Chinedu Albert, a legal expert specializing in Nigerian tech and innovation, has attributed the challenges facing the adoption of the eNaira, the Central Bank of Nigeria’s digital currency (CBDC), to a previous crypto ban.

In an exclusive interview with Cointelegraph on December 29, Albert described the eNaira as an ambitious concept. However, he observed that it reflects the government’s response to its “ill-advised” decision to enforce a sweeping ban on cryptocurrencies and other virtual assets on February 5, 2021.

Central Bank of Nigeria bans Crypto currency transactions

This is 2021, and the Nigerian government wants to ban crypto. They never love to progress, no wonder Nigeria can’t move forward. pic.twitter.com/knYzTwwuIT

— Eyèn Drone Boss ❤️🇳🇬🇬🇧 (@ItsGreatman) February 5, 2021

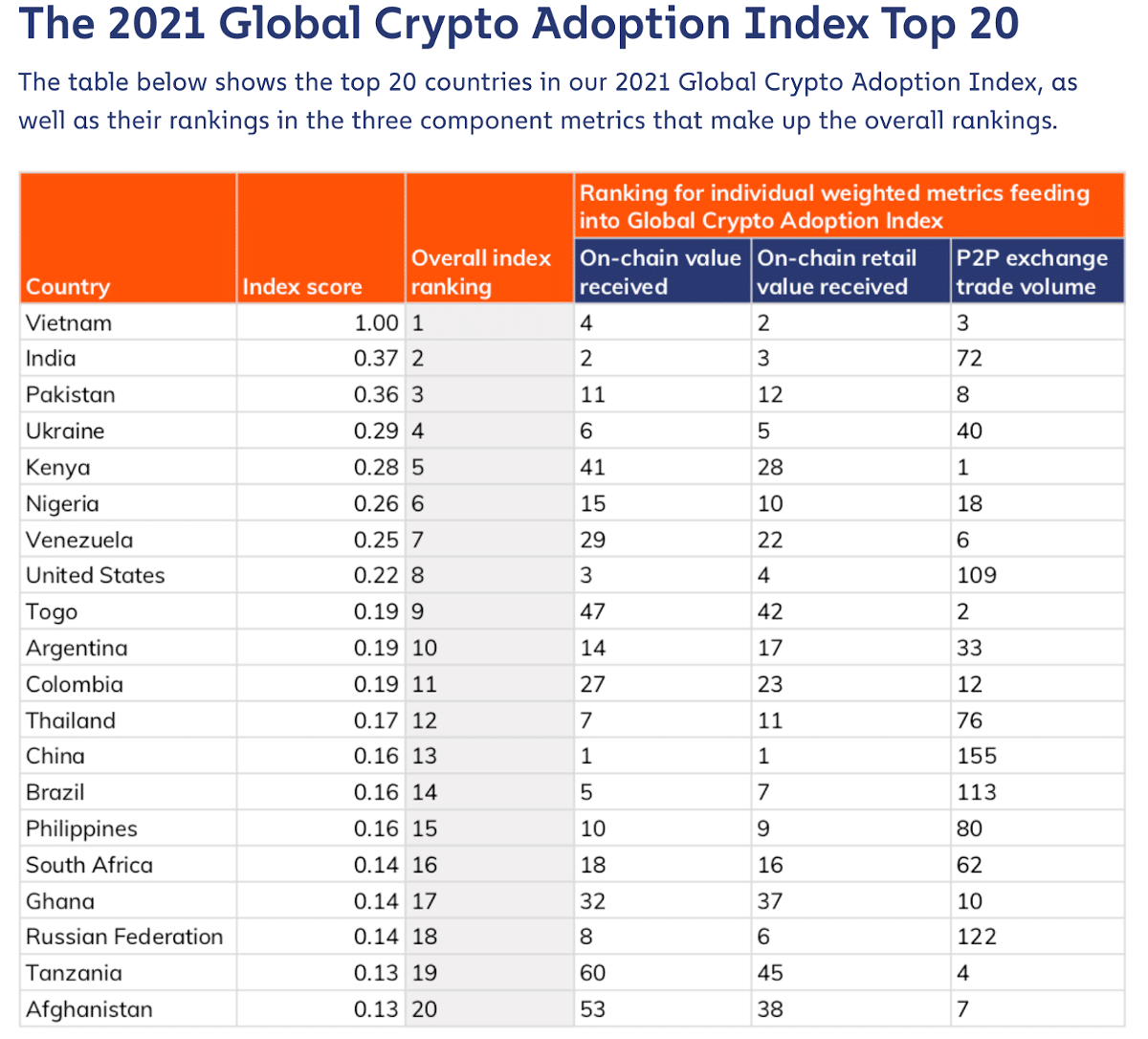

In 2021, Chainalysis data revealed that Nigeria secured the sixth position in the Global Crypto Adoption Index, boasting an overall score of 0.26%, slightly surpassing the United States at 0.22%.

Despite this seemingly commendable standing, Albert argued that the eNaira faces challenges due to its vulnerability to government policies and inflation, key factors contributing to its subdued adoption.

