Of particular concern is the surge in financial pyramid schemes—where returns are paid to earlier investors from funds contributed by new investors—and crypto’s increasing role.

"In 2023, almost all pyramid schemes and illegal brokers offered investments in internal tokens or accepted contributions in cryptocurrency," The Central Bank wrote in Russian, translated by Decrypt via Google Translate.

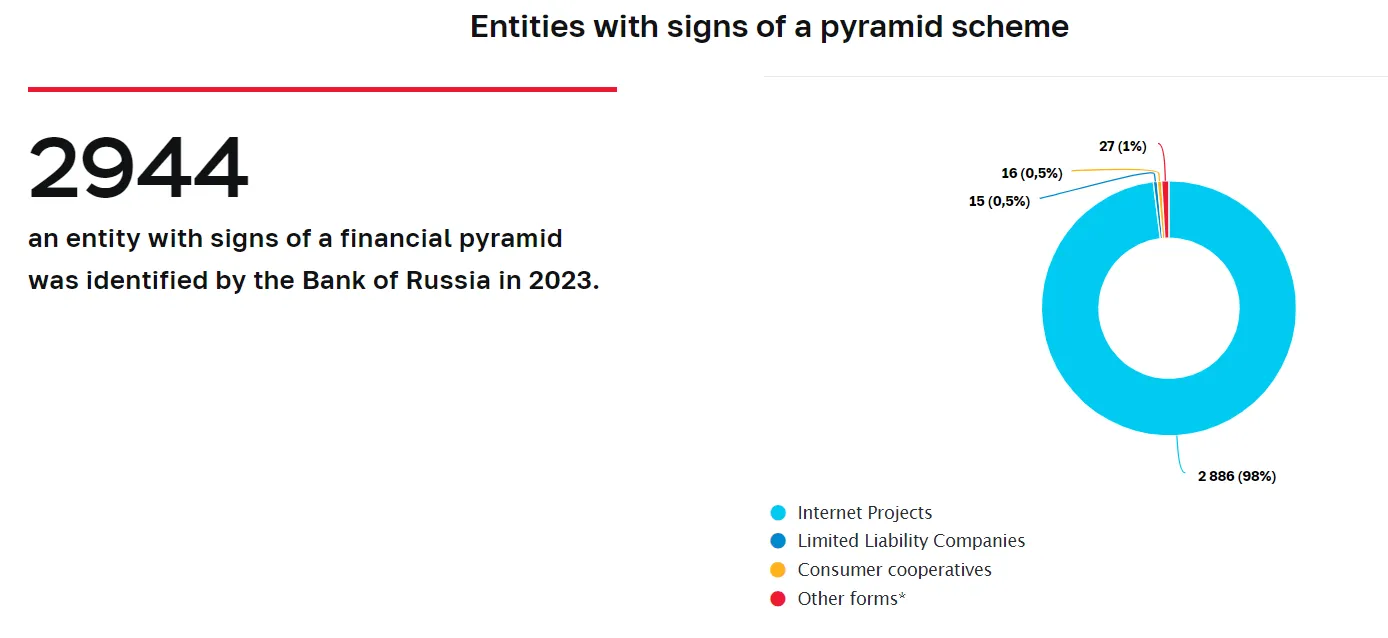

Crypto is an appealing ingredient given the promise of anonymity and borderless transactions .In total, the Central Bank identified 2,944 crypto pyramid cases, adding up to 150% growth from the previous year.

Other key findings include the rise of 'pseudo-brokers' —entities falsely presenting themselves as professional securities market participants—such as illegal foreign exchange dealers who rely heavily on crypto to mask their activities. The rise of social media as a victim recruiting tool, along with the shorter lifespan of scams, does mean an increasing number of scams with a decreasing amount of inflicted damage.

