Harvest Fund Management has officially submitted an application for the first spot Bitcoin exchange-traded fund (ETF) in Hong Kong. This move comes in response to the recent approval of spot Bitcoin ETFs in the United States and the guidelines released by the Securities and Futures Commission (SFC) of Hong Kong in December 2023.

Venture Smart Financial Holdings Ltd. (VSFG) has announced its intention to submit an application to the Securities and Exchange Commission (SFC) for a spot Bitcoin ETF. This move aligns with the growing interest among asset management companies, including Samsung Asset Management, to explore the potential of spot Bitcoin ETFs in Hong Kong.

As reported by Tencent News, Harvest Fund Management took the initiative by submitting the first spot Bitcoin ETF application to the SFC on January 26. The regulator is expected to make a decision on the approval after the Lunar New Year or shortly thereafter, aiming to list the first spot Bitcoin ETF on the Hong Kong Stock Exchange post the Spring Festival.

Following the recent clearance of spot crypto products by the United States Securities and Exchange Commission (SEC), the SFC of Hong Kong is reportedly keen on expediting the licensing process for the first spot Bitcoin ETF. The regulator’s strategy aligns with the U.S. SEC, raising the possibility of simultaneous approval for multiple applications.

Comparing Hong Kong and U.S. Spot ETFs

According to a Hong Kong fund professional, the performance of Hong Kong’s spot Bitcoin ETFs might mirror that of the U.S. market, especially considering the approval timing. However, family office investment managers in Hong Kong express optimism, citing genuine interest in subscribing to spot ETFs and a potential increase in direct Bitcoin subscriptions compared to the U.S.

While Harvest Fund Management takes the lead, it is anticipated that other players, including Venture Smart Financial Holdings, may follow suit in submitting applications for spot Bitcoin ETFs in Hong Kong. Livio Weng, COO of HashKey, reveals that about 10 fund firms are exploring the possibility of offering spot crypto ETFs in the region.

Hong Kong’s regulatory environment reflects a favorable stance toward the cryptocurrency industry. In 2023, the SFC established cryptocurrency-focused laws, making it easier for both institutional and ordinary investors to participate in crypto operations. Recent reports also indicate an interest in stablecoin trials in response to Hong Kong’s efforts to establish stablecoin governance regulations.

The Road Ahead: Hong Kong’s Crypto Market Dynamics

As Hong Kong gears up for the potential introduction of spot Bitcoin ETFs, the broader cryptocurrency ecosystem in the region is witnessing increased activity. With multiple financial institutions expressing interest and regulatory support in place, Hong Kong is poised to solidify its position as a major cryptocurrency hub in Asia.

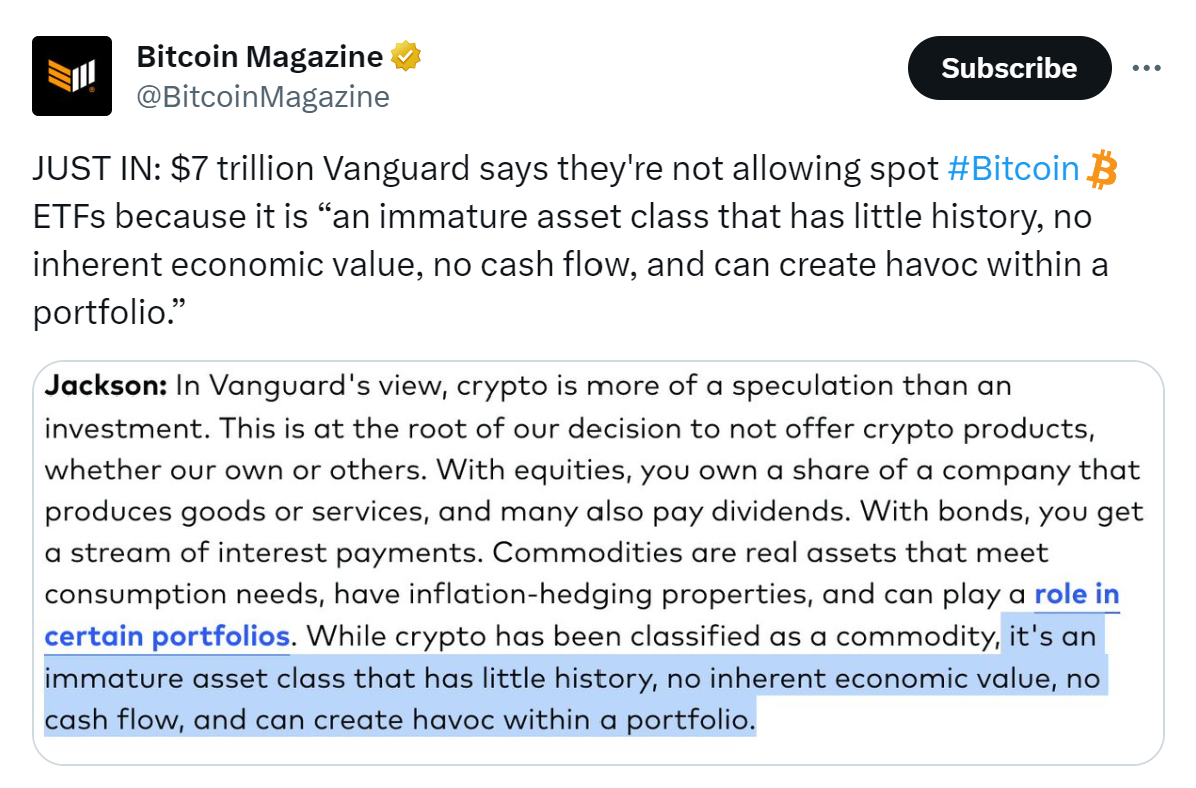

The spotlight is now on the SFC’s decision post-Lunar New Year and the subsequent development of a thriving crypto market in the region. However, not all have been enticed with the Bitcoin ETF prospect. In 2017, the esteemed financial expert Jack Bogle delivered a memorable caution to the public, advising them to “steer clear of Bitcoin like the epidemic.” By persistently adhering to the cautious investment approach established by its deceased originator, Vanguard Group Inc. continues to irk the digital currency community, even after more than six years have transpired.

Amidst the jubilation stemming from the long-awaited debut of the inaugural fully comprehensive Bitcoin exchange-traded funds in the United States, Vanguard stirred controversy last week with its steadfast decision to decline offering the new ETFs on its vast trading platform.

There were myriad posts on X generated by individuals vowing to withdraw their funds from the colossal asset management entity Vanguard. This prompted the company to become a trending topic on X.

The corporation, wielding control over $8.6 trillion, has not only spurned Bitcoin-spot products but has also eliminated futures-backed Bitcoin funds from its platform. Consequently, in contradistinction to its rivals, it currently abstains from providing any cryptocurrency items.

cryptonews.net

cryptonews.net