A consortium of Japanese firms plans to issue a yen-based digital currency called DCJPY. The currency, slated for launch by July 2024, is designed to facilitate transactions and settlements of clean energy certificates, harnessing DeCurret’s blockchain-backed network.

Cryptocurrency exchange DeCurret said on Thursday that GMO Aozora Net Bank will issue DCJPY. According to a recent report, the telecommunication firm Internet Initiative Japan (IIJ) will then use it to settle clean energy certificates.

Japan Mints Stablecoin for Clean Energy Certificate Settlement

DeCurret will execute the DCJPY transactions on a network it developed. Bank deposits back the network through blockchain technology. This is similar to other nations using digital currencies backed by bank deposits and blockchain technology.

The Revised Funds Settlement Act, passed in 2022, has also been instrumental in this development. This legislation recognizes stablecoins as a new electronic payment method, thereby enabling banks, trust companies, and transfer operators to issue them.

Consequently, Binance, which already holds a license to serve traders in Japan, has qualified as an issuance partner. Other companies can issue stablecoins once the Financial Services Agency of Japan approves their license applications.

Read more: What Is a Stablecoin? A Beginner’s Guide

Stablecoins on the Come Up

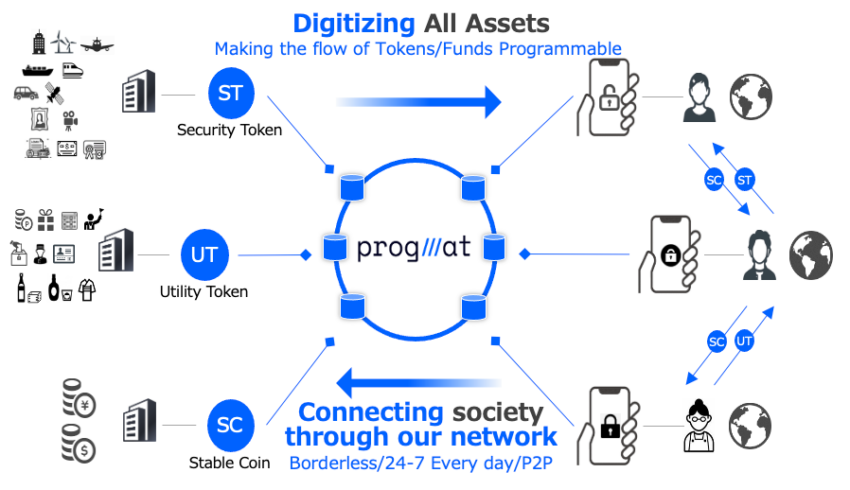

Mitsubishi developed its Progmat platform in line with the Japanese government’s ‘Revised Funds Settlement Act.’ The legislation, passed in 2022, recognizes stablecoins as a new electronic payment method,” a recent announcement revealed.

The Progmat platform, developed by Mitsubishi, supports the issuance of stablecoins backed by yen and US dollars. This technology allows businesses to streamline foreign trade transactions and purchase digital securities as well as non-fungible tokens (NFTs).

Motoki Yoshida, the marketing manager of TOKI, a Progmat partner said,

“The basic architecture involves financial institutions interested in issuing stablecoins depositing an equivalent amount of fiat currency with MUFG’s trust bank. Progmat then issues an equivalent amount of stablecoins. The funds in the trust bank are bankruptcy-remote, making this potentially the most secure stablecoin for use on public blockchains.”

If more businesses adopt these new technologies, they could dramatically shift how transactions are conducted. Initiatives like this could also help propel Japan to the forefront of the digital currency adoption.

beincrypto.com

beincrypto.com