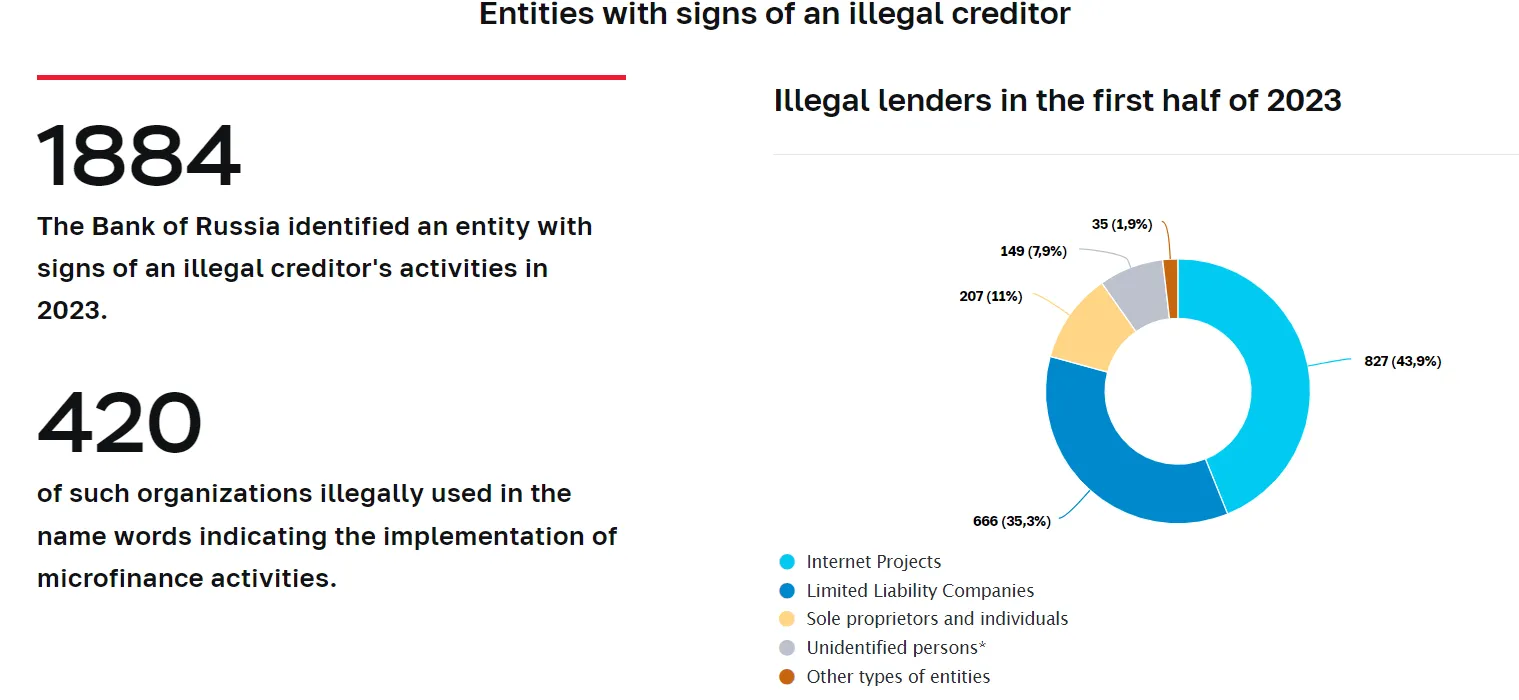

“Almost 44% of illegal lenders promoted their services only through the Internet, without having offices. For the most part, they used social media pages and groups, or popular ad platforms, without creating permanent sites,” The Central Bank explained.

The report says the Bank identified 1,884 cases of illegal lenders using these platforms to promote their services.

The Central Bank of Russia is fighting back. In addition to monitoring systems to detect illicit actors, the institution said it works closely with law enforcement, internet regulators, and the financial sector to curb these scams. This includes blocking over 1,500 scam websites and educating citizens on the warning signs of financial fraud.

Law enforcement actions have also been robust, with more than 125 criminal cases and 620 administrative cases opened in 2023.

The statistics come as Russia's stance on cryptocurrencies oscillates between crackdowns on scams and enlisting the same technology for political maneuvering—notably to sidestep U.S. sanctions. The decentralized nature of cryptocurrencies presents a double-edged sword, offering both a shield against cross-border sanctions from governments and strengthening a weapon of deception against everyday citizens.

Edited by Ryan Ozawa.

decrypt.co

decrypt.co