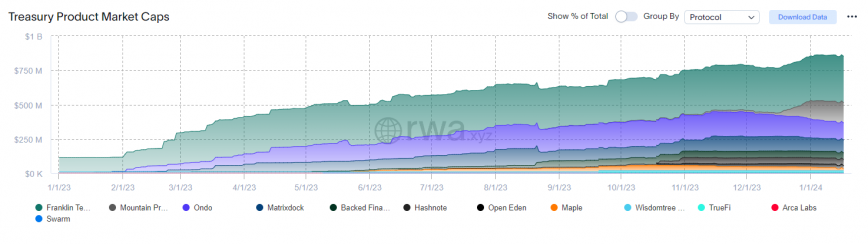

Recent data from the analytics company rwa.xyz reveals a 657% yearly growth in the market cap of tokenized US treasuries, reaching $863.6 million as of Jan. 18.

A tokenized US treasury is a digital representation of traditional financial instruments like government bonds, US treasuries, or cash equivalents on a blockchain.

The burgeoning industry is currently dominated by investment firm Franklin Templeton through its Franklin OnChain US Government Money Fund (FOBXX) mutual fund. FOBXX has successfully tokenized over $336 million in US government securities, cash, and repurchase agreements. Each share is valued at $1, and the majority of these tokens are issued on the Stellar blockchain, with a $2 million segment on Polygon.

Asset manager WisdomTree has also made strides using Stellar. WisdomTree’s Short-Term Treasury Digital Fund (WTSYX), which tracks the Solactive US 1-3 Year Treasury Bond Index, has seen more than $10 million in tokens sold to investors.

Another significant player is USDM, a dollar-backed stablecoin issued by Mountain Protocol, standing as the second-largest RWA with a market cap of nearly $149 million. Positioned as an “institutional-grade stablecoin,” USDM is built on the Ethereum blockchain and offers a 5% annual percentage yield.

Although the largest tokenized treasury issuer in the US uses Stellar’s blockchain infrastructure, Ethereum’s blockchain takes the spot of the largest network, representing almost $494 million, or over 57%, of the total market size. This figure surpasses Stellar’s market share by 43%, which stands at $344 million.

The expansion in market value is paralleled by the growth in the number of companies entering the tokenized treasury space. From just three firms a year ago, the industry now boasts 12 players, which might suggest interest in the tokenization of traditional financial assets in the US.

cryptobriefing.com

cryptobriefing.com