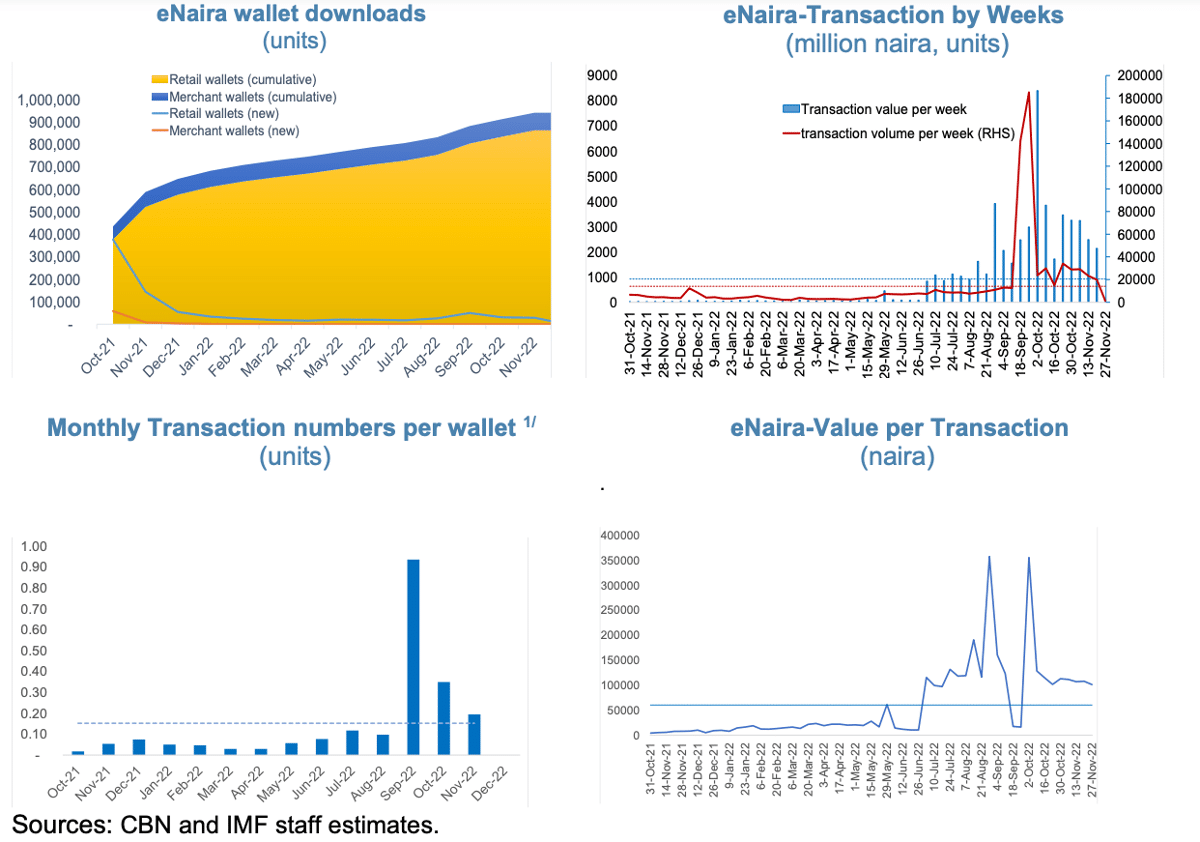

The eNaira debuted on October 25, 2021, and achieved the distinction of becoming the world’s second public CBDC following the Bahamas’ Sand Dollar project. However, two months past its second anniversary, the digital currency grapples with adoption hurdles.

According to a May 2023 report from the International Monetary Fund (IMF), the average weekly eNaira transactions totaled 14,000, constituting only 1.5% of monthly transactions per wallet.

This data indicates that 98.5% of wallets remained inactive in any given week.

Furthermore, Albert stressed that Nigerians need more confidence in the national currency, the naira, and the central authority overseeing it. He emphasized that adopting the CBDC hinges on the government earning the trust of Nigerians and the naira attaining a more credible status.

This sentiment aligns with the views expressed by Mr. Tobi Aremotobi, a digital finance expert based in Nigeria, whose viral comment in July 2023 deemed the eNaira an “exercise in futility.”

Aremotobi shared his experience with Tech Cabal, a local Nigerian media company, highlighting the practical challenges associated with eNaira.

He mentioned that the phrase “I’ll pay you with eNaira” was used teasingly among colleagues, but in reality, spending money stored in the eNaira wallet posed significant hurdles.

Most merchants in Nigeria do not accept the digital currency, and a notable majority of tech-savvy individuals remain unconvinced about the suitability of blockchain-based currency for mainstream adoption.

While the restriction on digital assets for Nigerian banks and financial institutions was officially lifted on December 23, the eNaira will likely hover around red zones.

🚨Nigeria unbans CRYPTO🚨

Nigeria, which has just sacked their central bank Governor, has lifted its 2021 ban on cryptocurrencies.

As one of the most populous countries in the world (~215 Million), this move paves the way for Africa-wide crypto adoption.

Bullish for Bitcoin.… pic.twitter.com/WxFhFdE9n1

— Inspiry Day (@InspiryDay) December 23, 2023

This is because Nigerians have limited enthusiasm for the digital currency, touted as Africa’s first CBDC, and there are concerns about looming crypto regulations in the future.

A Distinct Hope for eNaira?

The IMF report on the eNaira underscores its objective to tackle Nigeria’s substantial informal economy and improve transparency in informal payments.

To achieve this goal, the eNaira aims to integrate with existing mobile money frameworks, presenting two potential approaches for the Central Bank of Nigeria. This involves leveraging established local mobile money networks such as Kuda, oPay, and Flutterwave or constructing a retail access network.

The former option involves routing funds through mobile money accounts to eNaira wallets, incurring additional service costs.

Recently, the CBN has partnered with the African-focused financial technology firm Flutterwave to introduce eNaira as a payment option for merchants and financial institutions.

This strategic move is aimed at boosting eNaira adoption. However, the IMF data views it as a de-risking measure, which may not align with Nigeria’s mobile money market, where cash transactions dominate.

cryptonews.com

cryptonews.com