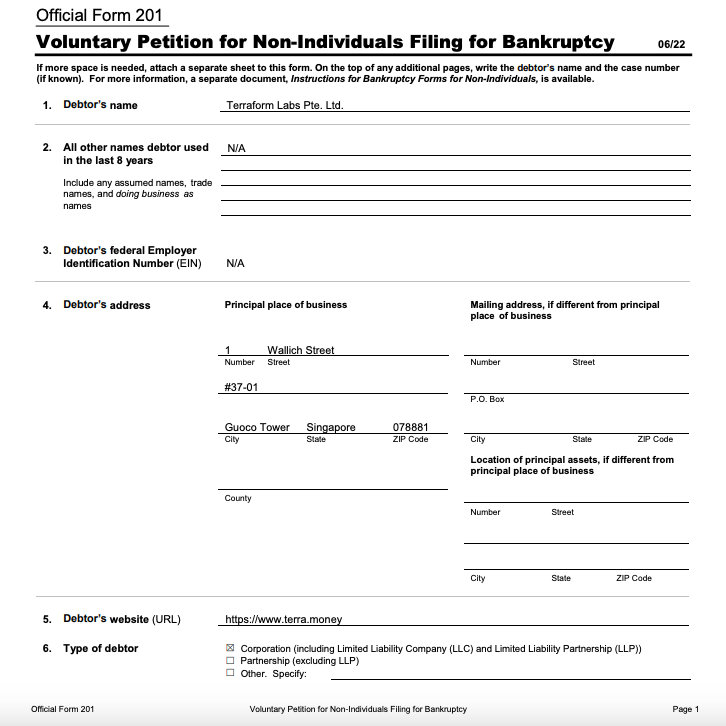

Terraform Labs, led by Do Kwon and the creator of the now-defunct TerraUSD (UST) stablecoin, has initiated Chapter 11 bankruptcy proceedings in the United States.

The filing, made at the United States Bankruptcy Court for the District of Delaware on January 21, discloses estimated liabilities and assets ranging between $100 million and $500 million.

In response to the bankruptcy filing, Chris Amani, CEO of Terraform Labs, emphasised the resilience of the Terra community and ecosystem in facing challenges. Amani stated that the legal action is essential for the company to continue working towards shared goals while addressing outstanding legal issues.

The court document indicates that the defunct firm’s estimated liabilities and assets both fall within the $100 million to $500 million range.

The bankruptcy declaration comes just four days after the U.S. Securities and Exchange Commission (SEC) agreed to a postponement of Kwon’s upcoming fraud trial to March 25, following a request from his legal team to delay the proceedings.

The collapse of Kwon’s Terra ecosystem occurred in May 2022, leading to the SEC filing civil charges against Terraform Labs and Kwon in February 2023. The charges allege a “multi-billion dollar crypto asset securities fraud” linked to the tokens previously known as UST and Terra (LUNA).

After the implosion of the firm, Kwon’s whereabouts remained unknown until his arrest in Montenegro in March 2023. The arrest took place after he attempted to use falsified travel documents to leave the country.

Both the U.S. and South Korea are seeking Kwon’s extradition, with speculation rising about potential multiple sentences in both countries. If extradited to South Korea, Kwon could face a 40-year jail sentence, as the majority of his alleged crimes are said to have occurred in that country.

coinculture.com

coinculture.com