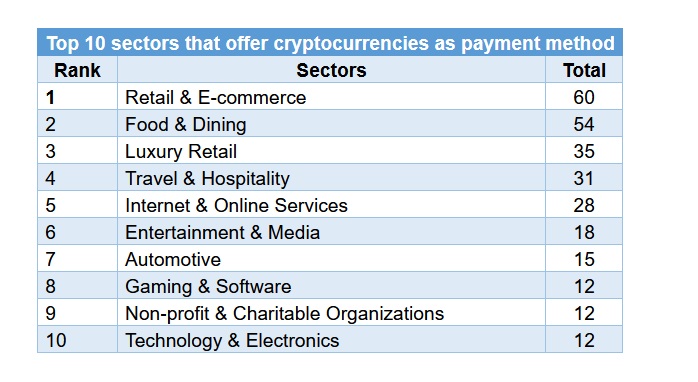

In a study conducted by crypto tax software CoinLedger, the landscape of cryptocurrency payments has been unveiled, shedding light on the sectors that have embraced digital currencies as a viable method of transaction. With more than 300 major companies under scrutiny, the Retail and E-commerce sector emerged as the frontrunner, boasting 60 companies that now accept cryptocurrency payments.

Epicenter of Change: Retail & E-commerce Lead Cryptocurrency Adoption

The Retail and E-commerce sector has become the epicenter of cryptocurrency adoption, with major players such as adidas, Yankee Candle, and H&M leading the charge. Notably, online shopping platforms like Etsy have also integrated cryptocurrency options, marking a significant shift in consumer behavior.

Following closely is the Food & Dining sector, with 54 companies, including names like Chipotle, Domino's, and delivery services such as DoorDash and Uber Eats. Luxury Retail claims the third spot, featuring 35 companies, including brands like Gucci and Ralph Lauren, signaling a shift towards exclusivity in the digital payment realm.

Travel & Hospitality secured the fourth position, with 31 companies accepting crypto payments, ranging from commercial airlines to cruise companies. Internet & Online Services round off the top five, with 28 companies providing crypto-friendly payment options, including platforms like Google Play, Spotify, and various VPN services.

Unveiling the Advantages: Why Cryptocurrency Payments Are Surging

The study delves into the reasons behind the surging popularity of cryptocurrency payments, citing several advantages that traditional currencies lack. Cryptocurrencies, epitomized by bitcoin, offer decentralization, reducing the risk of manipulation or interference from centralized entities. Cryptocurrency transactions come with lower costs, particularly advantageous for cross-border transfers, potentially leading to substantial savings for individuals and businesses. The use of cryptographic techniques and blockchain technology ensures a high level of security, making cryptocurrency transactions resistant to fraud.

Cryptocurrencies hold the promise of providing financial services to the unbanked or underbanked, fostering global financial inclusion. Users benefit from increased control and ownership of their funds, facilitated by private keys, diminishing reliance on intermediaries and enhancing financial autonomy.

David Kemmerer, Co-Founder and CEO of CoinLedger commented on the findings: “The increasing number of companies accepting cryptocurrency payments reflects the growing acceptance and adoption of digital currencies in the mainstream economy. This trend not only aligns with the evolving preferences of tech-savvy consumers but also offers benefits such as reduced transaction fees and increased security.”

“From major retailers to small businesses, the diversification of sectors embracing cryptocurrencies demonstrates the versatility and potential of blockchain technology. As this trend continues, it's likely to contribute to the broader acceptance of cryptocurrencies as a legitimate form of payment, paving the way for a more decentralized and accessible financial landscape.”

financemagnates.com

financemagnates.com