BlackRock (NYSE: BLK) is the largest asset manager in the world, with $9.42 trillion in assets under management (AUM). Meanwhile, Bitcoin (BTC) is the largest cryptocurrency, with $827 billion in market capitalization.

Notably, BlackRock has shown a growing interest in cryptocurrencies, particularly in Bitcoin. On August 28, Finbold reported BlackRock as a major shareholder in 4 of the 5 largest Bitcoin miners. The company has also applied to launch a spot Bitcoin ETF through its ETFs arm, iShares.

In the meantime, the finance titan has actively increased its position in publicly traded Bitcoin mining companies in the United States. Interestingly, BlackRock is a major shareholder in all US-based public Bitcoin mining companies except for Core Scientific Inc (OTCMKTS: CORZQ).

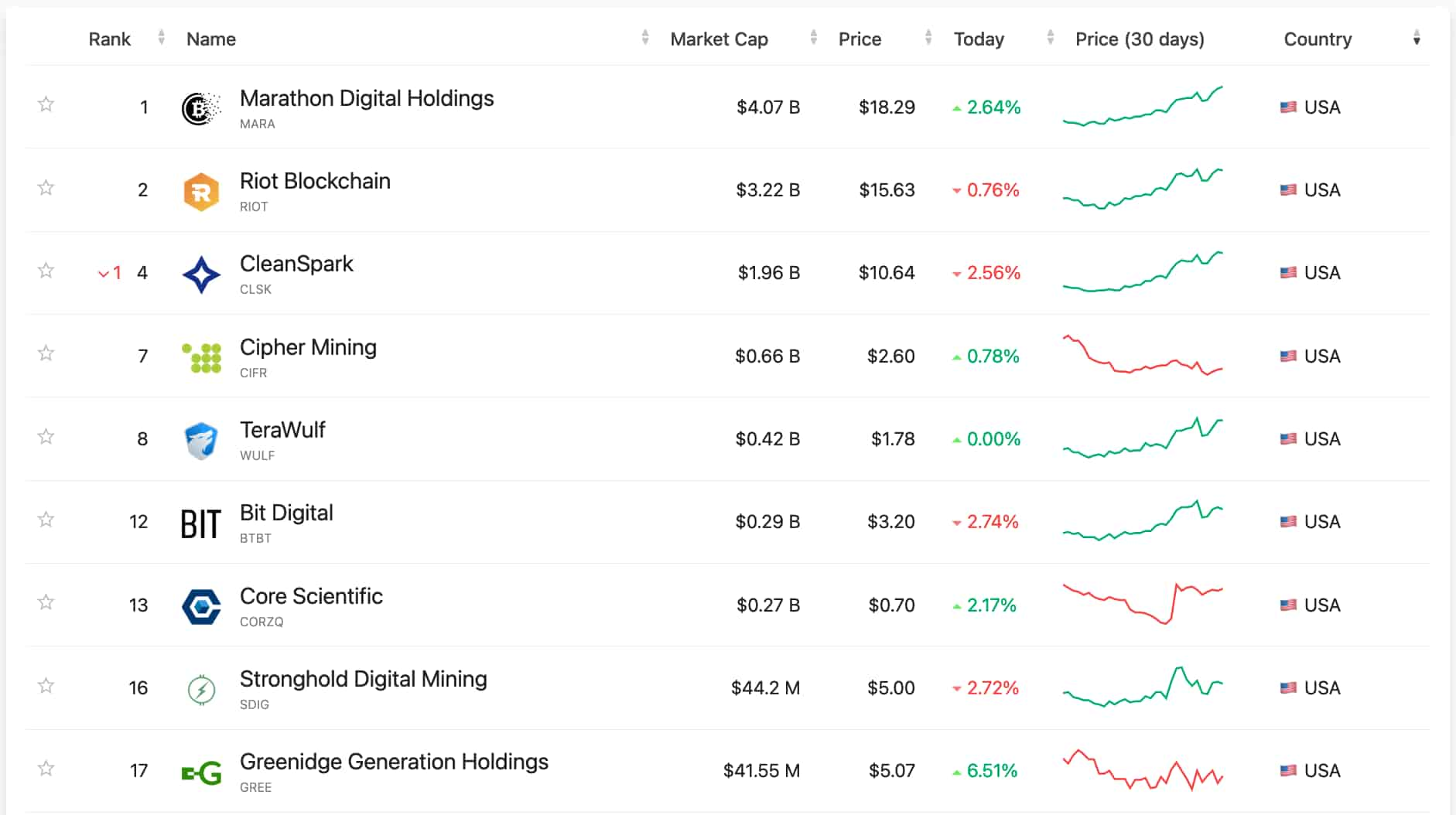

According to data from CompaniesMarketCap on December 16, Marathon Digital Holdings (NASDAQ: MARA) is the largest Bitcoin mining company with a $4.07 billion market cap. Riot Blockchain (NASDAQ: RIOT) follows with $3.22 billion, and CleanSpark (NASDAQ: CLSK) has grown to be the third with $1.96 billion.

Cipher Mining (NASDAQ: CIFR), TeraWulf (NASDAQ: WULF), BitDigital (NASDAQ: BTBT), Stronghold Digital Mining (NASDAQ: SDIG), and Greenidge Generation Holdings (NASDAQ: GREE) have less than $1 billion capitalization – but also compose part of BlackRock’s investment portfolio.

BlackRock’s shares in US Bitcoin mining companies

In particular, Finbold retrieved shareholders’ data from each of these companies on CNN Business. We noticed that BlackRock has increased its position in most of them while selling shares in others.

First, BlackRock now has 11,206,584 MARA shares (5.30%) worth $98.73 million. The financial titan also owns 5.65% of RIOT shares (11,215,047) worth $109.68 million. These are the two largest positions, both increased since the last report, with more purchases.

Third, there is CIFR, followed by WULF and the recently added CLSK to BlackRock’s portfolio. Featuring an ownership of $8.95 million (1.07%), $9.47 million (3.68%), and $33.68 million (5.38%), respectively.

Nevertheless, BlackRock has sold 11,042 BTBT shares, resulting in a current position worth $8.59 million (4.81%).

In addition, both SDIG and GREE constitute the smallest percentage of BlackRock’s Bitcoin mining companies ownership. Worth $115,235 (0.37% out of the company’s total shares) and $68,366 (0.31%), respectively.

It is important to note that all publicly traded Bitcoin mining companies have negative ‘earnings’ since inception. However, this unfavorable scenario has not prevented BlackRock from increasing its position as a major shareholder.

Essentially, the Bitcoin mining business is highly competitive and uncertain, fully dependent on BTC’s price performance.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com