Japan is paving the way for web3 and crypto initiatives amid an overhaul in its investment laws. This goal is to turbocharge the nation’s tech sector, specifically targeting venture capital (VC) investments in crypto and web3 startups.

At the core of this development lies the February 2024 revision of the “Industrial Competitiveness Enhancement Act.”

Japan Moves to Embrace Web3 and Crypto Startups

This amendment, now under deliberation, aims to bolster strategic domestic investments. This includes expansive and long-term tax measures for investments and production in strategic sectors such as electric vehicles, steel, and semiconductors.

A pivotal aspect of this legislative update is the inclusion of cryptocurrencies as assets permissible for acquisition and holding by Investment Business Limited Partnerships (LPS). This adjustment in its legal framework helps validate the crypto space and aligns with Japan’s forward-thinking stance on digital assets.

Complementing this law amendment is Japan’s revised taxation approach towards held cryptocurrencies. As of late 2023, corporations are relieved from the year-end market value assessment for third-party-issued cryptocurrency.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

This is a move mirroring the treatment of individual investors. As a result, this reform is anticipated to boost domestic entrepreneurship by,

“Reducing the tax burden on corporations engaged in the holding and operation of crypto.”

Financial Firms Eager to Invest

Amid these regulatory advancements, top financial entities like SBI Holdings are seizing the opportunity. The firm announced plans to launch a ¥100 billion fund targeting startups in web3, AI, and the metaverse.

This initiative, one of Japan’s largest venture capital endeavors, illustrates the growing financial commitment to these innovative sectors. With substantial investments from major institutions like Sumitomo Mitsui Banking Corporation and Mizuho Bank, Japan is also cementing its status as a key player in the global tech market.

Read more: 10 Challenges Faced By Employees In Web3 Startups

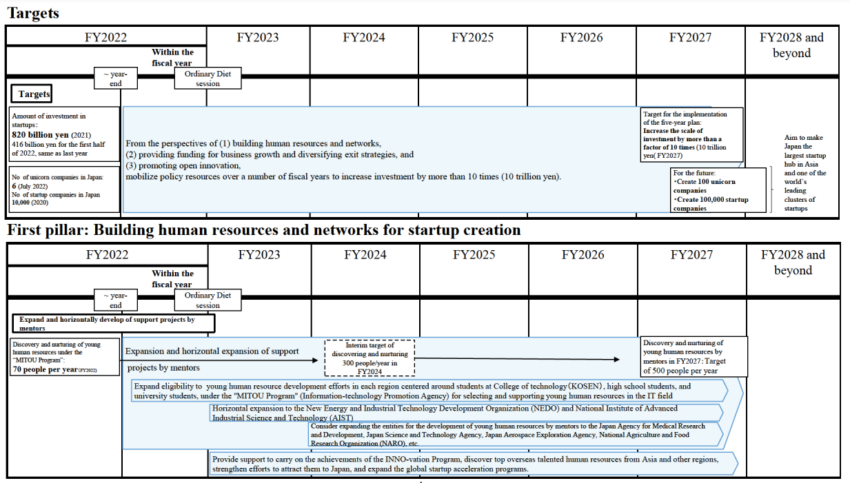

These legislative and financial developments are part of a concerted effort to position Japan as a leading startup hub. The government’s “Five-Year Plan for Startup Development,” aims to elevate startup investments to around ¥10 trillion by 2027.

Japan’s Vice Commissioner for International Affairs at the Financial Services Agency, Toshiyuki Miyoshi, spoke on the Five-Year Plan and offered a,

“Commitment to promoting it as a leading asset management and financial center of the world.”

Overall, the combination of regulatory reform, financial backing, and strategic focus is transforming Japan into a global powerhouse for web3, AI, and metaverse innovations.

beincrypto.com

beincrypto.com