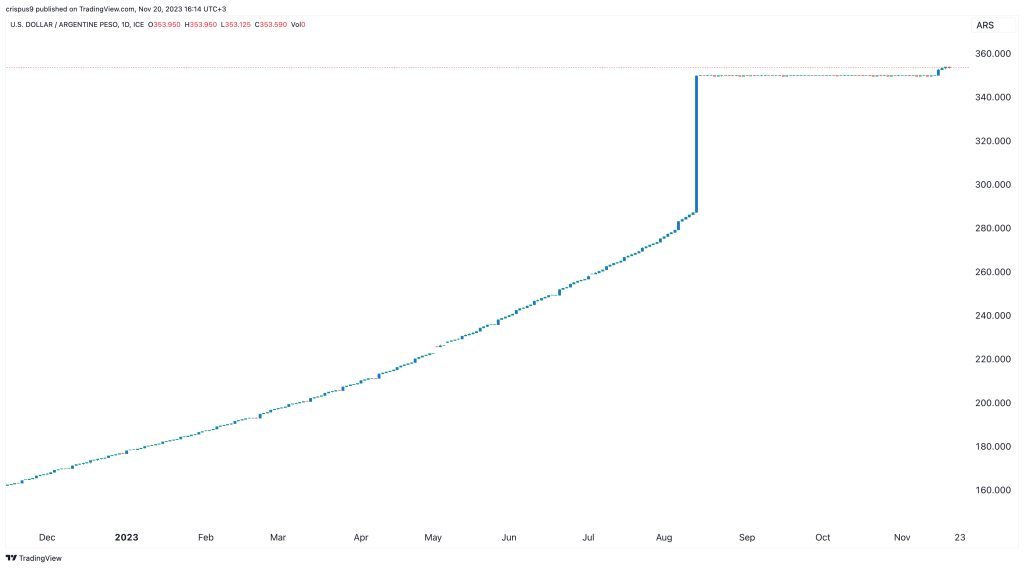

The USD/ARS exchange rate surged to its highest point on record as investors reacted to the outcome of the Argentine election. The pair surged to a high of 353.60, which was much higher than the year-to-date low of 172.82. In all, it has jumped by more than 850% from the lowest point during the pandemic.

Javier Milei win

The biggest emerging market news on Monday was the victory by Javier Milei, a controversial libertarian candidate in Argentina. His victory ushers a period of uncertainty in Argentina, an embattled South American country.

He has made several pledges, including dollarizing the economy, “burning” the central bank, and reducing government spending dramatically. He has also pledged to do with most government ministries in a bid to tame inflation.

Milei takes the helm of a country that has collapsed from being one of the most successful countries in the world to one of the poorest. The poverty rate stands at over 40% while the headline inflation has jumped to over 120%.

The jobless rate has surged while the important agricultural sector is on its deathbed. Recent data shows that Argentina’s corn and soybeans production will be much lower than expected.

So why do progressives hate Argentina’s Javier Milei with the intensity of 1,000 suns?

— Mike Lee (@BasedMikeLee) November 20, 2023

Progressives will try to make it sound nuanced. It’s not.

It’s simple: Milei defiantly refuses to worship at the idolatrous altar of big government.

To them, that’s unforgivable.

Therefore, it is unclear whether the new administration will work to save the Argentinian peso. A plan to dollarize the economy will be difficult since the country does not have enough reserves. The most recent data shows that it has already moved to negative reserves.

Worse, Argentina is one of the most indebted countries in the world. It still owes billions of dollars to the IMF and other creditors. After several defaults, there is a likelihood that more of them are coming. In a note, analysts at Bloomberg said:

“Milei’s ambitious vision of a market-friendly, small-state, dollarized Argentina will finally be put to test. He has yet to clarify on timing and process for dollarization — which, with negative reserves, doesn’t seem feasible for the near term.”

USD/ARS forecast

The outlook for the Argentine peso is not good for now. After crashing this year, it now heads to the unknown now that Milei has won the election. Therefore, the path of the least resistance for the USD/ARS is upward as investors wait for the initial policies of the new administration. This rally could see it jump to the next psychological level of 400.

The post USD/ARS: Argentina peso heads to the abyss after Javier Milei win appeared first on Invezz

invezz.com

invezz.com