The price of the flagship cryptocurrency Bitcoin (BTC) has moved up more than 23% over the past month and over 160% year-to-date in sharp moves that helped cryptocurrency-related stocks recover amid renewed optimism.

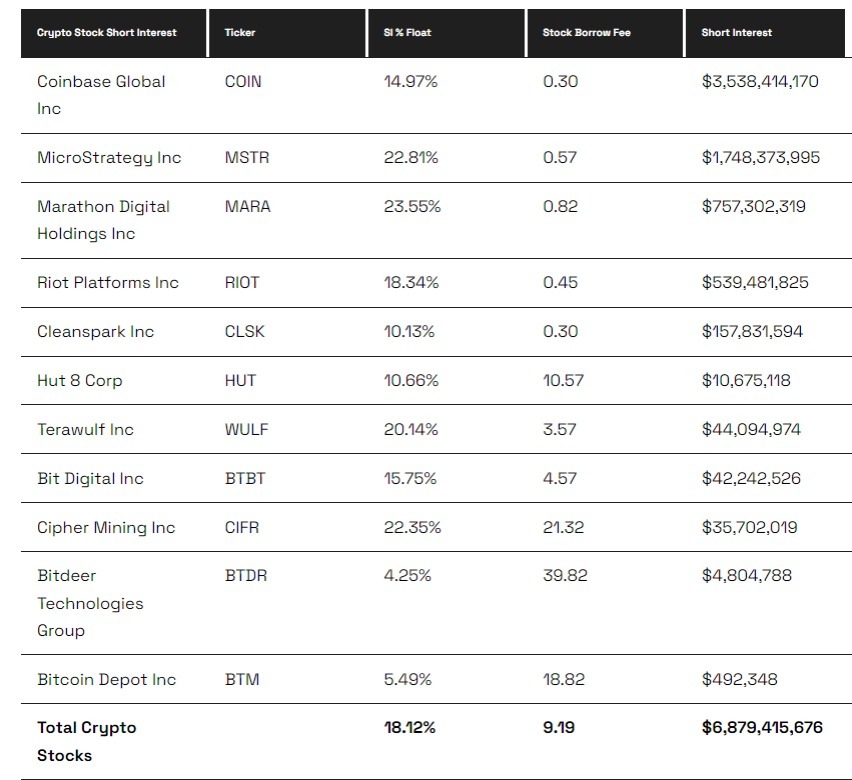

As cryptocurrency-related stock prices grew, short sellers lost over $2.6 billion in less than three months and a total of at least $6 this year while betting against the sector and these companies, according to a report from financial data firm S3 Partners.

Bitcoin’s price recovery helped the price of Nasdaq-listed cryptocurrency exchange Coinbase’s stock surge over 60% over the past month to now be up over 270% year-to-date, while MicroStrategy’s stock price grew 26% in a month and 290% so far this year. MicroStrategy, it’s worth noting, is the largest publicly-traded Bitcoin holder with a portfolio of 174,530 BTC worth over $7.6 billion.

Shorts sellers who bet against these companies, including publicly traded Bitcoin miners, saw their total losses hit at least $6 billion. According to the report, these short sellers ended up having to buy the stocks to cover their positions, which helped push stock prices higher “along with the long buying that has driven up stock prices since the end of October.

Short sellers have suffered the most from Coinbase’s soaring stock, which has cost them over $3.5 billion in losses as the firm’s value grew, while those shorting MicroStrategy lost around $1.7 billion from its price growth.

However, some short sellers have not given up and added more bets against the current rally, hoping it will soon lose momentum. Since Bitcoin’s rebound in mid-September, short sellers have opened $697 million worth of new positions.

Featured image via Unsplash.

cryptoglobe.com

cryptoglobe.com