New Zealand Central Bank Governor Adrian Orr has raised a critical voice about the viability of cryptocurrencies, particularly stablecoins and Bitcoin, as a substitute for traditional fiat money.

Orr’s incisive commentary sheds light on the inherent risks and uncertainties associated with these digital assets.

Orr’s Take on the Misnomer of Bitcoin and Stablecoin Stability

Stablecoins, which are cryptocurrency tokens pegged to the value of a stable asset, like fiat currency, are often touted for their potential to offer stability in the volatile crypto market.

However, Orr emphasizes that this stability is illusory, rooted more in perception than financial reality. He remarked,

“Stablecoins are the biggest misnomers and oxymorons. They’re only as good as the balance sheet of the person offering that stablecoin.”

This statement underscores the precariousness of relying on an asset whose stability is as fluctuating as the entities backing it.

Read more: A Guide to the Best Stablecoins in 2024

Orr also expressed deep concerns about the role of cryptocurrencies in the broader financial ecosystem. He questioned their ability to fulfill the key roles of money. These include being a means of exchange, a store of value, and a unit of account.

Orr firmly believes that Bitcoin and other cryptocurrencies fall short in these aspects. He stated,

“Bitcoin is not a means of exchange, a store of value, or a unit of account yet people try to use it as that.”

This skepticism extends to the potential of these digital currencies to undermine the global financial system, a worry shared by many central banks worldwide.

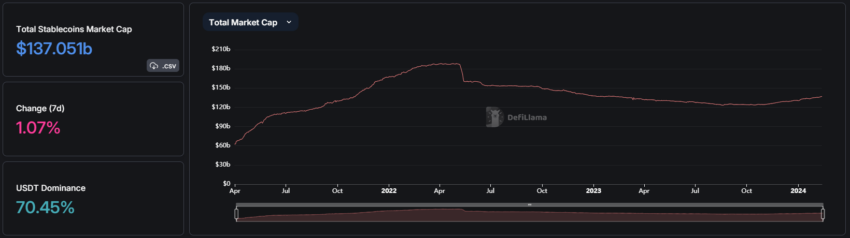

Despite these fears, the total stablecoin market cap is currently at a 1-year high above $137 billion.

Stablecoin Climate in the US

Meanwhile, in the United States, stablecoin regulations appear to be drawing closer to a significant shift. Congresswoman Maxine Waters has indicated that regulations for stablecoins are nearing completion.

This movement towards regulation is a reflection of the growing need for oversight in an industry marked by its rapid expansion and innovation.

Read more: What Is a Stablecoin? A Beginner’s Guide

The impending regulations are expected to provide much-needed clarity and security for both consumers and financial institutions, leveling the playing field between traditional banking and the crypto sector.

As the debate around the role and regulation of cryptocurrencies continues, Orr’s insights offer a sobering reminder of the challenges and complexities inherent in integrating these new forms of money into the established financial system.

His expertise and cautionary stance provide a valuable perspective in the ongoing conversation about the future of finance in a digital world.

beincrypto.com

beincrypto.com