South Korean crypto-related KOSDAQ stocks “soared” on the news of the US Securities and Exchange Commission (SEC)’s approval of 11 Bitcoin spot ETFs.

No South Korean crypto firm has yet floated on the Korean Exchange. However, several listed companies have crypto-related interests.

Kangwon Domin Ilbo reported that venture capital firms with stakes in big South Korean crypto exchanges were the biggest winners in the market on January 11.

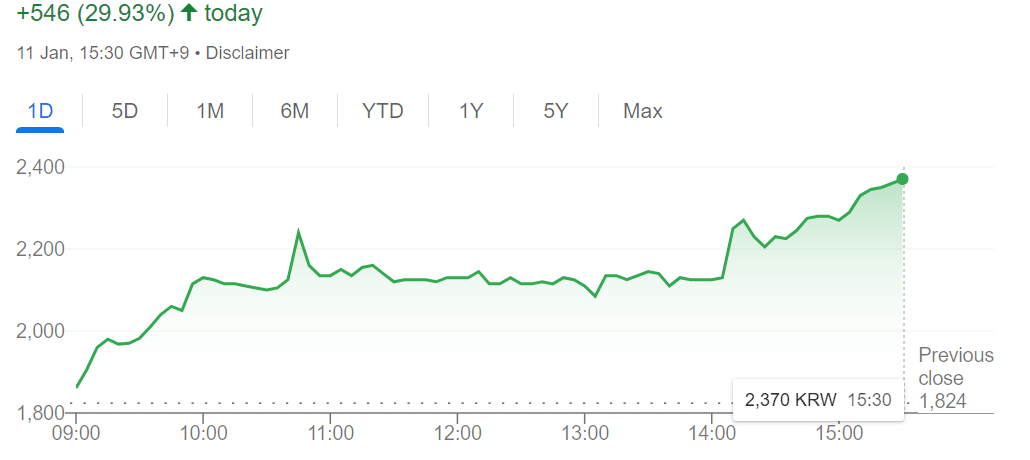

These include Woori Technology Investment, which saw its price rise almost 30% to a 12-month high on January 11.

Hanwha Investment & Securities also posted a 30% day-on-day share price rise after the American ETF news broke.

Both firms own shares in Dunamu, the operator of Upbit. The latter is South Korea’s largest virtual currency exchange by revenue and trading volume.

Another crypto exchange investor, T Scientific, posted a share price rise of over 20% on the same day.

The firm’s parent company Wizit also witnessed a 29.89% rise. T Scientific owns a stake in Bithumb Korea, the operator of the crypto exchange Bithumb, Upbit’s closest rival.

🇰🇷 South Korean Exchange Searches for ‘Lost’ Owners of $206M Worth of Crypto

The South Korean crypto exchange Bithumb wants to find the “dormant” owners of $206 million worth of coins, including #Bitcoin, #Ethereum, and #XRP.#CryptoNewshttps://t.co/lfLfubkD6t

— Cryptonews.com (@cryptonews) January 1, 2024

Bitcoin ETF Revitalizing South Korea’s Stock Market?

Bithumb has previously announced its plans to launch on the Korean Exchange in 2025, and will hope the buoyant share prices help its cause.

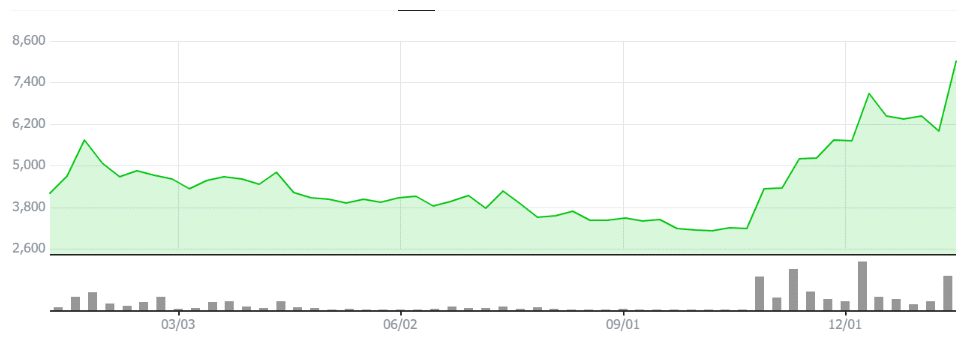

There were further gains for other blockchain and crypto-related firms, with Daesung Private Equity recording a 29.93% price rise.

Daesung launched an $83 million metaverse fund at the end of 2022 with other Daesung group firms, as well as the Industrial Bank of Korea and Shinhan Capital.

Another winner was Atinum Investment, with a 15.43% rise. Last year, Atinum led a $6.5 million Series A investment into the US-based data analytics platform CryptoQuant’s operator Team Blackbird.

More modest gains were recorded in the blockchain and fintech space, with the likes of Galaxia MoneyTree posting gains of over 7%.

During the 2021 bull run, South Korean market analysts claimed Dunamu could follow Coinbase onto the New York Stock Exchange.

Experts predicted Dunamu could raise $17.9 billion with a US IPO, but talk on this front cooled quickly following the onset of crypto winter.

cryptonews.com

cryptonews.com