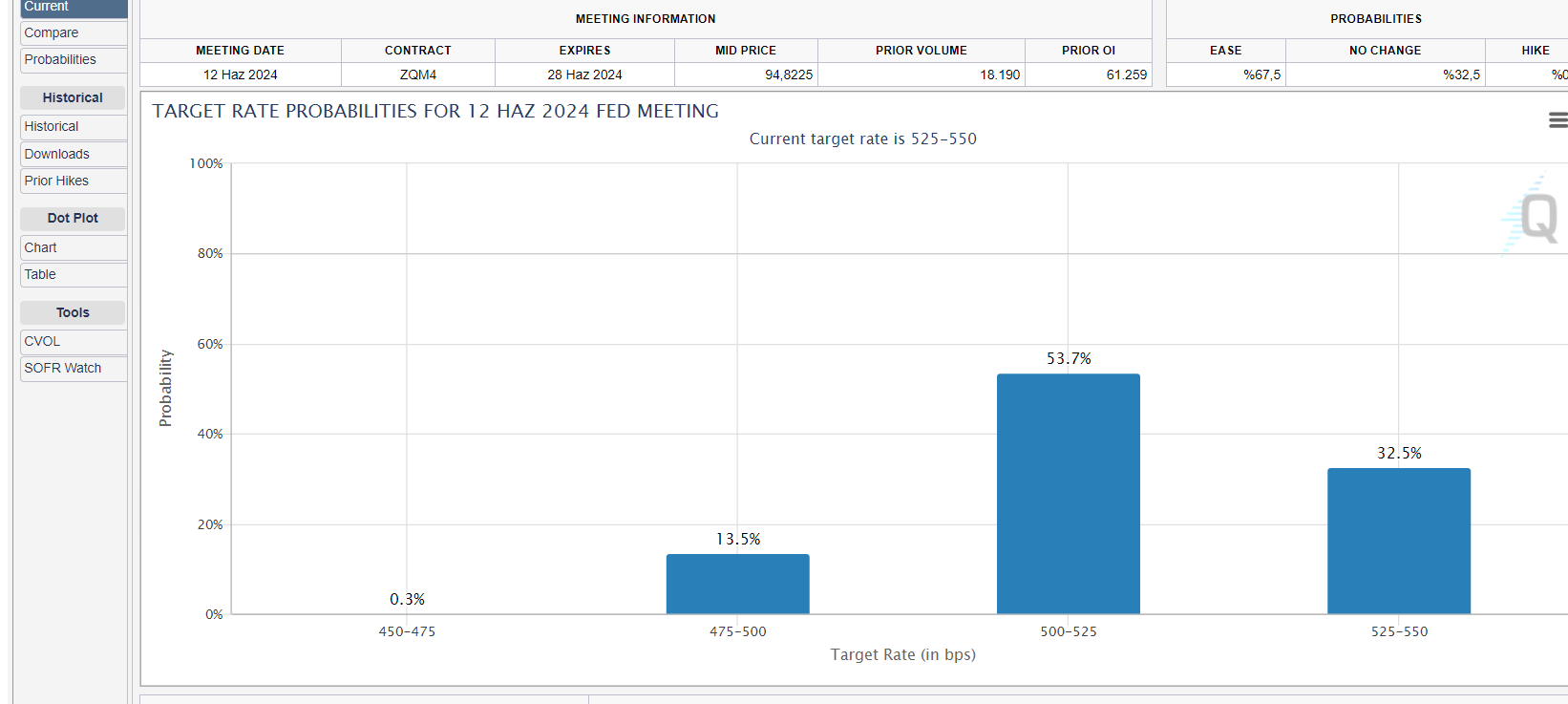

According to CME Group's FED Watch tool, the probability of keeping interest rates constant in May is priced at 76%, while the probability of a 25 basis point cut is priced at 23%.

On the other hand, the probability of the FED keeping interest rates constant in June is priced at 32%, while the probability of a 25 basis point cut is priced at 53.7%.

As you may remember, the FED kept its interest rate decision unchanged in January, in line with expectations, and kept interest rates constant in the range of 5.25-5.50 percent.

It is expected that there will be an increase in Bitcoin (BTC) and cryptocurrencies as the FED starts to cut interest rates. Because Bitcoin reached its peak of $ 69,000 in November 2021, when the FED started increasing interest rates. Since the subsequent bear market is directly related to the FED's interest rate increases, it is thought that BTC may return to its old days with a policy change and interest rate cuts.

At this point, experts expect the BTC price to experience tremendous increases if interest rate cuts come immediately after the Bitcoin Halving.

Experts said they predict that interest rate cuts after April will push the BTC price to a new high, as the halving is expected to push the Bitcoin price above its all-time high of $69,000.

*This is not investment advice.