Moody’s reveals a significant rise in blockchain-based tokenized funds, emphasizing efficiency gains and technological risks.

In a recent report, global financial services powerhouse Moody’s highlighted the burgeoning realm of blockchain-based tokenized funds.

Moody’s underscores the efficiency gains in investing assets like government bonds through tokenized funds, noting an untapped market potential. However, they caution about the tech-related risks, emphasizing the need for fund managers to possess broader technological expertise.

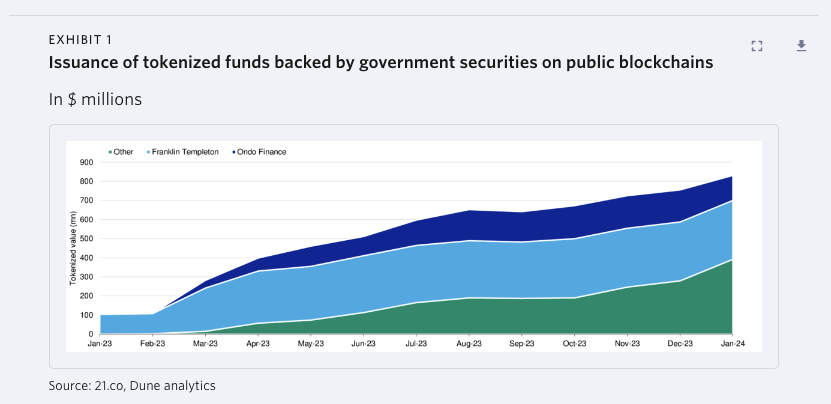

The surge in fixed-income tokenized funds is largely driven by investments in government securities, a trend accelerated by recent U.S. Federal Reserve interest rate hikes. Remarkably, tokenized fund issuance backed by such securities swelled from $100 million to over $800 million on public blockchains by the end of 2023.

The largest issuance was carried out by Franklin Templeton, Moody’s reported, referring to their U.S. Government Money Fund registered on the Stellar (XLM) and Polygon (MATIC) blockchains.

Other financial institutions like Swiss-based Backed Finance and UBS are also exploring this space. Moody’s suggests that in the absence of stablecoins or central bank digital currencies, tokenized money market funds could serve as stablecoin collateral alternatives in defi markets.

Moody’s also mentioned SC Ventures’ launch of the tokenization platform Libeara and Nomura’s Laser Digital’s unveiling of the Libre protocol for Brevan Howard and Hamilton Lane funds.

Tokenized funds, while similar to traditional bond funds in investment strategy, differ in their digital format. These digital tokens on distributed ledgers enhance liquidity, decrease costs, and enable fractionalization. However, they introduce complexities and risks alongside the benefits, such as technological failures and exposure to stablecoin volatility.

The report concludes that tokenized funds present technology-driven efficiencies, but the supporting framework needs further development and standardization.